“Failure to hold $2.50 on a closing basis would neutralize the bullish structure, potentially inviting rotation back toward $2.40–$2.42 support.”, — write: www.coindesk.com

(CoinDesk Data)

(CoinDesk Data)

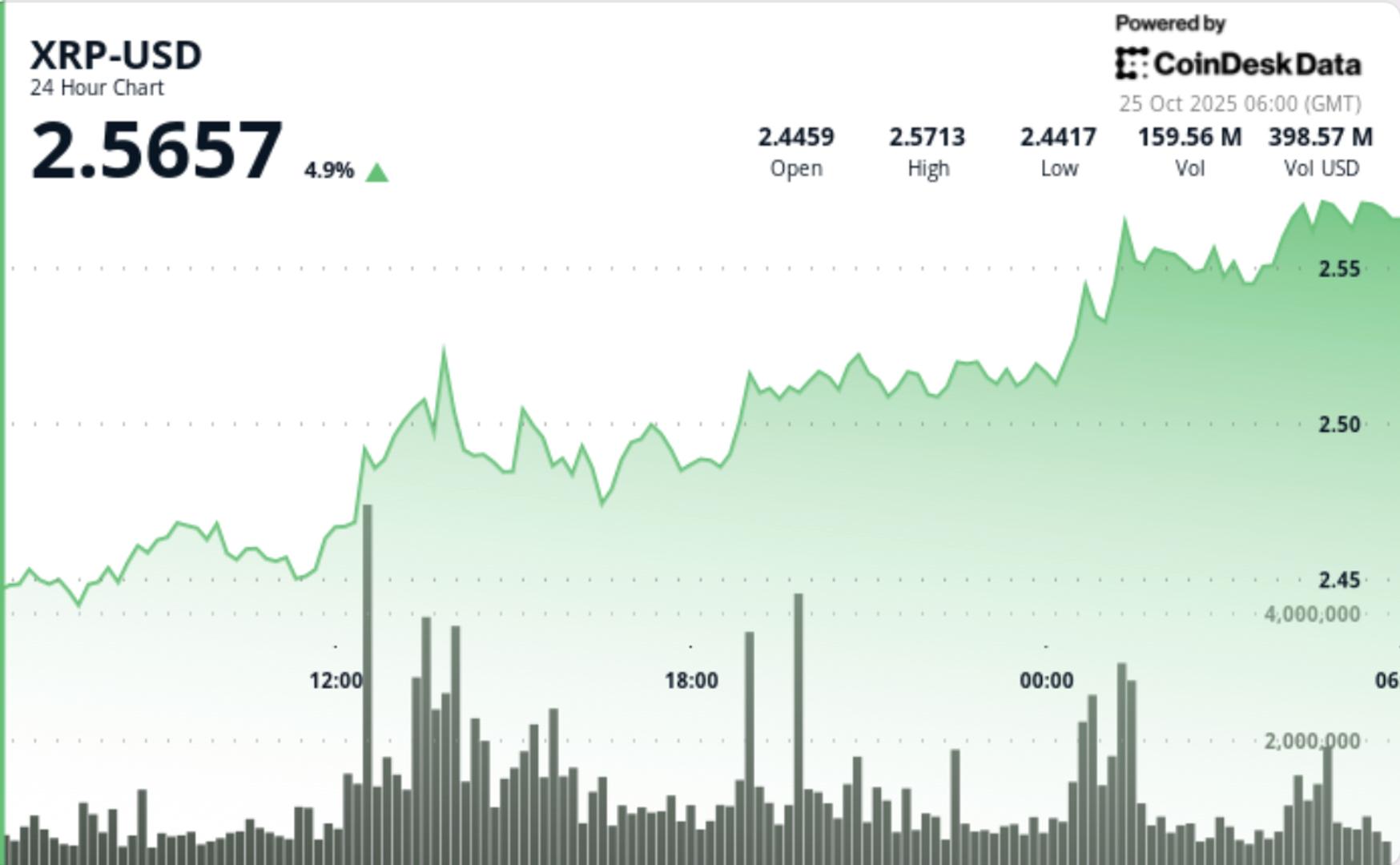

- XRP surged past $2.50, breaking key resistance with a 31% increase in volume above weekly averages.

- The token’s rise followed improved macro sentiment and softer US inflation data, leading to risk-on flows into major altcoins.

- Traders are watching if $2.50 holds as a new base, with sustained volume potentially pushing prices toward $2.70–$2.80.

News Background

- The token’s latest advance followed weeks of consolidation between $2.35 and $2.50, with technical strategists tracking an inverse head-and-shoulders base through mid-October.

- Thursday’s decisive move through the neckline at $2.50 confirmed that pattern, opening a potential continuation phase toward the $2.65–$2.80 range if buying persists.

- Market positioning shifted as macro sentiment improved. Softer US inflation data and falling Treasury yields triggered risk-on flows into major altcoins. XRP outperformed the CoinDesk 5 index by roughly five percentage points, signaling asset-specific accumulation rather than sector momentum.

Price Action Summary

- XRP climbed from $2.50 to $2.57 throughout the session, with intraday volume peaking at 142 million — 31% above its seven-day average.

- The breakout was defined by three sequential higher lows at $2.44, $2.48 and $2.51, confirming controlled accumulation through the $2.50 zone.

- While brief profit-taking emerged near $2.58, XRP held above breakout support, suggesting institutions added exposure on retests.

- Elevated spot volume combined with muted derivatives leverage confirmed genuine buying interest rather than short-squeeze dynamics.

Technical Analysis

- The completed inverse head-and-shoulders formation now defines XRP’s near-term technical bias. Momentum indicators, including RSI and MACD, both turned higher on the daily chart, while volume expansion validates the strength of the move.

- Immediate resistance lies at $2.60, followed by secondary targets near $2.80. Failure to hold $2.50 on a closing basis would neutralize the bullish structure, potentially inviting rotation back toward $2.40–$2.42 support.

What Traders Should KnowTraders are monitoring whether $2.50 holds as the new base — a level now regarded as the pivot for short-term trend confirmation. Exchange balance data shows XRP reserves down roughly 3.3% since early October, a historically bullish signal linked to whale accumulation phases.

Open interest has stabilized and funding rates remain neutral, leaving the move largely spot-driven. Sustained volume above 130 million through the weekend could validate continuation towards $2.70–$2.80, while fading participation may trap prices back inside the $2.40–$2.55 range.

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

View Full Report

October has been defined by forced selling and false starts and is on track to become the worst since 2015, dampening an otherwise bullish month that averages over 25% returns for bitcoin.

October has been defined by forced selling and false starts and is on track to become the worst since 2015, dampening an otherwise bullish month that averages over 25% returns for bitcoin.

- Bitcoin remained stable above $110,000, showing resilience after a significant liquidation event in October.

- Ether and Solana led gains among major cryptocurrencies, with Solana attracting institutional interest as a risk sentiment proxy.

- Market sentiment is cautious, with traders opting for selective exposure amid ongoing macroeconomic volatility.

Read full story