“XLM demonstrates resilience with modest gains and exceptional volume surge, signaling potential momentum building beneath current consolidation patterns.”, — write: www.coindesk.com

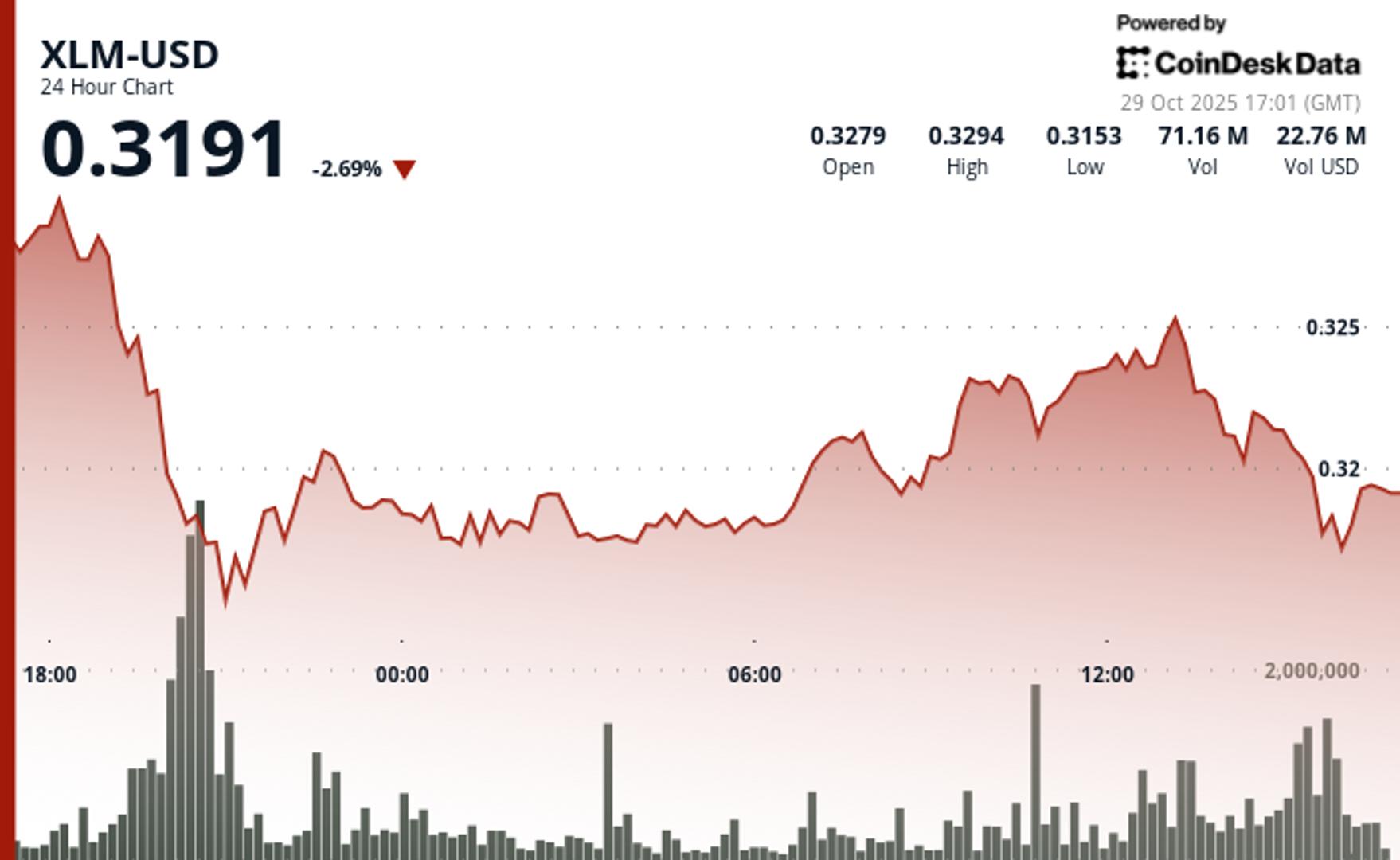

XLM slightly outperformed the broader crypto market by 1.23%, consolidating between $0.315 and $0.325 after rebounding from a $0.3162 low. Diminishing short-term volume suggests distribution has eased, with strong support forming above $0.32 ahead of the upcoming Protocol 24 upgrade.

The surge in volume without sharp price swings indicates steady institutional buying, often a precursor to sustainable breakouts. Meanwhile, Stellar’s ecosystem continues to expand, reaching $639 million in tokenized assets—a 26% monthly increase—led by Franklin Templeton’s $446 million tokenized treasury fund.

XLM/USD (TradingView)

XLM/USD (TradingView)

XLM Technical Overview

- Support / Resistance

- Primary support: $0.316

- Immediate resistance: $0.325

- Broader range: $0.31 – $0.33

- Volume Analysis

- 134% increase above 30-day average volume

- Occurred alongside modest price gains

- Indicates institutional accumulation rather than retail speculation

- Chart Patterns

- Volume-price divergence evident

- Suggests controlled buying activity

- Points to potential volatility expansion ahead

- Targets & Risk/Reward

- Breakout above $0.325 could target $0.35 – $0.40 range

- Downside risk limited to $0.31 support zone

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

View Full Report

However, bitcoin and other non-yielding assets may benefit in the coming months as liquidity returns and investors rotate out of cash-heavy positions into growth and alternative stores of value.

- Bitcoin fell to $108,000 after the Fed’s decision and a silent meeting between Trump and Xi in South Korea.

- Major cryptocurrencies like XRP and Dogecoin saw losses, with futures tied to the S&P 500 also trading lower.

- The Fed’s policy shift towards easier financial conditions may benefit crypto markets, but geopolitical factors remain crucial.

Read full story