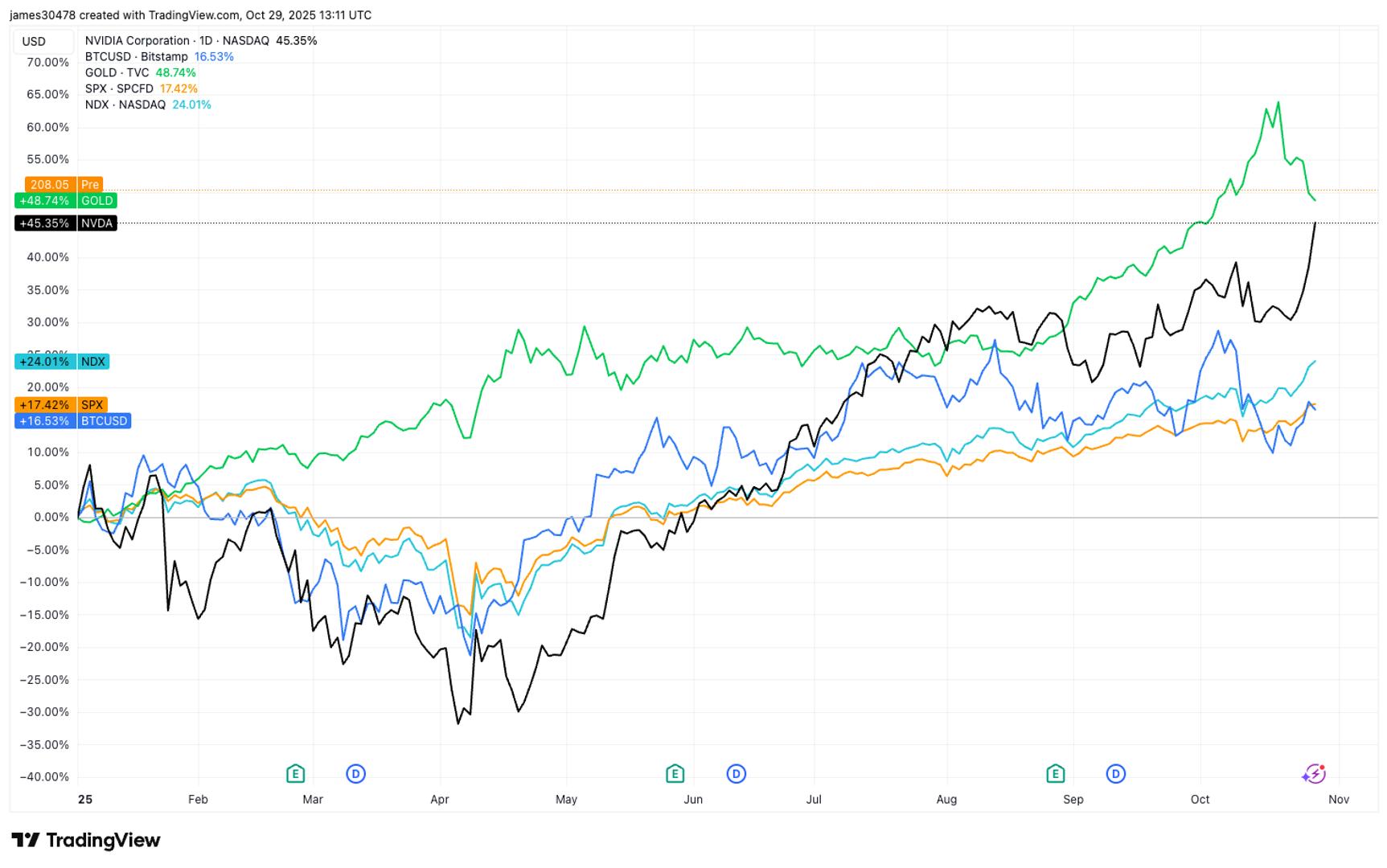

“Bitcoin is not just lagging gold in 2025, but its returns have also slipped below those of the S&P 500 and the Nasdaq.”, — write: www.coindesk.com

With additional gains on Tuesday while bitcoin dipped, the S&P 500’s 17% rise year-to-date is ahead of BTC’s 16% advance. The Nasdaq has widened its lead over bitcoin, now higher by 24%. Gold continues to be the top-performing major asset class with a 50% rise.

No rally in US stocks can be talked about with mentioning the Mag 7 names, and specifically within that group Nvidia (NVDA). Shares are up 17% over the past five days amid a continuing barrage of AI-related partnership deals, pushing the company’s market cap above $5 trillion early Wednesday.

Microsoft (MSFT) and Apple (APPL) remain just behind NVIDIA, each valued at around a $4 trillion market cap.

According to the X account Hedgie Markets, NVIDIA is responsible for nearly 20% of the S&P 500’s gains this year and now accounts for 8.3% of the index’s total weighting.

To put Nvidia’s size in perspective, the company’s market cap is now larger than the combined values of AMD, Arm Holdings, ASML, Broadcom, Intel, Lam Research, Micron, Qualcomm, and Taiwan Semi, according to Dow Jones Market Data.

Nvidia’s growth has coincided with the huge developments in artificial intelligence. On Tuesday alone, the company announced a series of new partnerships with Palantir (PLTR) and Samsung, a $1 billion investment in Nokia, and a potential collaboration with the US Department of Energy to build new supercomputers.

It’s more of the same in opening action on Wednesday, with the Nasdaq higher by 0.5%, Nvidia up 4.6% and bitcoin slipping back under $113,000, roughly 10% below its record high.

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

View Full Report

Western Union’s new Solana-based stablecoin and crypto cash-out network mark a smart step into blockchain-enabled remittances, the report said.

Western Union’s new Solana-based stablecoin and crypto cash-out network mark a smart step into blockchain-enabled remittances, the report said.

- Western Union shares rose 6.5% on Tuesday after the firm unveiled its Solana-based stablecoin and crypto off-ramp network.

- William Blair said the move shows stablecoins are an opportunity for remittance firms, not a threat.

- The bank kept its market perform rating on the stock, citing slow core growth despite strong yield and digital progress.

Read full story