“In January-March 2025, the volume of venture financing of cryptocurrency startups increased to $ 6 billion-twice as much as in the same period last year ($ 2.6 billion), and twice as much as in the fourth quarter ($ 3 billion). This is stated in the analytical report of PitchBook, which is referred by Cointelegraph. The total number of transactions decreased to 405, which is 39.5% less than last year, but slightly higher than the previous quarter (372). Despite the complex macroeconomic background, […]”, – WRITE: Businessua.com.ua

In January-March 2025, the volume of venture financing of cryptocurrency startups increased to $ 6 billion-twice as much as in the same period last year ($ 2.6 billion), and twice as much as in the fourth quarter ($ 3 billion). This is stated in the analytical report of PitchBook, which is referred by Cointelegraph.

The total number of transactions decreased to 405, which is 39.5% less than last year, but slightly higher than the previous quarter (372). Despite the complex macroeconomic background, analysts noted the preservation of investors’ interest in practical scenarios for the use of cryptocurrencies.

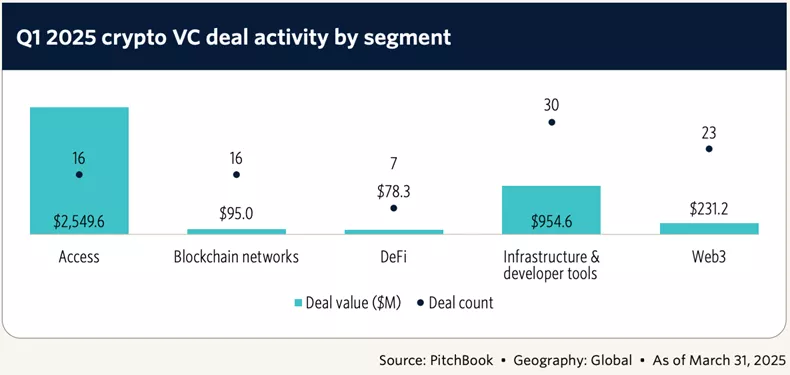

Most of the money was raised by companies operating with digital assets, exchanges and financial services – $ 2.55 billion within 16 transactions. In the second place are infrastructure projects and developers ($ 955 million in 30 transactions), then-web3 startups with $ 231.2 million (23 transactions).

Source: Pitchbook.

The report especially emphasizes the value of the expected IPO of Circle. According to experts, this can be the most important event for the market since the time of Coinbase. If the company is estimated by the above range ($ 4–5 billion), it will be a positive signal about the viability of such business models and can activate a new wave of investment.

Pitchbook also draws attention to the increase in the capitalization of steiblcoins: in the first quarter it rose by 12% – from $ 202.3 billion to $ 227.1 billion – against the background of stagnation of other sectors. Against this background, analysts predict further interest in startups that work with payments, money transfers and treasury operations that directly use the speed of circulation of stable coins.

At the same time, the report mentions the potential increase in demand for real -time reserves, improved castodial services and key management systems – as a reaction to a BYBIT incident.

Recall that in May, the cost of placement of ETORO shares was $ 52, which exceeded the expected range and testified to increased demand from investors. From May 19, Coinbase will be the first cryptocons in the S&P 500 index.

The gun

Please wait …