“Institutional flows surged 54% above the weekly average, indicating strategic selling rather than retail panic.”, — write: www.coindesk.com

(CoinDesk Data)

(CoinDesk Data)

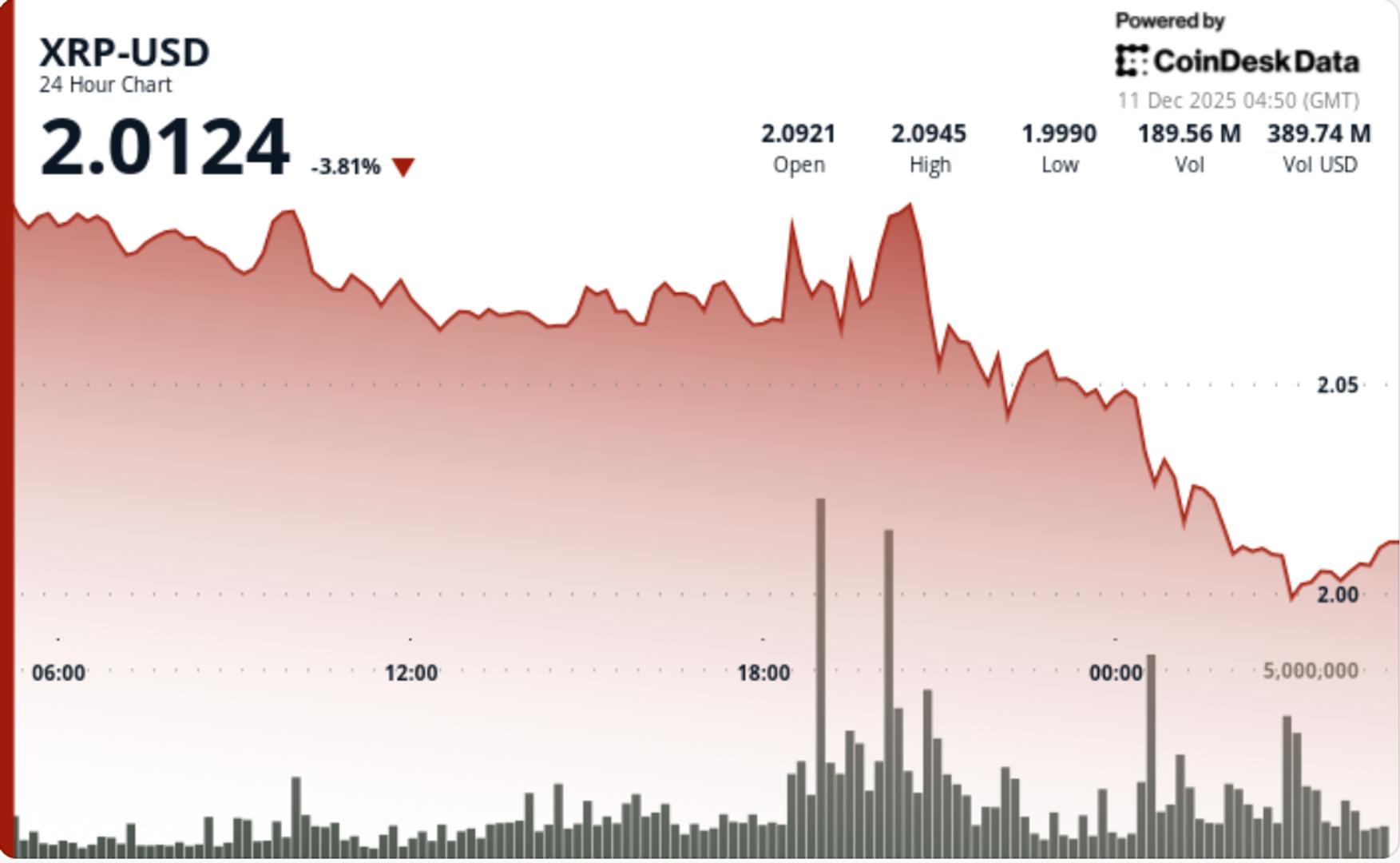

- XRP fell from $2.09 to $2.00, marking a 4.3% decline and underperforming the broader crypto market.

- Institutional flows surged 54% above the weekly average, indicating strategic selling rather than retail panic.

- Despite ETF inflows, XRP struggles to break the $2.09–$2.10 resistance, maintaining a tight trading range.

What to Know

- XRP slipped from $2.09 to $2.00, losing 4.3% on the session and underperforming the broader crypto market by roughly 1%.

- The rejection was decisive: a 172.8M volume spike (205% above the daily average) hit right as XRP tagged $2.08, flipping the entire move into a failed breakout. The selloff didn’t come from retail panic.

- Volume across the session ran 54% above the 7-day average — classic institutional distribution above resistance rather than emotional dumping.

- Exchange balances dropped from 3.95B to 2.6B tokens over the last 60 days, compressing supply even as the spot price failed to hold the breakout attempt. That divergence is setting up an increasingly asymmetric structure as XRP trades in a narrowing multi-month triangle

News Background

- US spot XRP ETFs pulled in over $170 million in weekly inflows, marking another week with zero outflows.

- Heavy spot selling continues to hit the $2.09–$2.10 band, where XRP has now failed multiple times.

- Market makers flagged rising distribution pressure ahead of yesterday’s move, with heavy offers sitting above $2.10.

- Exchange supply continues to grind lower, falling to 2.6B tokens, strengthening long-term supply compression.

- Despite the ETF support, XRP lagged broader crypto as CD5 fell 3.1% on the day — suggesting the move was token-specific rather than macro-driven.

Price Action SummaryXRP dropped 4.3% from $2.09 → $2.00

• Intraday range: 5.4% as resistance rejection triggered high-volatility unwind

• Volume: 172.8M peak at 19:00 UTC (up 205% above daily average)

• Multiple rejections at $2.08–$2.10 created a hard ceiling

• Late-session stabilization formed higher lows near $1.999–$2.005

• Relative performance: lagged broader crypto by ~1%

Technical Analysis

- Support: $2.00 psychological shelf. Below that sits a soft zone at $1.95, aligned with prior demand clusters.

- Resistance: $2.09–$2.10 is the dominant wall — the session created a clear supply shelf here. Any close above $2.10 flips the entire short-term bullish structure.

- Volume Structure: 54% above weekly averages = institutional flows, not noise The 172.8M spike exactly at the failed breakout confirms aggressive sellers defending the level.

- Pattern: Multi-month triangular compression tightening as exchange supply falls. Price remains mid-range; neither breakout nor breakdown confirmed.

- Momentum skewed bearish short-term after clean rejection. Bounce attempts capped below $2.08 on declining volume is equal to a weak follow-through.

What Traders Are Watching.

- Can $2.00 survive a second test? A clean break exposes a fast move towards $1.95.

- ETF inflows remain the biggest offset to spot weakness — any slowdown removes the floor.

- A breakout requires multiple hourly closes above $2.10 with sustained >100M volume.

- Compression now extremely tight — the next move should be larger than the last.

- Exchange balance drop is the wildcard: thinner supply = faster swings once direction confirms

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025, with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch, the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B, while derivatives volume peaked the same month at over $4B.

View Full Report

Market uncertainty persists due to internal Fed divisions and unclear future rate paths until 2026.

Market uncertainty persists due to internal Fed divisions and unclear future rate paths until 2026.

- Bitcoin and Ether prices fell following the Federal Reserve’s rate cut and mixed signals about future monetary policy.

- The Fed’s decision to purchase short-term Treasury bills aims to manage liquidity, not to implement quantitative easing.

- Market uncertainty persists due to internal Fed divisions and unclear future rate paths until 2026.

Read full story