“October’s UK labor data: Rising wages, steady unemployment challenge BoE’s rate stance as inflation moves above the BoE’s 2% target.”, — write: www.fxempire.com

- UK wages rose 5.2% in October, complicating BoE rate cut bets amid rising inflation and steady unemployment at 4.3%.

- The BoE faces pressure as October wage growth outpaces forecasts, signaling higher inflation risks into Q1 2025.

- BoE expected to hold rates at 4.75% Thursday, with rising wages and inflation clouding early 2025 outlook.

In this article:

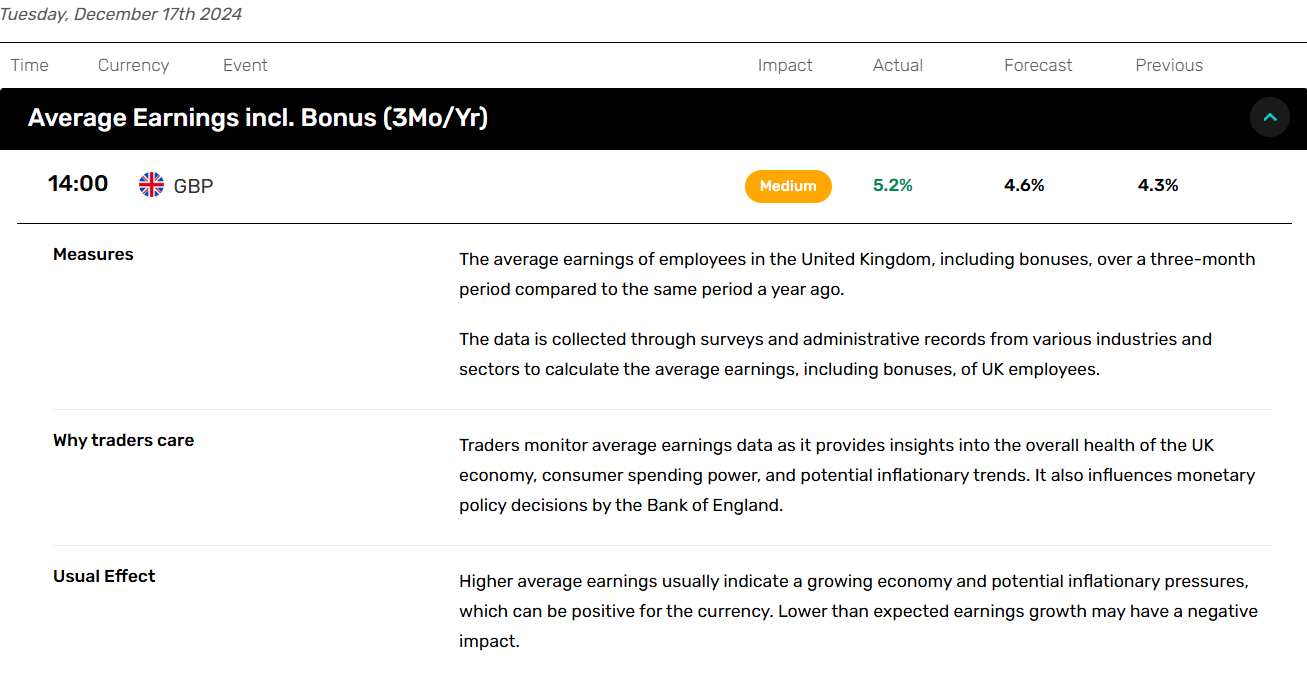

The UK unemployment rate held steady at 4.3% in October, suggesting a stabilizing labor market. However, average hourly earnings (including bonuses) rose by 5.2% in the three months to October 2024, compared to the same period in 2023, up sharply from 4.3% in September.

- The number of payrolled UK employees grew by 24,000 month-on-month in October but dropped by 22,000 over the three-month period.

- Job vacancies fell by 31,000 from September 2024 to November 2024, marking the 29th consecutive period of decline.

- Claimant counts edged up by 300 in November after falling by 10,900 in October.

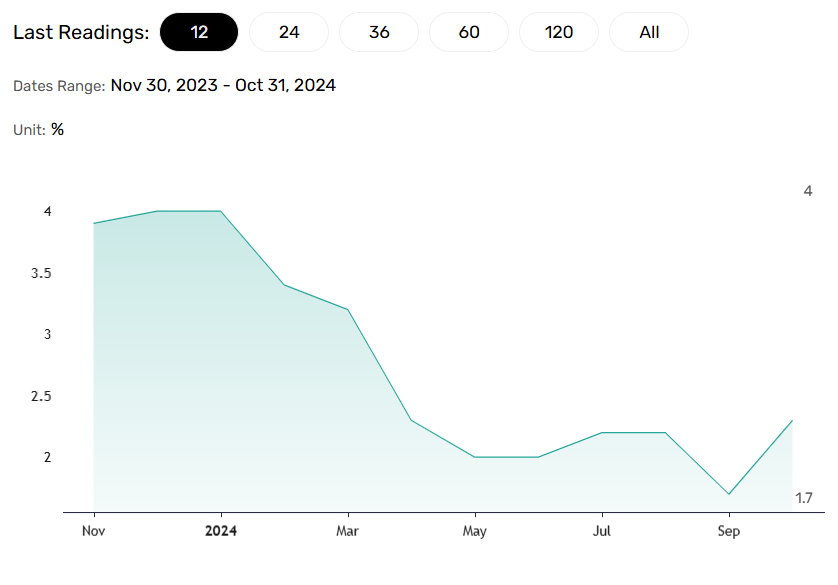

The UK’s annual inflation rate jumped from 1.7% in September to 2.3% in October, surpassing the BoE’s 2% target. Upcoming UK inflation figures, due on Wednesday, may further dampen expectations for a Q1 2025 BoE rate cut. Economists expect an annual inflation rate of 2.6% in November.

However, the BoE must also consider the implications of the UK Budget. Businesses have warned about higher wages paired with job cuts, complicating the wage growth-unemployment dynamic as a guide for consumption and inflation trends.

What Do Experts Think About the Upcoming BoE Interest Rate Decision? Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, remarked on December’s PMI data, stating,

“While the December PMI is indicative of the economy more or less stalled in the fourth quarter, the loss of confidence and increased culling of jobs hints at worse to come as we head into the new year.”

Williamson concluded,

“Policymakers at the Bank of England may be cautious about cutting interest rates, however, given the resurgence of inflation being signaled, adding further to downturn risks in 2025.”

GBP/USD Response to the UK Labor Market Data Ahead of the October UK labor market report, the GBP/USD briefly climbed to a high of $1.26981 before falling to a pre-report low of $1.26656.

After the release of the UK Labor Market Overview Report, the GBP/USD surged from $1.26707 to a high of $1.26947, reflecting the impact of wage growth on monetary policy.

On Tuesday, December 17, the GBP/USD was up 0.07% to $1.26905.

About the Author

With over 20 years of experience in the finance industry, Bob has been managing regional teams across Europe and Asia and focusing on analytics across both corporate and financial institutions. Currently he is covering developments relating to the financial markets, including currencies, commodities, alternative asset classes, and global equities.

Advertisement