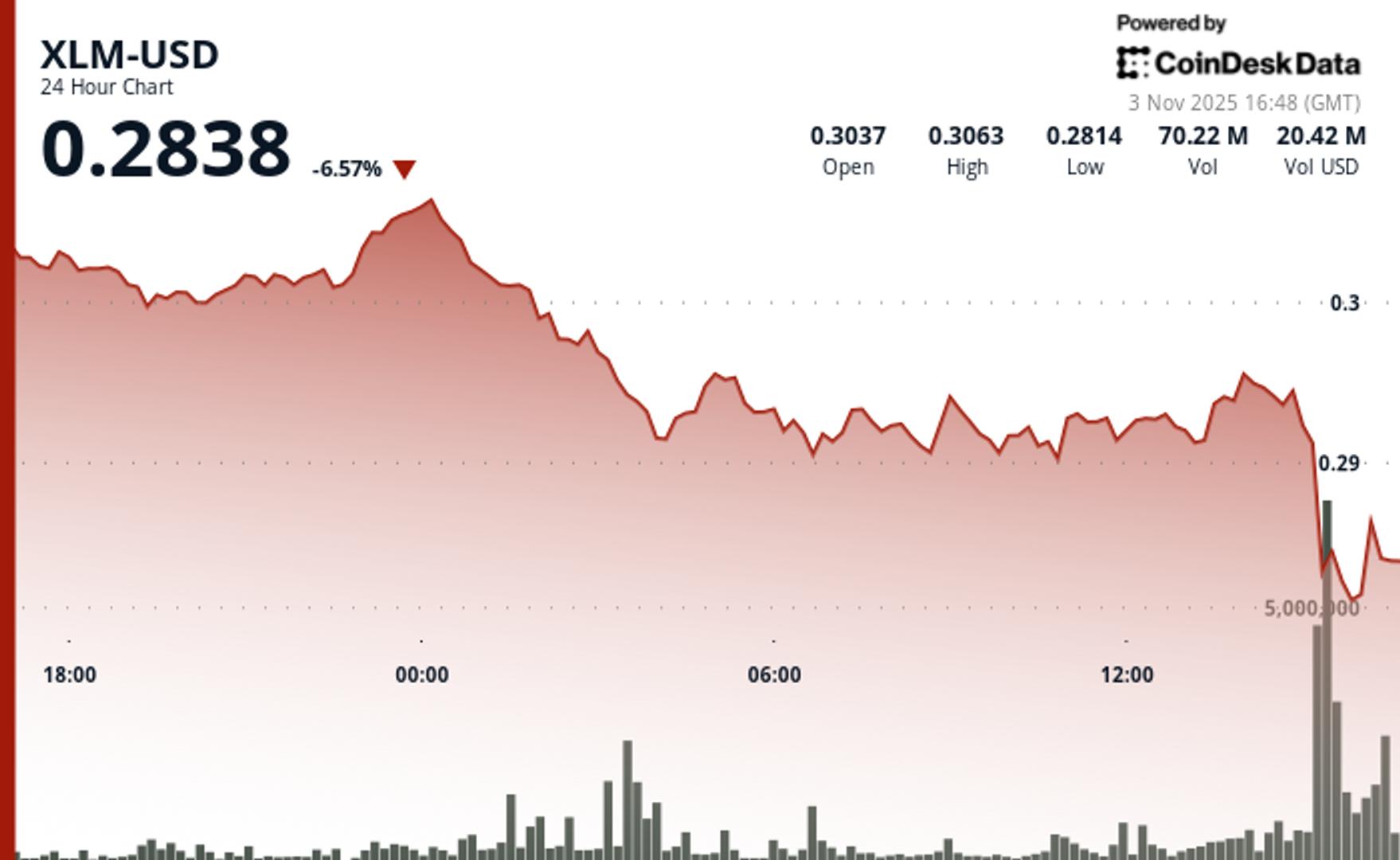

“XLM steadies after a sharp 5.5% sell-off, with traders watching the $0.277 level as the critical line between recovery and renewed downside pressure.”, — write: www.coindesk.com

Despite the rebound, XLM underperformed the broader crypto market (CD5) by 2.10%, reflecting network-specific headwinds even as sector sentiment improved. Traders highlighted Stellar’s $5.4 billion real-world asset tokenization milestone as evidence of growing network utility, although the muted relative strength hinted at cautious rather than exuberant buying.

A brief capitulation between 15:27 and 15:31 UTC saw XLM plunge 5.5% from $0.293 to $0.277, with volume spiking to 12.8 million shares per minute. Support held firm at $0.277, sparking a sharp rebound towards $0.285 as buyers stepped in aggressively following the washout.

Technically, Stellar faces resistance at $0.3014 after a failed hold of $0.2900 support, with current consolidation near $0.281 suggesting a balance between bulls and bears. The 887% volume surge during the breakdown underscores lingering volatility even as fundamental momentum builds.

XLM/USD (TradingView)

XLM/USD (TradingView)

Key Technical Levels Signal Mixed Momentum for XLMSupport & Resistance

- Support: Critical support established at $0.277 following extreme washout.

- Resistance: Strong resistance confirmed at $0.3014 after breakdown from $0.2900 support.

- Range: Current consolidation between $0.281 – $0.285.

Volume Analysis

- 24-hour volume is 11.18% above the 30-day average, confirming directional conviction.

- Breakdown phase: Extraordinary spike to 259.3M shares (+887% vs. SMA).

- Stabilization: Volume normalized below 4M shares, indicating reduced volatility.

Chart Patterns

- Decisive break below ascending trendline support during capitulation.

- 24-hour range: $0.0287 (9.4%) from $0.3038 high to $0.2817 low.

- Stabilization: Price stabilizing after rebound attempts from $0.277 low.

Targets & Risk/Reward

- Immediate resistance: $0.2900 (former support).

- Upside target: $0.3014, contingent on sustained momentum.

- Downside risk: Retest of $0.277 support if consolidation fails.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

View Full Report

The token climbed to nearly $4.30 late on Sunday, before tracking downward throughout Monday.

The token climbed to nearly $4.30 late on Sunday, before tracking downward throughout Monday.

- ICP fell 5.48% to $3.77 after failing to hold above $4.20 resistance.

- Volume surged to 8.7M tokens, 70% above the 24-hour average.

- Key support now sits near $3.70, with resistance capped at $3.95–$4.05.

Read full story