“Investor Confidentnce Rises As Bitcoin Holds Above $ 100,000 and Basis Trade Yields Approach 9%, Drawing Strong Institutional Interest.”, – WRITE: www.coindesk.com

Exchange-Traded Funds (ETFS) Recorded $ 667.4 Million in Net Inflows on May 19, The Largest Single-Day Total Since May 2, Signaling Renewed Institutes Interest.

Nearly Half of these inflows, $ 306 Million, Went Into ishares Bitcoin Trust (IBIT), Now at $ 45.9 Billion in Net Inflows, Accounting To Data Source Farside Investors.

The Renewed Demand Follows Bitcoin’s Strong Price Performance, Having Traded Above $ 100,000 for 11 Consuctive Days, Which Has Helped Restore Market Confidence.

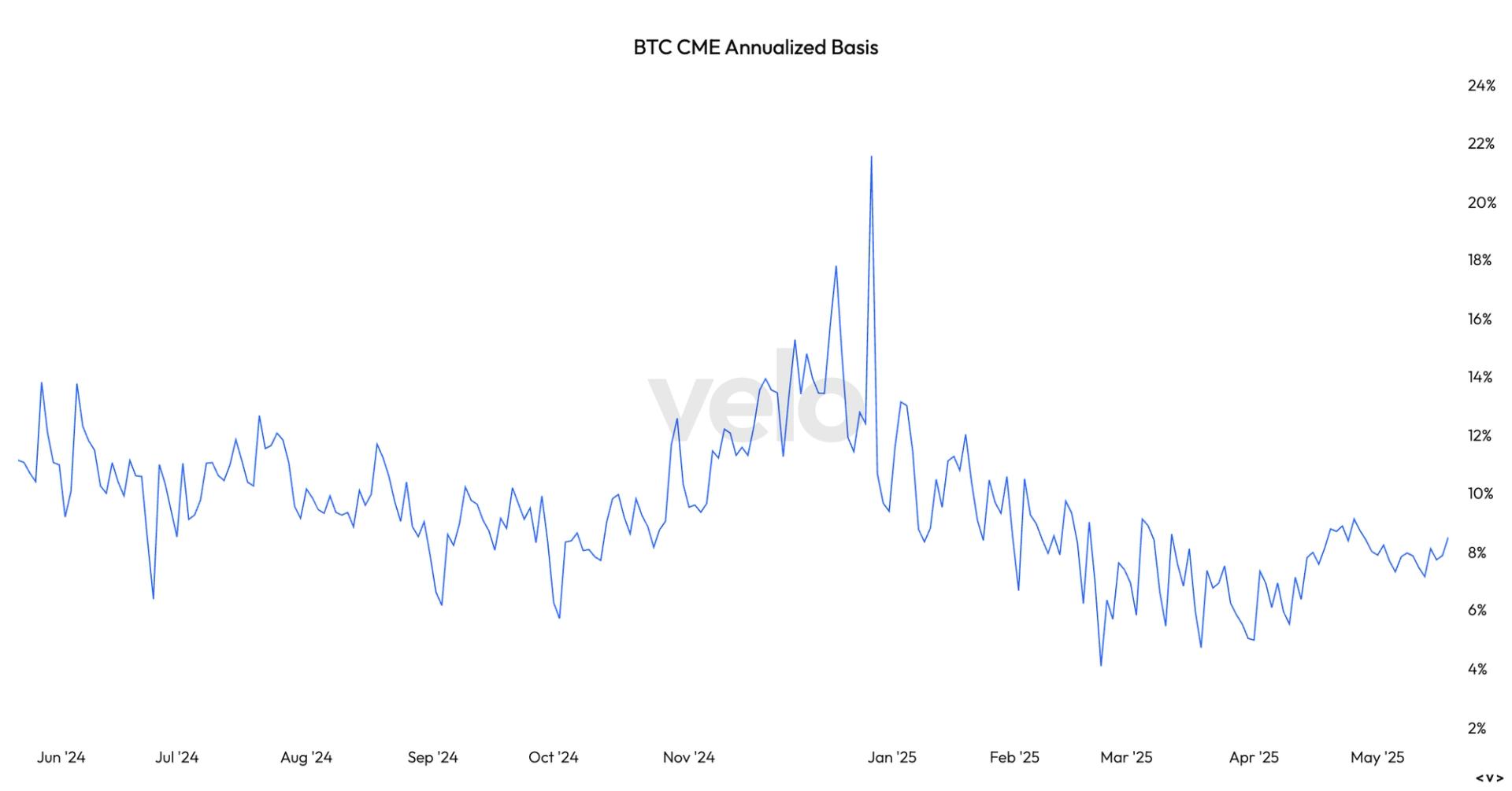

Additionally, The Annualized Basis Trade, A Strategy Where Investors Go Long on The Spot etf and Simultaneously Short Bitcoin Futures Contracts on the CME, HAS BECOME INCREARE 9%, Almost Double What Was Seen in April.

Accorging to velo data, this have sparked a modest Uptick in Basis Trade Activity As EvidenCed by An Increase in Trading Activity in the CME Futures.

On Monday, CME Futures Volumes Hit $ 8.4 Billion (Roughly 80,000 BTC), The Highest Since April 23. Meanwhile, Open Interest Stood at 158,000 BTC UndersCoring the Growing APPETITE for LEVERGED AND ARBITRAGE Strategies.

That said, Both Both Futures Volume and Open Interest Remain Well Bell The Levels Seen Whitcoin Reachn Reach An All-Time High of $ 109,000 in January, Indicating There’s Still.

The upwing in the Basis Suggests the Growth May Be ALREADY HAPPENING, Bringing Back Players That Left The Market Early This Year WHEN The BASIS DROPED TO Under 5%.

Recent 13f filings reveailed that the grewers pension Board exited itf positions in the first quarter, Likely in resiscy to a think-text favoraable Basis Trade Environment. However, Given that 13f Data Lags by a Quarter and the Basis Spread Has Since Widened From 5% to Nearly 10%, It Is Plasible that It Renected The Market in The Second Quarter To -To Capital Opportunity.

In addition to his professional endeavors, James Serves as an Advisor to Coinsilium, A UK Publicly Traded Company, WHERE HE PROVides Guidance on Their Bitcoin Treasury Strategy. He Also Holds Investments in Bitcoin, Microstrategy (MSTR), and Semler Scientific (SMLR).

X Icon