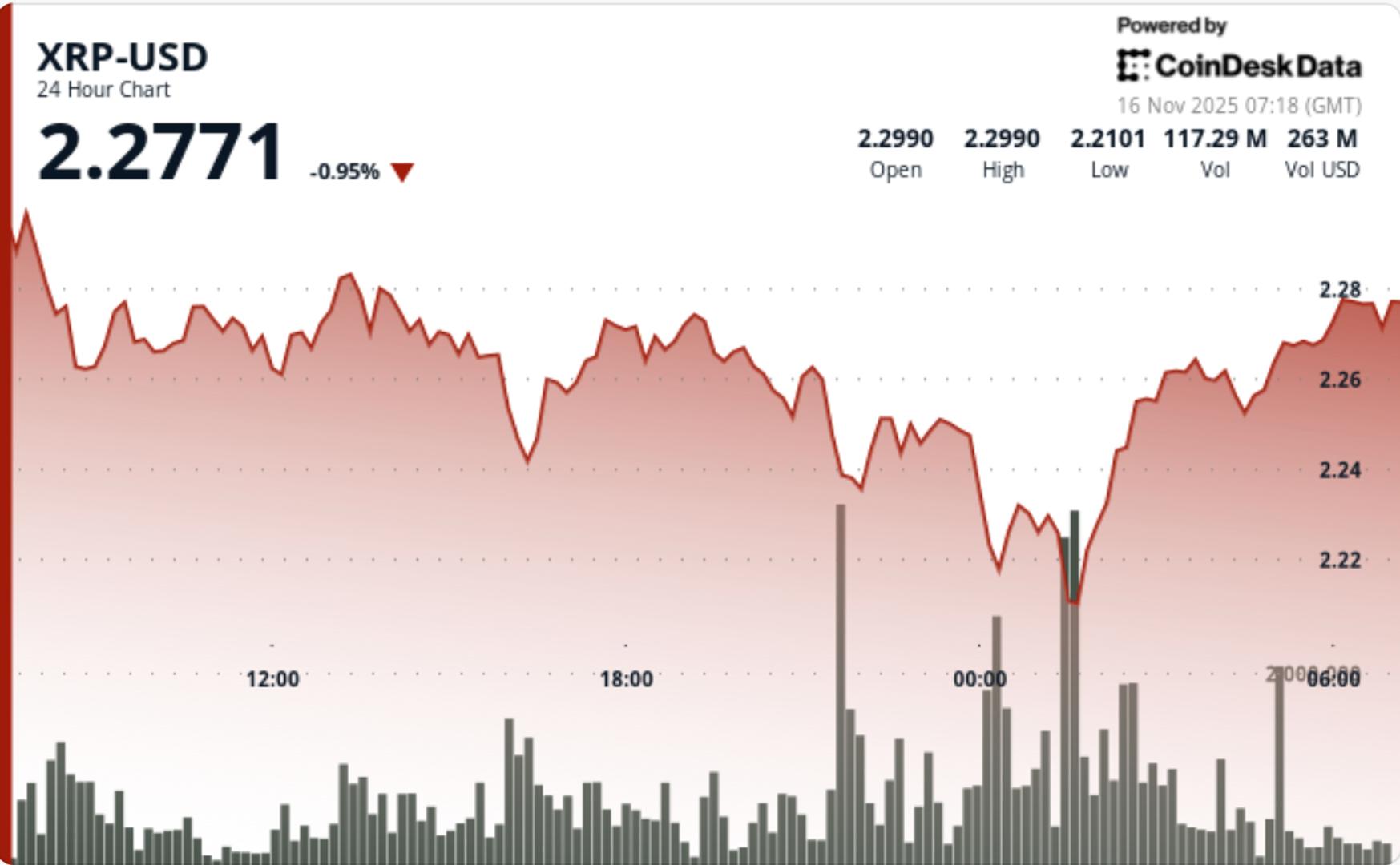

“The market remains bearish with XRP struggling to break above the $2.23–$2.24 resistance zone.”, — write: www.coindesk.com

(CoinDesk Data)

(CoinDesk Data)

- XRP experienced a significant selloff, dropping from $2.31 to $2.22, despite the launch of a new US spot XRP ETF.

- The market remains bearish with XRP struggling to break above the $2.23–$2.24 resistance zone.

- Institutional interest is evident from ETF inflows, but broader market pressures continue to suppress crypto momentum.

News BackgroundThe decline unfolded against a backdrop of mixed institutional signals and heightened macro uncertainty. Crypto markets remain trapped in a medium-term downtrend, with sentiment pinned in the fear zone as volatility spikes across majors.

Canary Capital’s newly launched US spot XRP ETF (XRPC) registered $58.6 million in first-day volume, far exceeding analyst expectations of $17 million. Yet the strong debut failed to stabilize XRP, as derivatives markets flashed stress signals. Roughly $28 million in XRP liquidations hit within 24 hours, with long positions accounting for nearly $25 million of the wipeout.

Market analysts warn that institutional flows remain conflicted—ETF inflows show interest, but broader risk-off pressure continues to suppress crypto liquidity and momentum.

Price Action SummaryXRP dropped 4.3% from $2.31 to $2.22 during the 24-hour session ending November 16 at 02:00 UTC. The decline carved a $0.10 range with a clear sequence of lower highs confirming a bearish structure.

The most aggressive selling hit at 00:00 UTC, when 74M XRP traded—69% above the 24-hour average—breaking the $2.24 support. Price slid to $2.22, marking the session low. Three separate volume spikes above 57M during decline phases validated sustained distribution.

Despite the ETF catalyst, the selloff accelerated as the price rejected $2.31 and failed to find support near prior consolidation zones. The pair settled into a tight $2.22–$2.23 consolidation after the breakdown.

Technical AnalysisSupport/Resistance:

- Primary support: $2.22 (capitulation low)

- Immediate resistance: $2.23–$2.24 breakdown zone

- Critical Fibonacci support: $2.16 (0.382 retracement) — loss of this level risks swift drop toward $2.02–$1.88

Volume Profile:

- Breakdown volume: 74M XRP (+69%) confirming capitulation

- Two reversal-phase spikes (01:39, 01:46): 4.7M each, signaling selling exhaustion

- Recovery saw normalized but steady volume, consistent with bottom-fishing interest

Chart Structure:

- Overnight price hammered into support, printing a textbook V-shaped reversal

- Higher lows formed at $2.209 → $2.217 → $2.227, indicating momentum shift

- However, broader downtrend from $2.31 remains intact pending resistance reclaim

- Failure to break $2.23–$2.24 zone limits upside follow-through

Momentum Indicators:

- Intraday oversold conditions triggered reversal, but daily trend bias remains bearish

- 50D/200D structure slopes downward, adding overhead pressure

What Traders Should KnowXRP sits at a tactical pivot after a dramatic washout:

- Holding $2.22 is crucial — failure exposes direct move toward $2.16, then $2.02–$1.88

- A confirmed reclaim of $2.24, followed by $2.31, is needed to rebuild bullish structure

- ETF flows will influence volatility — follow early XRPC volume at US market open

- The V-shaped rebound provides short-term relief, but major resistance overhead limits immediate upside

- A sustained break above $2.48 is required to shift trend bias back toward $2.60+ targets

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025, with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch, the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B, while derivatives volume peaked the same month at over $4B.

View Full Report

Dogecoin rebounding sharply from a heavy-volume flush while Shiba Inu broke key support before staging an aggressive intraday reversal.

Dogecoin rebounding sharply from a heavy-volume flush while Shiba Inu broke key support before staging an aggressive intraday reversal.

- Dogecoin rebounded 3.0% after a sharp decline, driven by institutional buying and strong volume support.

- Shiba Inu fell 2.0%, breaking key support before a V-shaped recovery signaled potential stabilization.

- Broader crypto markets face pressure from AI-bubble concerns and Bitcoin ETF outflows, impacting meme-coin volatility.

Read full story