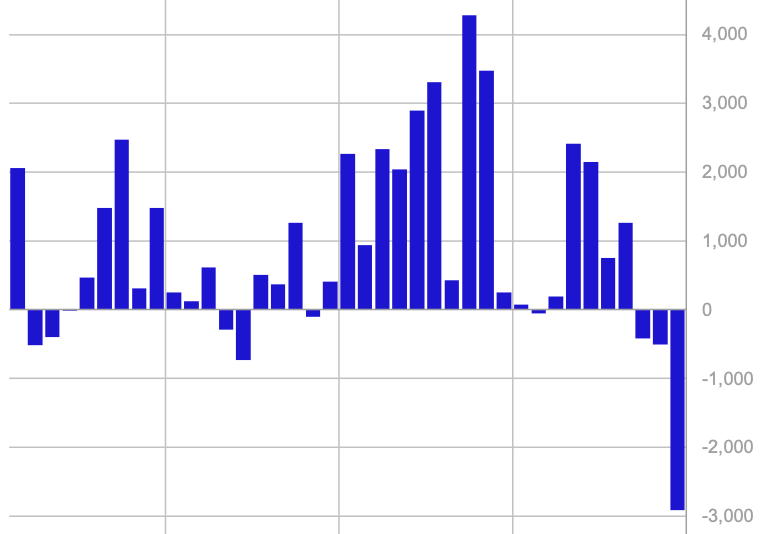

“Investor withdrawals Hit $ 3.8b over Weeks Amid Bybit Hack, Fed Uncertainty, and Profit-Taking from 19-Week Inflow Streak.”, – WRITE: www.coindesk.com

The Massive Outflows Mark A Significant Shift in Sentiment AFTER A PROLONGED Period of Steady Investment Into Digital Asset Products.

This Latest Wave of Withdrawals Extended A Three-Week Streak of Outflows, now totaling $ 3.8 Billion. Coinshares Research Analyst James Butterfill Pointed to Seval Factors Likely Driving The Sell-Off, Including Mounting Investorns Following The FABERN IncreASINGly Hawkish Stance On Monetary Policy.

Before This Downturn, Crypto Investment Products Had Enjoed 19 Consuctive Weeks of Inflows, Suggesting that Some Investors Were Locking in Profits Amid Growing Market Uncerta.

Bitcoin (BTC), The Largest Cryptocurrency by Market Capitalization, Bore The Brunt of the Outflows, Lozing $ 2.6 Billion Over The Past Week. Meanwhile, Funds That Bet Against Bitcoin, Known As Short Bitcoin Etps, Saw Only A Modest Inflow of $ 2.3 Million, Indicating that Bearish Sentiment Has Yet to Fully Take Hold.

While Most assets strugleld, a few buckked the trend – SUI (SUI) Emerged as the Top Performer With $ 15.5 Million in Inflows, Followed BY XRP (Xrp), Wht.

SPOT BITCOIN ETFS FACED ONE OF THEIR TOUGHEST WEEKS YET, WITH INVESTORS PULLING SIGNFICANT CAPITAL FROM THOUS FUSE FUSE. Blackrock’s ishares Bitcoin Trust (IBIT), The Largest of Its Kind, Recorded A Staggering $ 1.3 Billion in Outflows, Accounting To Coinshares, The Highest Weekly Witch.

Similarly, CME Bitcoin Futures Open Interest Droped Sharply Over the Past Two Weeks, Falling from 170,000 BTC to 140,000 BTC, Signling a Potential Shift in Institutesal Positioning. At Same Time, The Three-Month Futures Annualized Rolling Basis Is Yielding 7%, Only Slightly Higher than the 4% YELD OFFFERED BY SHORT-TRIM US TREESURIES.

“This Tells Me the Hedge Funds Are Starting to Unwind Their Basis Trade Position, Which Is a Net Neutral Position,” Said James Van Straten, Analyst at Coindesk. “WITH A Narrowing Spread Between Futures Yields and Risk-FREEE RETURNS, Traders May Be Relocating Capital Away from Bitcoin Derivatives in Favor of Safer, More Liquid Assets.

Disclaimer: Parts of this Article Were Generated with the Assistance from AI Tools and Review by Our Editory Team to Enseure Accucy and Adherice Tour Standards. For more information, See Coindesk’s Full Ai Policy.

X Icon