“One Analyst Characterized Bitcoin’s Recovery from Last Week’s Decline As A “Peaceful Rally,” with Buyers Stepping in To Support The Uptrend.”, – WRITE: www.coindesk.com

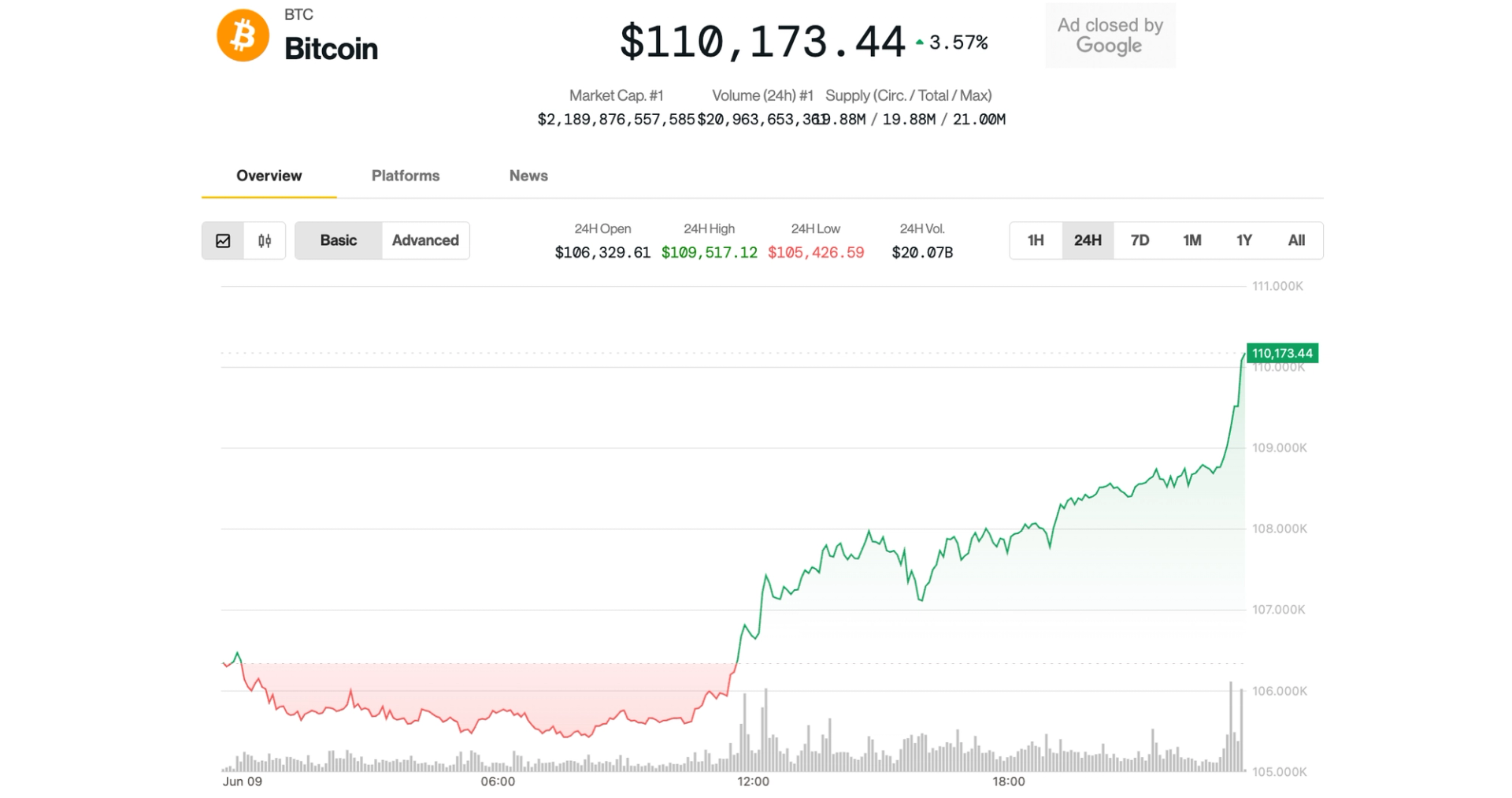

Quiet Climb On Monday Accelerated to Its Strongest Price in June, Rebounding from Last Week’s Decline to Near All-Time High Levels.

The Largest Crypto Advanced by 3.7% Over The Past 24 Hours, Topping $ 110,000, and It’s Changing Hands by Only 2% from ITS Record Prices Observed in May. Ethereum’s Ether

Kept Pace with A 3.8% Gain During the Same Period, Bouncing Above $ 2,620. Native tokens of Hyperliquid

and sui

OutperFormed Mist Large-Cryptocurrencies, Rising 7% and 4.5%, Respectively.

Bitcoin’s Move Higher Caunght Levered Traders Off-Guard, Liquidating Over $ 110 Million Worth of Short Positions Within and Hour, Coinglass Data Shows. Across All Crypto Assets, Some 330 Million of Shorts Were Liquidated Durying The Day, The Most in A MONT. SHORTS are seeking to Profit from Declining Asset Prices.

The Move Happened While Traditional Markets Showed Muted Action, with The S&P 500 and Nasdaq Indexes Flat on the Day. Crypto-Related Stocks Bounced Durying the Session to Catch up with Btc’s Recovery Over the Weekend.

“A ‘PEACEFUL’ IS A Perfect Way to Describe this Price Action,” Said Well-Followed Analyst Caleb Franzen, Founder of Cubic Analytics. “Just A Consistent Development of Highher Highs and Higher Lows. Any SIGNS OF WEAKNESS? BUYERS STEP IN AND DEFAKE OF THE TREEN.”

The Crypto Market is Now Steadier Footing for a Potential Next Leg Higher after Bitcoin’s 10% Decline to Near HAVING FLUSHED EXCESSIVE LEVERAGE, BITFINEX Analysts Noted in a Monday Report.

However, on -chain Data Indicates Rising Sell Pressure from Long-Term Holders That Could Overwhelm Demand, The Analysts Adeded.

“Bitcoin is now at a Crossroads – balanced between structural Support and Waning Bullish Momentum, Waiting for Its Next Macro Cue,“ The Bitfinex Note Added.

TOSE Macro Catalysts May Come Later this Week, Noted Jake O, OTC Trader at Crypto Trading Firm Wintermute.

“Us and Chinese Trade Representatives Are Schemeduled to Meet Today, With Markets Likely Sensitive to Any Headlines Following Last Week’s Positive Momentum, and The Data Calent. CPI Will Offer Fresh Insight Inflation, “He Said.

Update (June 9, 21:51 UTC): Adds Short Liquidation Data from Coinglass.

X Icon