“Technical indicators suggest bearish control, with traders watching key support levels and potential ETF-driven volatility.”, — write: www.coindesk.com

News BackgroundBitwise Asset Management confirmed that its spot Dogecoin ETF may launch within 20 days under the Section 8(a) automatic-approval rule, pending no SEC intervention. The move follows last week’s debut of SOL, LTC, and HBAR ETFs on Wall Street and signals accelerating institutional product development across the meme-coin segment.

Grayscale also amended its own spot DOGE ETF filing, initiating a similar countdown period. The parallel efforts underscore how regulators’ passive stance under Section 8(a) could fast-track listings even without explicit SEC endorsement.

Despite the broader optimism, DOGE’s price action decoupled sharply from the ETF narrative as large holders liquidated positions into strength. On-chain data recorded over 1 billion DOGE (~$440 million) moved by whale wallets in the past 72 hours—aligning with the heaviest distribution week since early October.

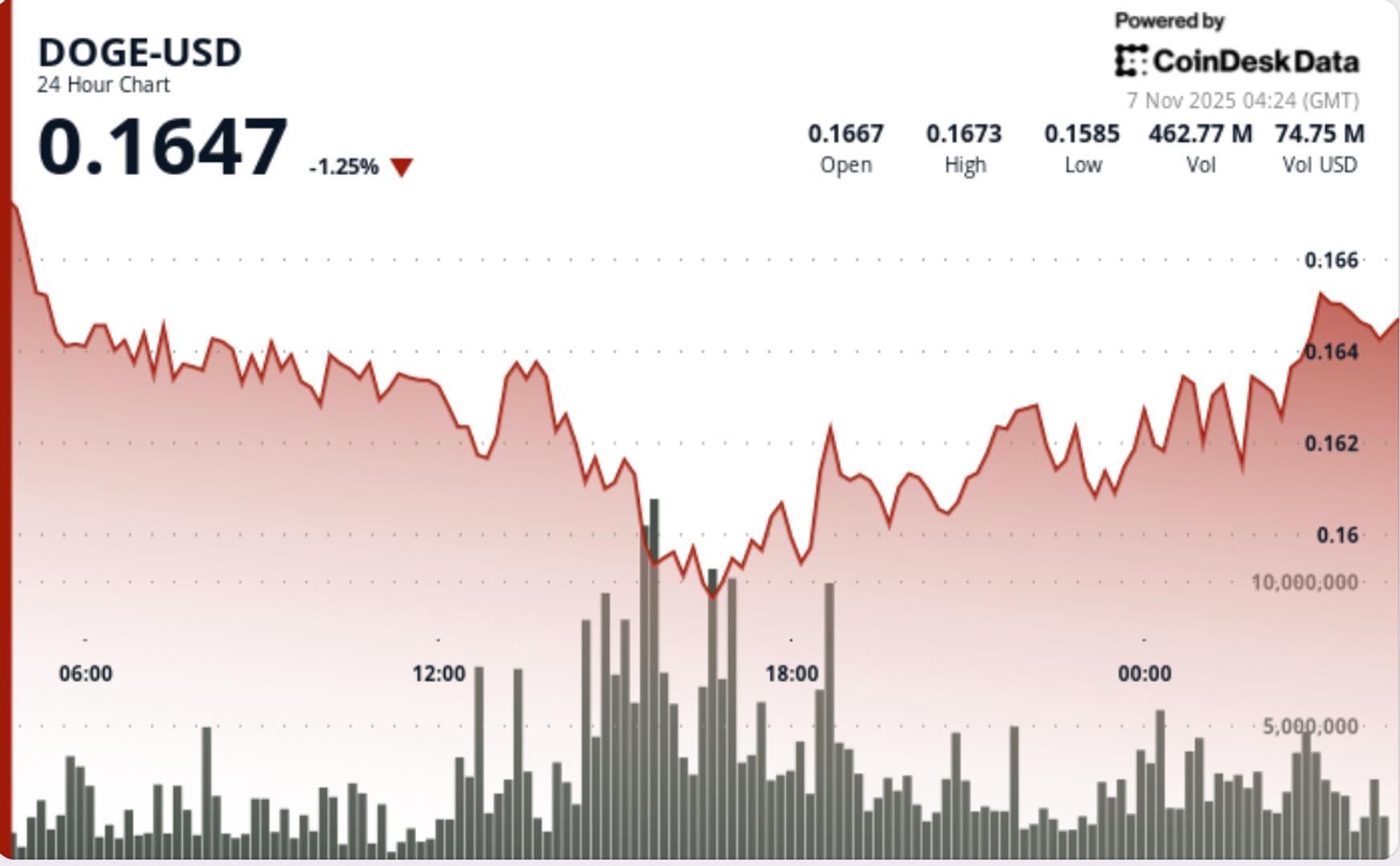

Price Action SummaryDOGE fell 2.4% to $0.1634 over the 24-hour session, breaking below $0.167 support amid accelerating selloffs. The token traded through a 6.4% intraday range, establishing sequential lower highs during the first 16 hours of trading.

The sharpest drop hit at 15:00 GMT, when volume surged to 793.4 million tokens—roughly 150% above average—driving DOGE to its session low at $0.1590. Multiple rebound attempts failed at $0.1639 resistance, confirming persistent supply overhead.

Late trading brought stabilization as DOGE rebounded from $0.1615 to close near $0.1631, with final-hour activity averaging 6.2 million tokens per minute—slightly above the norm and signaling measured re-entry from institutional participants.

Technical AnalysisThe session produced a textbook breakdown-and-retest pattern, confirming short-term bearish control while hinting at possible base formation. Descending highs from the open validated resistance near $0.1674, while the late-session higher lows at $0.1615–$0.1625 established the early framework for a potential reversal.

Momentum indicators remain mixed. RSI recovered from near-oversold territory (38–42 band), and MACD flattening suggests decelerating downside momentum. However, with aggregate futures open interest declining 12% and funding rates flipping negative on Binance, speculative appetite remains subdued.

The volume profile supports a transition phase—heavy distribution early followed by measured accumulation late in the session. This structure often precedes short-term consolidation before volatility compresses ahead of a decisive breakout.

What Traders Should KnowTraders now focus on whether DOGE can defend $0.1575–$0.1615 support while ETF-driven sentiment builds. The ETF countdown could act as a volatility catalyst, but technicals remain fragile until the price closes above $0.1674.

If bulls reclaim that level, short-term upside targets align with $0.172–$0.180, coinciding with pre-breakdown supply. Conversely, failure to hold $0.1575 risks exposing the $0.15 psychological zone, where on-chain cost basis data clusters.

The interplay between ETF headlines and whale flows will likely dictate near-term direction: sustained outflows from large holders could cap any ETF-driven optimism through mid-November.

A deep dive into Zcash’s zero-knowledge architecture, shielded transaction growth, and its path to becoming encrypted Bitcoin at scale.

A deep dive into Zcash’s zero-knowledge architecture, shielded transaction growth, and its path to becoming encrypted Bitcoin at scale.

- Shielded adoption surgedwith 20–25% of circulating ZEC now held in encrypted addresses and 30% of transactions involving the shielded pool.

- The Zashi wallet made shielded transfers the default, pushing privacy from optional to standard practice.

- Project Tachyonled by Sean Bowe, aims to boost throughput to thousands of private transactions per second.

- Zcash surpassed Monero in market share, becoming the largest privacy-focused cryptocurrency by capitalization.

View Full Report

The breakdown unfolded alongside a surge in trading volume that reached 137.4 million, representing an 84% spike above the daily average.

The breakdown unfolded alongside a surge in trading volume that reached 137.4 million, representing an 84% spike above the daily average.

- XRP dropped 7.5% as it broke key support levels, leading to significant trading activity and liquidations.

- Trading volume surged 84% above the daily average during the selloff, highlighting institutional involvement.

- Despite a brief rebound, XRP remains under bearish control, with $2.20 as a critical support level.

Read full story