“On -chain Data flagged institctional-Sized Flows, with Nearly 155 Million in XRP Turnover Dringing Recovery Periods, Far Above The 63 Million Daily Average.”, – WRITE: www.coindesk.com

(Coindesk Data)

(Coindesk Data)

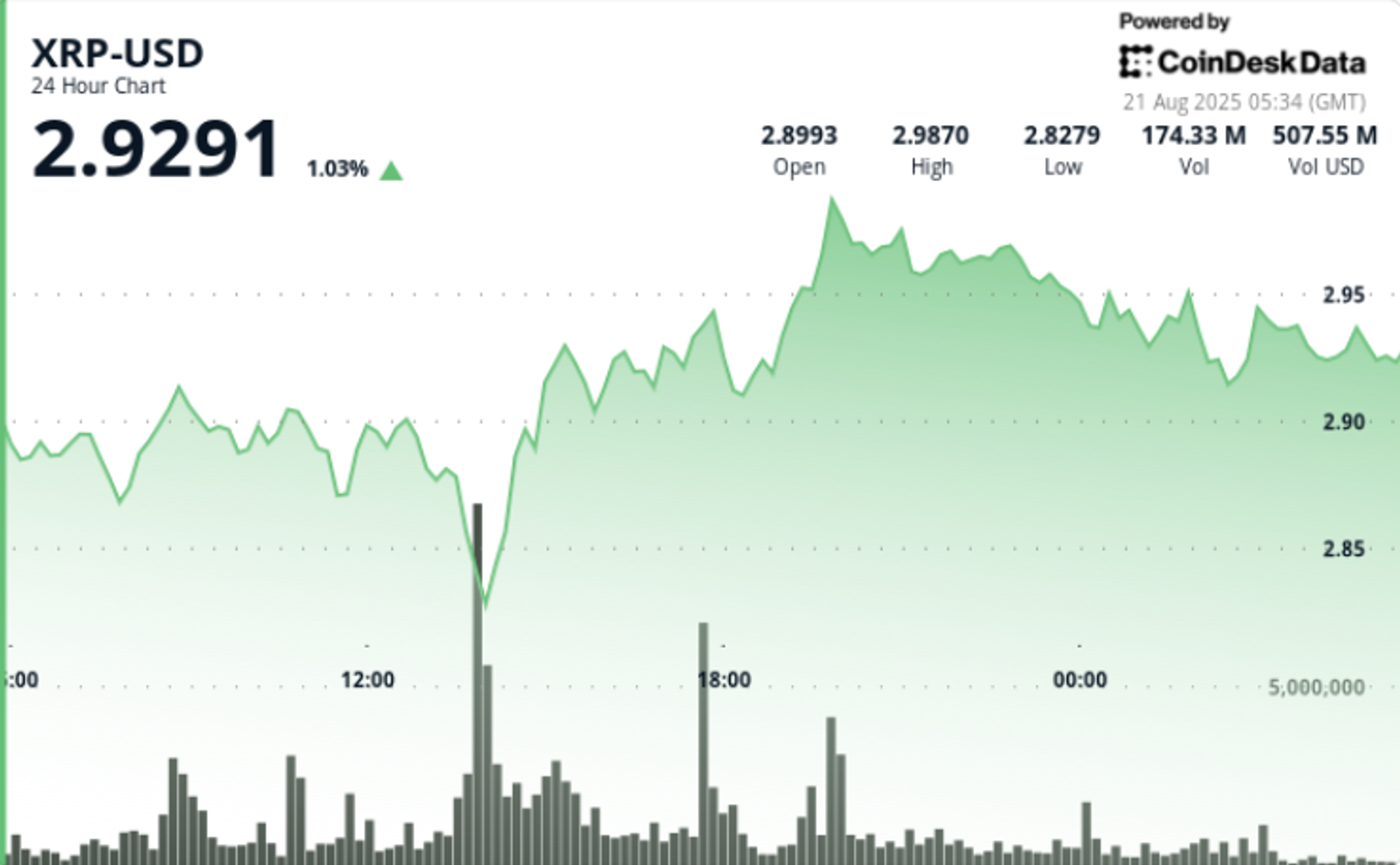

- XRP Rallied Towards $ 3, With Trading Volume IncreASING by Over 6% Above Its Weekly Average, Indicating Renewed Institutional Interest.

- The Token Faces A Strong Resistance at the $ 3 Mark, Despite A Significant Price Swing Between $ 2.84 and $ 2.99.

- Traders Are Closely Monitoring WHETHER The $ 2.93 Support Level Will Hold or If A Break Above $ 3 Will Trigger Further Upward Momentum.

News Background• Xrp’s Rally ComESS AMID BROADER Crypto Stabilization, With Altcoins Tracking Modest Inflows After Last Week’s DrawDown.

• On -chain Data flagged institctional-Sized Flows, with Nearly 155 Million in XRP Turnover Dringing Recovery Periods, Far Above The 63 Million Daily Average.

• Market Chatter Initially Suggested Xrp Was Hitting New Highs, Thought The Actual All-Time Peak Remains $ 3.84 from January 2018-UndersCoring theater This is a Recovery TEST

Price Action Summary• XRP Swung 5.1% Between $ 2.84 and $ 2.99 in The 23-Hur Window From Aug. 20 13:00 to aug. 21 12:00.

• The Strongest Push Came Augund 19:00 UTC On Aug. 20, WHEN The TOKEN SURGED FROM $ 2.84 to $ 2.99 on 80.6 Million Volume.

• Subsequent Sessions Showed Consolidation, with Repeated Bounces in the $ 2.89– $ 2.93 Range, Confirming IT as Interim Support.

• A Sharp Wipsaw in the Final Hour (AUG. 21 11: 03–12: 02) SAW An 8.6% Swing: from $ 2.916 to $ 2.901 On 960,000 UNITS, Before Stabilizing.

Technical Analysis• Support: $ 2.89– $ 2.93 Zone Shows Multiple Strong Bounces on Above-Average Participation.

• Resistance: $ 2.99– $ 3.00 Psychologic Celing Caps Momentum; Repeated Rejects Visible.

• Volume: 80.65 Million During the Rally Vs. A 24-Hour Baseline of ~ 63 Million.

• Pattern: SideWays Consolidation Following Bullish Impulse; Momentum tilting slightly downward.

What Traders Are Watching• WHETHER $ 2.93 SUPPORT HOLDS IN THE SHORT TERM OR GIVES WAY TO A RETEST OF $ 2.82.

• Break Above $ 3.00 As A Potential Trigger for Trend Continusion.

• Volume Sustainability – if Flows Taper, Bulls Risk Lozing Control.

Shaurya Holds Over $ 1,000 in Btc, Eth, Sol, Avax, Sushi, Crv, Near, YFI, YFI, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, CAKE, Vet, Vet, Vet RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, Banana, Rome, Burger, Spirit, and ORCA.

He Provides Over $ 1,000 to Liquidity Pools on Compound, Curve, Sushiswap, Pancakeswap, Burgerswap, Orca, AnaSwap, Spiritswap, Roki Protocol, Yearn Finance Olympusdao, Rome, Trader Joe, and Sun.

X Icon

All Content Produced by Coindesk Analytics is Undergoes Human Editing by Coindesk’s Editorial Team Before Publication. The Tool Synthesizes Market Data and Information from Coindesk Data and Other Sources to Create Timely Market Reports, with All External Sources Clearly Attributed Within Each.

Coindesk Analytics Operates Under Coindesk’s AI Content Guidelines, WHICH PRIORITIZE Accuracy, Transparency, and Editorial Oversight. Learn more about Coindesk’s Approach to Ai-Generated Content In Our Ai Policy.

The Data Currently on Hand Does Not Support the Case for Lowering Interest Rates, Said the President of the Cleveland Fed.

The Data Currently on Hand Does Not Support the Case for Lowering Interest Rates, Said the President of the Cleveland Fed.

- Cleveland Fed President HamMACK SAYS the DATA DO NOT SUPPORT The CASE FOR A RATE CUT.

- Her Remarks Suggest Chairman Powell Continues to have Support at the Central Bank for His Hawkish Stance.

- Bitcon Fell To a Session Low Following the Comments.

Read Full Story