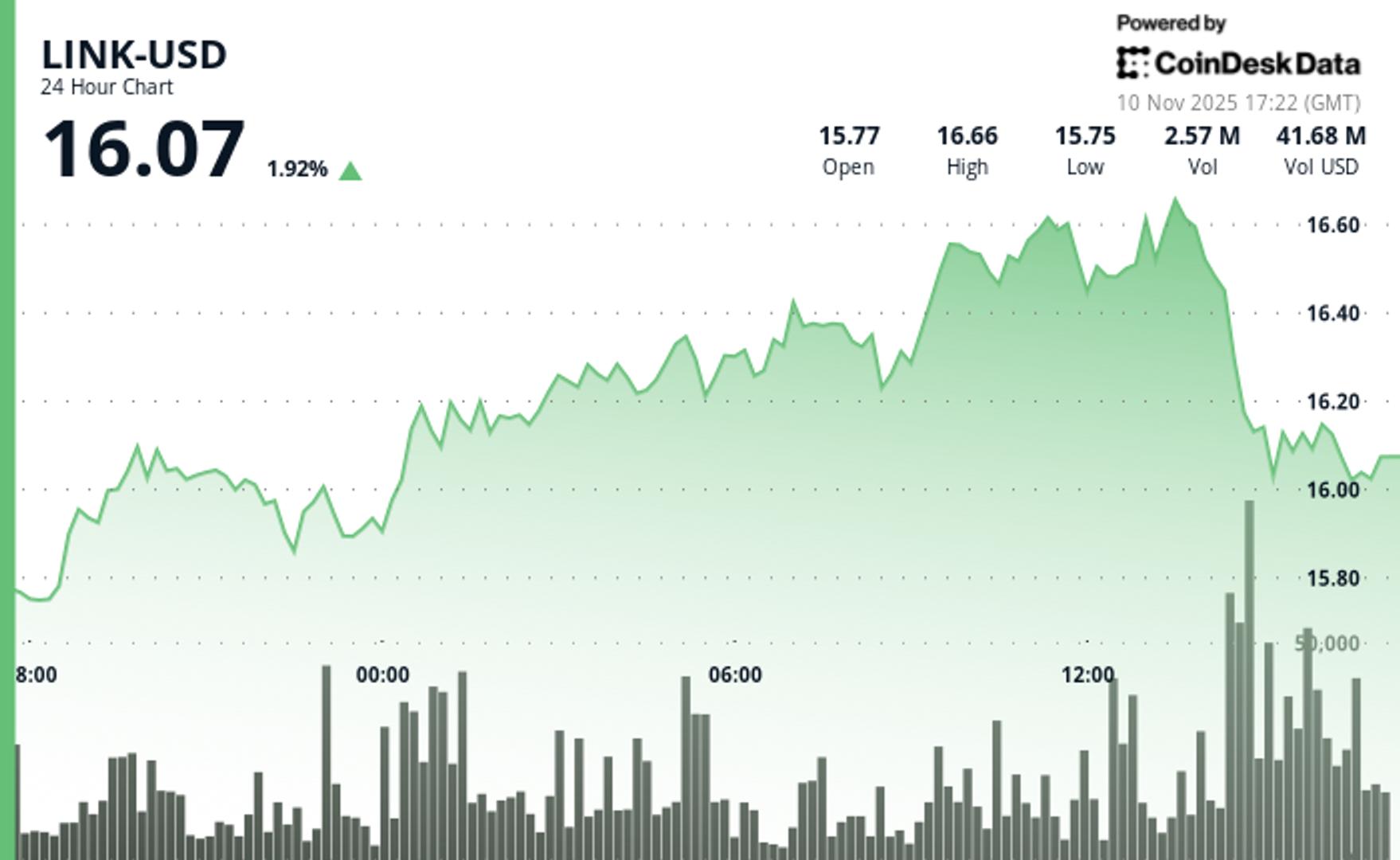

“Strong volume surge confirms the breakout above $16, although profit-taking near session highs introduces near-term uncertainty.”, — write: www.coindesk.com

The price jump followed a steady upward trend with higher lows and strong participation from traders, but the failure to hold above $16.50 signaled near-term exhaustion, CoinDesk Research’s technical analysis model said.

The most significant move came at midnight UTC, when 1.82 million tokens changed hands — nearly 70% above the daily average — confirming a breakout through the critical $16.00 level and validating the rally’s momentum.

However, the uptrend stalled as traders began taking profits near session highs. Volume exceeded 60,000 tokens in a short sell-off after 14:00 UTC, knocking LINK back to around $16, capping bullish continuation attempts for now, the model said.

The action occurred just ahead of Chainlink’s Rewards Season 1, set to launch November 11. The program allows eligible LINK stakers to earn token rewards from nine partner projects by allocating non-transferable points called Cubes.

Key Technical Levels Signal Consolidation for LINK

- Support/Resistance: Primary support is established at $16.47 following the breakdown, with $16.50 now serving as immediate resistance after the failed breakout attempt

- Volume Analysis: Midnight surge to 1.82M shares (69% above average) confirms breakout validity, although subsequent selling pressure exceeds 60K volume during the reversal

- Chart Patterns: 24-hour ascending trend with higher lows intact despite 60-minute consolidation failure; $16.51-$16.66 range defines near-term boundaries

- Targets & Risk/Reward: Bulls target return above $16.50 for continuation toward $16.66, while breakdown below $16.47 could test $16.30 support with $16.00 as ultimate downside target

Disclaimer: Parts of this article were generated with the assistance of AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy..

A deep dive into Zcash’s zero-knowledge architecture, shielded transaction growth, and its path to becoming encrypted Bitcoin at scale.

A deep dive into Zcash’s zero-knowledge architecture, shielded transaction growth, and its path to becoming encrypted Bitcoin at scale.

- Shielded adoption surgedwith 20–25% of circulating ZEC now held in encrypted addresses and 30% of transactions involving the shielded pool.

- The Zashi wallet made shielded transfers the default, pushing privacy from optional to standard practice.

- Project Tachyonled by Sean Bowe, aims to boost throughput to thousands of private transactions per second.

- Zcash surpassed Monero in market share, becoming the largest privacy-focused cryptocurrency by capitalization.

View Full Report

XLM surged past the $0.3020 resistance on strong institutional volume, outperforming the crypto market as analysts eye a possible seven-year triangle breakout targeting $1.52.

XLM surged past the $0.3020 resistance on strong institutional volume, outperforming the crypto market as analysts eye a possible seven-year triangle breakout targeting $1.52.

- XLM climbed 3.62% to $0.3004 with trading volume 18.90% above 30-day averages

- The token outperformed the crypto market by 4.86%, approaching the major relative strength threshold

- Technical analysts highlighted a seven-year symmetrical triangle pattern nearing the breakout point

Read full story