“Futures Now Price in Up to Five Rate Cuts in 2025 as Investors Bet on An Aggressive Policy Pivot.”, – WRITE: www.coindesk.com

Bitcoin (BTC), The Leading Cryptocurrency by Market Value, Traded 8% Lower at $ 75.800 and The Us Stocks Were on Track For Their Worst Three-Day Performance, with S & P 500 Fut. and Losses Approaching 15% Overall.

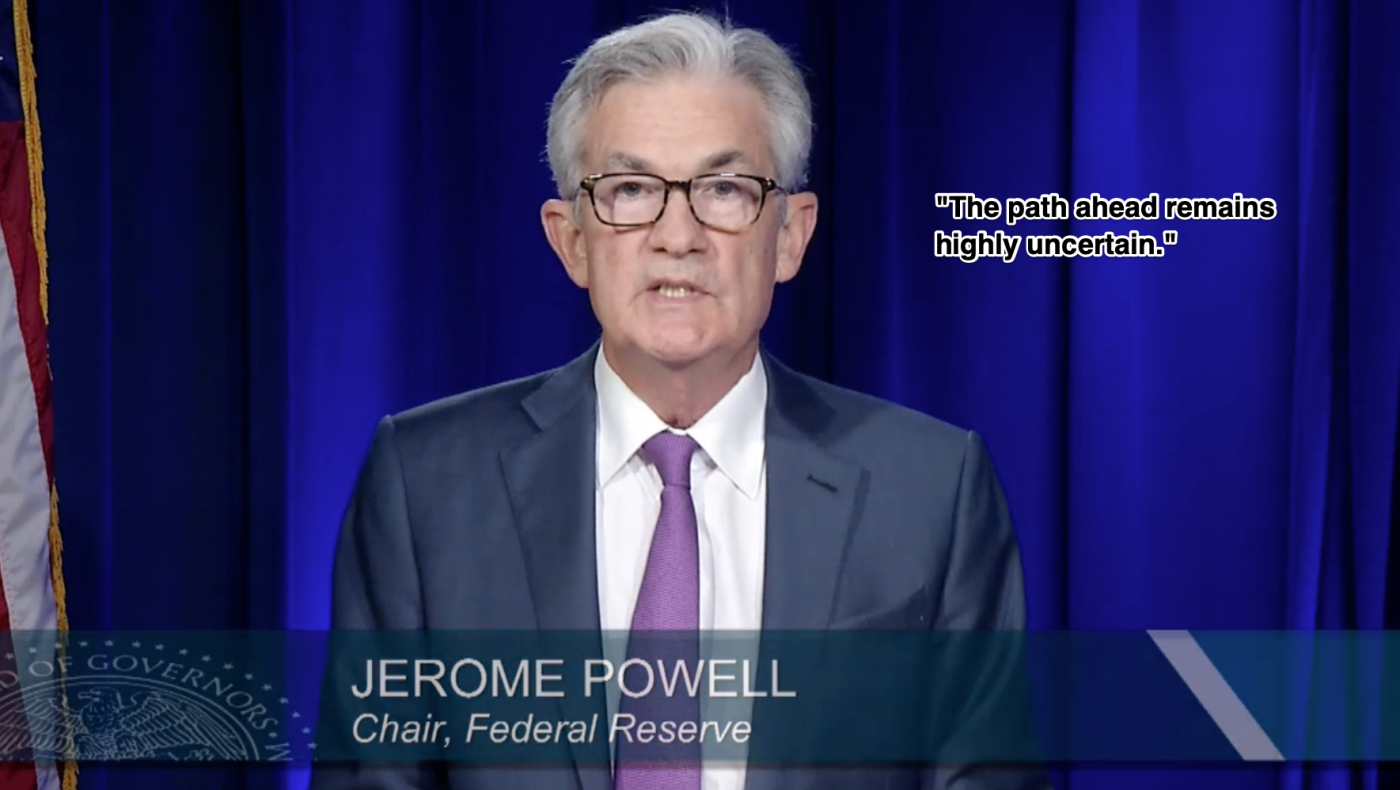

The Fed Has A History of Intervening During Financial Meltdowns with Rate Cuts and other Stimulus Measures. SO, Traders, Having Become Acustomated to Liquidity Support, Are Betting That Fed Will Act Similarly This Time.

ACCORDING TO THE CME FEDWatch Tool, The Federal Funds Futures Market is Now Pricing in As Many as Five Rate Cuts in 2025. For the UpComing May 7 Meeting, Theree would Lower the Target Range to 4.25-4.50%. By year-end, the Market sees the fed funs raate Falling as Low As 3.00–3.25%.

The Risk-Off, Coupled with The Growth Scare and Fed Rate Cut Bets, Is Giving Trump Administration What IT Wants-Plunging Treasury Yields. The All-Important 10-YEAR YIELD-The Benchmark for the US Economy-Has Droped to 3.923%.

The Popular Narrative Is That Lower YELDS Wuld Make It Easier for the Treasury to Refinance Trillions of Dollars in DEBT IN THE COMING 12 MONHS swoon.

This Refinancing Urgency Stems From A Policy Shift Undermer Treasury Secretary Janet Yellen, Who Moved From Longer-Dated Coupon Issuance to Short-Term Treasury Bills. Since 2023, About Two-Thirds of the Deficit Had been Financed Through Bill Issuance-Short-Term Debt with Rates Hovering AROUND 5%. While this may have temporarily supeported liquidity, It Created a ticking Time Bomb of Expensive Short-Term Debt that now Needs to be Rolled Over.

X Icon