“Without Significant Expansion, The New Wave of Stablecoin Launches May Simply RedistRibute Market Share Racer Rather Grow The Pie, Said The Bank.”, – WRITE: www.coindesk.com

That Dynamic Could Turn the Coming of Us Stablecoin Launches Into a zero-Sum Contest, Unless the Crypto Market Itelf Expands Significantly, Analysts Led.

TETHER, WHOSE USDT IS PRIMARILY USED OVERSEAS, PLANS TO DEBUT A US-COMPLIANT TOKEN, USAT. Unlike USDT, Whose Reserves Are About 80% Compliment with US Requirements, USAT’SAT’SATING Wuld Fully Meet the New Regulatory Standards, The Bank Said.

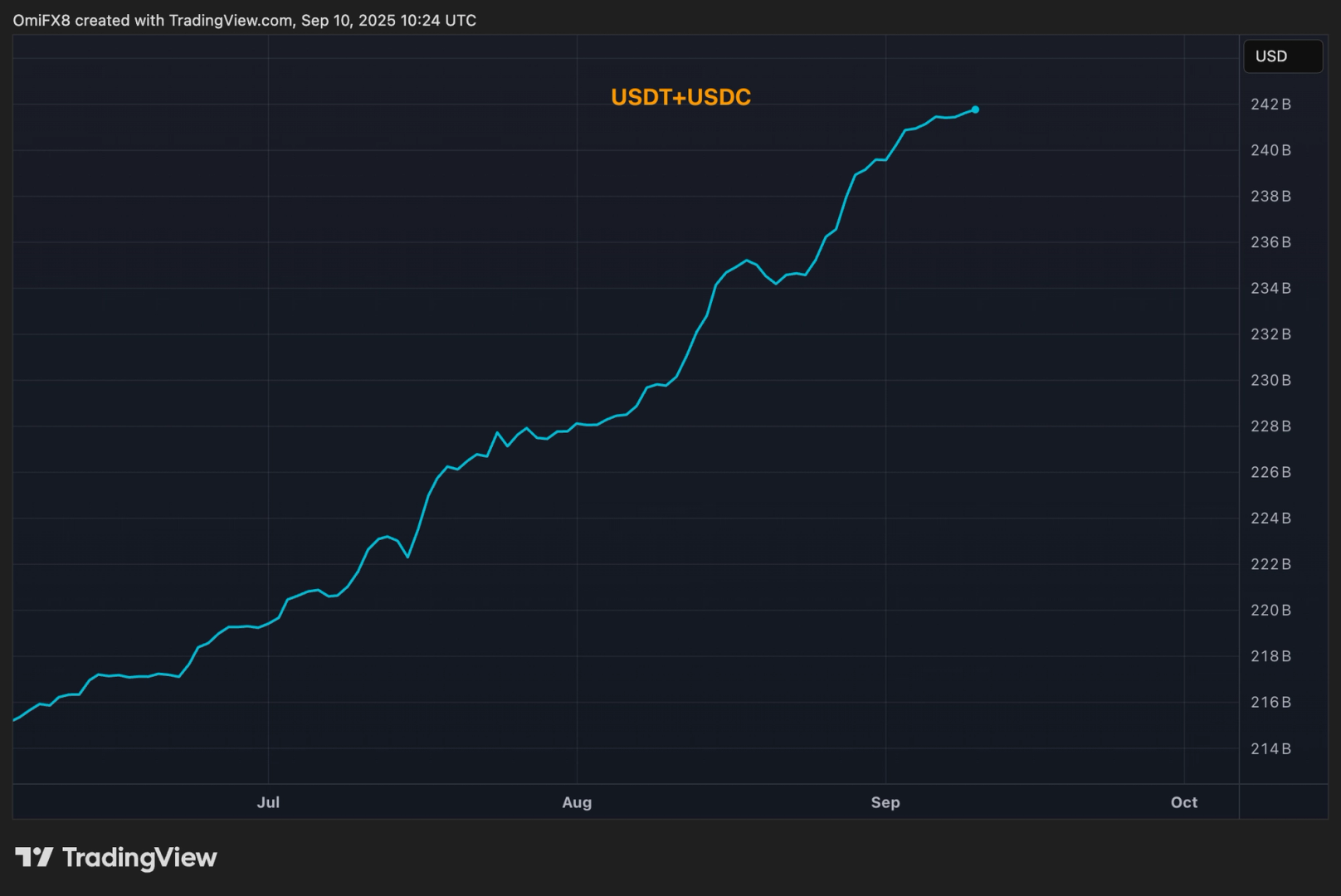

Stablecoins are cryptocurrencies whose valve is tied to anOTHER asset, Such as the US dollar or Gold. They Play A Major Role in Cryptocurrency Markets, Providing A Payment Infrastructure, and Are Also, USED TO TRANSFER MONEY INTERNATIONALLY. TETHER’S USDT IS The Largest Stablecoin, Followed by Circle’s (CRCL) USDC.

The passage of US Stablecoin Legislation in July Has Already Spurred a Fresh Round of Launches Aimed at Circle’s USDC, WHICH DOMINATES The US Market, The Report Noted.

While New Players Are Jockeying for Position Ahead of Regulatory Implementation, The Stablecoin Market’s Growth Remains Tied to Crypto’s Overall Market Cap, The Analysts Wrote.

Circle Is Also Lozing Ground to Competitors Like Hyperliquid, Whose Exchange Alone Accouns for Nearly 7.5% of USDC USAGE, As Well As Fintech Giant (Pepl) WHICH Are Rolling Out Their Own Tokens, Jpmorgan Said.

In Respons, Circle Is Developing ARC, A Blockchain Tailored to USDC Transactions, to Improve Speed, Security, and Interoperability and Kep USDC Central to Crypto InfrastRACTRUCTRUCTRUCTRUCTRUCTRUCTRUCTRUCTRUCTRUCTRACTRUCTURE.

Without Significant Expansion, The New Wave of Stablecoin Competition May Simply RedistRibute Market Share Racer Racher Than Grow the Pie, The Report Aded.

USDC Suppply Has Surged to $ 72.5 Billion, 25% AHEAD OF Wall Street Firm Bernstein’s 2025 Estimates, The Broker Said in a Report Earlier this month.

Read More: Circle’s USDC Market Share ‘On A Tear,’ Says Wall Street Broker Bernstein

Hedera’s Token Endured A Sharp Decline, Breaching Key Support Levels Before Stabilization Near $ 0.24.

Hedera’s Token Endured A Sharp Decline, Breaching Key Support Levels Before Stabilization Near $ 0.24.

- HBAR Fell 3.38% Over 23 Hours, Droping from $ 0.25 to $ 0.24 Amid Heavy Selling and A 55.91 Million Trading Volume Spike.

- The token Breached Multiple Support Levels But Stabilized at $ 0.24, Forming An Ascending Trianle Pattern that Signals Potential Consolidation.

- Despite Short-Term Weakness, Institutional Backers and Hedra’s Energy-Efficiency Technology Continue to Underpin ITS LONG-TRM MARKET APEAL.

Read Full Story