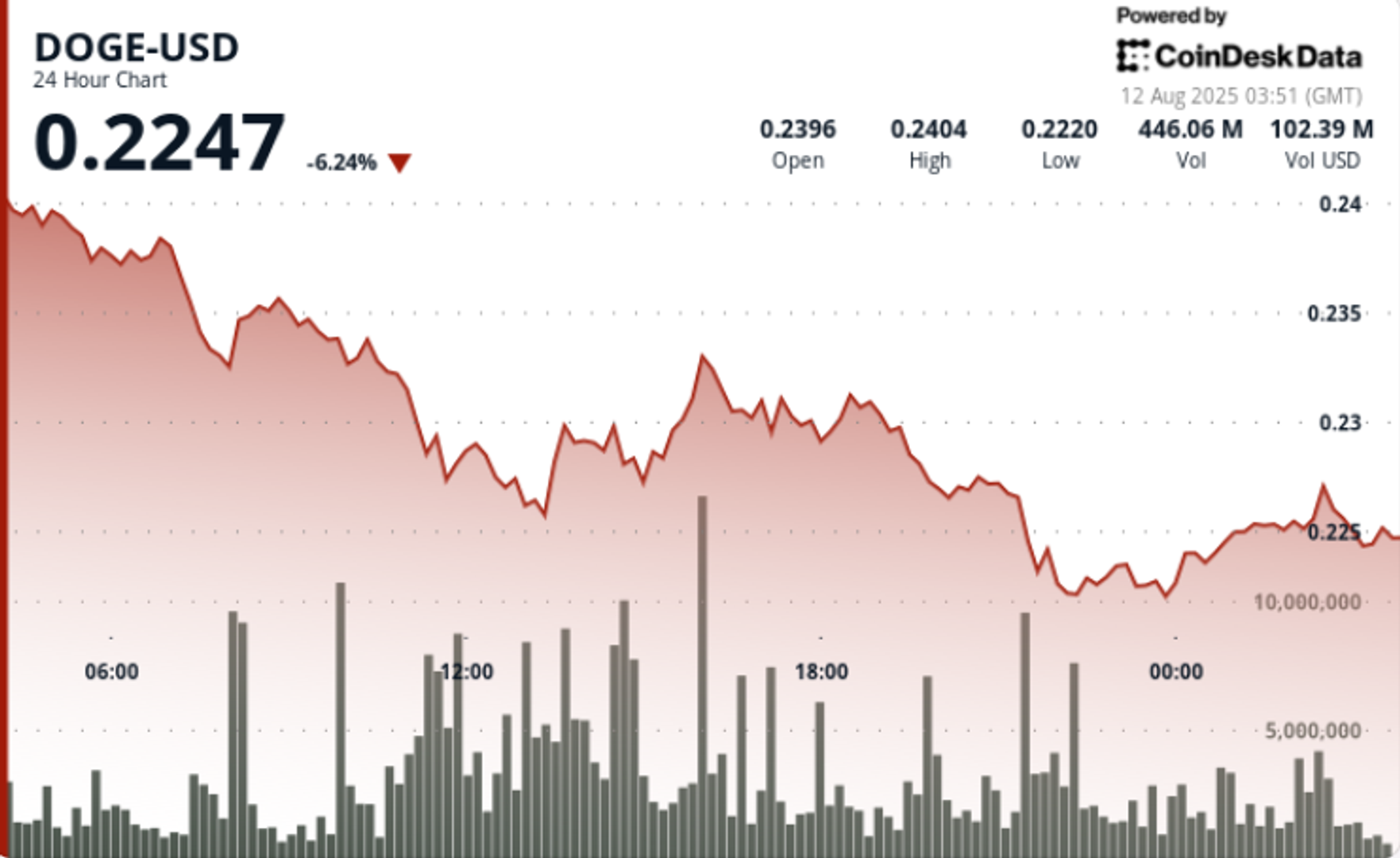

“Memocoin Slides Sharply On High-Volume Distribution Before Consolidating Near Key Support Levels.”, – WRITE: www.coindesk.com

(Coindesk Data)

(Coindesk Data)

- Doge Fell 6.88% from $ 0.24 to $ 0.22 As Selers Dominated the Market.

- Resistance Was Establized at $ 0.238, with Significant Selling Pressure Observed.

- Broader Market Factors, Including Regulatory Uncertainty and Trade Tensions, Contributed to the Deckline.

Buyers Step in at $ 0.226 Durying The 11:00 SESSION, Generation 793.38m in Volume. Secondary Resistance Forms at $ 0.231 As Multiple Rally Attempts Fail. Final-Hour Trade Sees Doge Range-Bound Between $ 0.2247- $ 0.2253 with Volume Compression, Suggesting Potential Seler Exhaustion.

News BackgroundThe Selloff Comes Amid Broader Weakness in Digital Assets, With Regulatory Uncertainty and Global Trade Tensions Weighting on Risk Sentimnt. Majoor Economies Are Escalating Tariff Disports, Pressuring Multinational Supple Chats, While Central Banks Signal Potential Policy Shifts-A mix that hasPTED InstITED InstITED Instituted Instituted Instituted Instituted Instituted Institut.

Price Action Summary• Doge Declines 6.88% from $ 0.24 to $ 0.22 In August 11 01: 00– August 12 00:00 Window

• $ 0.238 Resistance Locked in After 07:00 Seling Climax on 485.69m Volume

• $ 0.226 Support SEES 793.38m in Buy-Side Flows; $ 0.231 Secondary Resistance Caps Rebounds

• Final Hour Trades in Tight $ 0.2247- $ 0.2253 Range With Falling Volume

Market Analysis and Economic FactorsWhale and Institutional Profit-Taking at $ 0.238 Resistance Set The Tone for the Session, Triggering A Breakdown Below $ 0.23 and Forcing Retes of $ 0.226. Support Buying Was Evident on Two Major Volume Spikes (11:00 and 21:00), But Repeated Rejects Near $ 0.231 Kept Doge Pinned.

With Volume Thinning at SESSION LOWS, The Structure Hints at Possible Base-Building-Thought Macro Headwinds Could See $ 0.22 TESESTED AGAIN.

Technical Indicators Analysis• Resistance: $ 0.238 (High-Volume Reject), $ 0.231 (Secondary Cap)

• Support: $ 0.226 Initial Defense, $ 0.2247- $ 0.2249 intrady Floor

• 24 -Hor Range: $ 0.019 (7.89% volatility)

• Volume Compression Near Lows Signals Possible Seller Fatigue

• Multiple Failed Breakouts Above $ 0.231 CONFIRM SUPPLY Zone Overhead

What Traders Are Watching• RETEST OF $ 0.22 and WHERE BUYER FLOWS REAPPEAR AT Key Support

• Breakout Attempts Above $ 0.231 As A Firmst Step Town Recovery

• Impact of Macro Headlines on Broader Meme Coin Sentiment

• SIGNS OF RENEWED WHALE ACCUMULATION AFTER SELLING CLIMAX

Shaurya Holds Over $ 1,000 in Btc, Eth, Sol, Avax, Sushi, Crv, Near, YFI, YFI, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, CAKE, Vet, Vet, Vet RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, Banana, Rome, Burger, Spirit, and ORCA.

He Provides Over $ 1,000 to Liquidity Pools on Compound, Curve, Sushiswap, Pancakeswap, Burgerswap, Orca, AnaSwap, Spiritswap, Roki Protocol, Yearn Finance Olympusdao, Rome, Trader Joe, and Sun.

X Icon

All Content Produced by Coindesk Analytics is Undergoes Human Editing by Coindesk’s Editorial Team Before Publication. The Tool Synthesizes Market Data and Information from Coindesk Data and Other Sources to Create Timely Market Reports, with All External Sources Clearly Attributed Within Each.

Coindesk Analytics Operates Under Coindesk’s AI Content Guidelines, WHICH PRIORITIZE Accuracy, Transparency, and Editorial Oversight. Learn more about Coindesk’s Approach to Ai-Generated Content In Our Ai Policy.

Token Retreats from Early Highs as Institute Selling Emerges, With Volumes Remaining Elegated After Ripple-SEC Legal Resolution.

Token Retreats from Early Highs as Institute Selling Emerges, With Volumes Remaining Elegated After Ripple-SEC Legal Resolution.

- Xrp Fell 2% from $ 3.19 to $ 3.14 in the 24-HOUR PERIOD ENDING AUGUST 12, After Reaching An Intrady High of $ 3.32.

- Ripple Labs and the Sec Have Settled their Legal Dispute, Boosting XRP Trading Volumes by 208% to $ 12.4 Billion.

- Despite The Settlement, Xrp’s Price Remains InfluenCed by Macroeconomic Factors, Including Trade Dispetuses and Monetary Policy Shifts.

Read Full Story