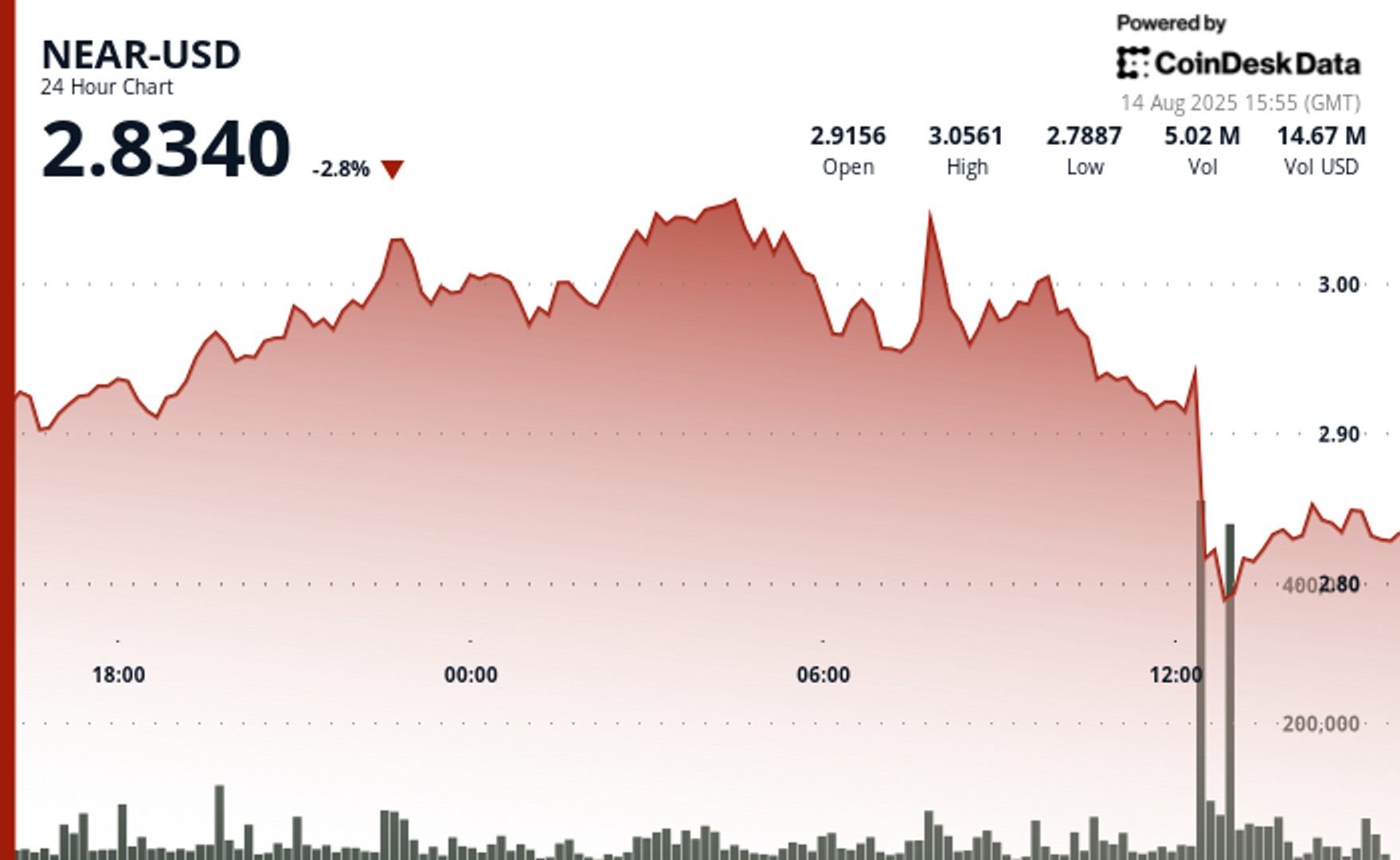

“Catgpt SAID: Near Protocol Swung Between $ 2.78 and $ 3.05 As Nearly 20 Million Tokens Changed Hands Durying Peak Sell Pressure, Before Buyers Stepped in to Lift Prices Back Toward $ 2.82.”, – WRITE: www.coindesk.com

The Decline from the $ 3.05 Resistance to $ 2.75 Support Was Driven by Heavy Institutional Selling, Totling Nearly 20 Million Tokens During Peak Pressure. Despite this, The Asset’s Fundamentals Remain Strong, Supported by a Sizable Active User Base of 16 Million Weekly Participants.

In the hour following the selloff, Near gained 0.35% to $ 2.83, Trading within a Controlled $ 0.07 Range Between $ 2.81 and $ 2.85. Key Institutional Buying Appeared at Several Intervals, Helping The Token Breach Short-Term Resistance at $ 2.83– $ 2.84 and Reach Session Highs of $ 2.85.

Trading Volume Easted to Round 100,000 Tokens per Minute, Suggesting Acumulation Rather Thankser -Specialty Retail Activity, With Preliminary Support Forming Near $ 2.81– $ 2.82.

Near/USD (TradingView)

Near/USD (TradingView)

Market Performance Indicators Reflect Mixed Corporate Outlook

- Near Protocol Recorded Substantial Price Valativity with A $ 0.26 Trading Range Representing 8.53% MOVEMENT BETWEENNEENNE OF THE SESSION HIGH of $ 3.05 and Low of $ 2.78.

- The Cryptocurrency Initially Demonstrated Upward Momentum from $ 2.90 to Reach $ 3.05 Dringing Evening Trading Hours, Establishing Technical Resistance at the LEVEL.

- Significant Institutional Selling Occurred Dringing August 14 Between 12: 00-13: 00 UTC WITH Exceptional Trading Volumes of 19.99 Million and 12.22 Million Tokens Respectively.

- Daily Trading Activity Substantally Exceed the 24-HOUR AVERAGE OF 5.47 Million Tokens, Reflection Height Institutional Selling Pressure.

- Market Price Declined to $ 2.75 Before Corporate Buying Interest Supported A Recovery to $ 2.82 at SESSION CLESSE.

- High-Volume Institute Selling Patterns Suggest Potential Continual Continued Downside Risk Despite Modest Recovery Attempts, Accounting To Market Strategists.

Disclaimer: Parts of this Article Were Generated with the Assistance from Ai Tools and Review by Our Editorial Team to Enseure Accucy and Adherence to Our Standards. For more information, See Coindesk’s Full Ai Policy.

All Content Produced by Coindesk Analytics is Undergoes Human Editing by Coindesk’s Editorial Team Before Publication. The Tool Synthesizes Market Data and Information from Coindesk Data and Other Sources to Create Timely Market Reports, with All External Sources Clearly Attributed Within Each.

Coindesk Analytics Operates Under Coindesk’s AI Content Guidelines, WHICH PRIORITIZE Accuracy, Transparency, and Editorial Oversight. Learn more about Coindesk’s Approach to Ai-Generated Content In Our Ai Policy.

X Icon

The Token’s Reed at $ 0.26 Came Amid A Broad Crypto Pullback, with The Coindesk 20 Index Sliding 4% and Rate-Cut Heps Fading.

The Token’s Reed at $ 0.26 Came Amid A Broad Crypto Pullback, with The Coindesk 20 Index Sliding 4% and Rate-Cut Heps Fading.

- Polygon’s Pol Token Slid 6% to $ 0.24 Thursday After Breaking Key Support, As Surging Us Wholesale Inflation Rattled Risk Assets.

- Trading Volume Spiked to 1.1 Million Units – More Than Triple Its Daily Average – After A Sharp Reject at the $ 0.26 Resistance Level.

- The Coindesk 20 Index Fell 4% Over The Same Period, with Profit-Taking Acceleration Across Major Cryptocurrencies.

Read Full Story