“According to the results of October, the annual inflation in the USA was 2.6% against 2.4% a month ago. The indicator met market expectations of 2.6%. On a monthly basis, the consumer price index rose by 0.2%, as in September. The consensus forecast was for a 0.2% increase. The indicator excluding food and energy prices increased by 0.3% compared to the previous month and by 3.3% by October last year. In the previous report, the values were 0.3% and 3.3%, respectively. Analysts expected […]”, — write: businessua.com.ua

According to the results of October, the annual inflation in the USA was 2.6% against 2.4% a month ago. The indicator met market expectations of 2.6%.

Monthly consumer index prices increased by 0.2%, as in September. The consensus forecast was for a 0.2% increase.

The indicator excluding food and energy prices increased by 0.3% compared to the previous month and by 3.3% by October last year. In the previous report, the values were 0.3% and 3.3%, respectively. Analysts expected the pace of September to be maintained.

Prices for services, excluding housing and energy, rose 0.31% after rising 0.4% in September, 0.33% in August, 0.21% in July and declining 0.05% and 0, 04% in May-June. IN Fed emphasized the importance of the metric when analyzing the trajectory of inflation.

The release of macro statistics increased bitcoin’s daily growth rate by 0.5%, to 3.8%. At the time of writing, the price of the asset approached $88,800. Ethereum returned to $3,200, paring daily losses to 1.2%.

Binance BTC/USDT 15-minute chart. Source: TradingView.

“Expectations for the Fed’s next interest rate decision are likely to be independent of today’s report as the central bank is currently leaning more heavily on employment issues,” commented Charles Schwab UK Managing Director Richard Flynn.

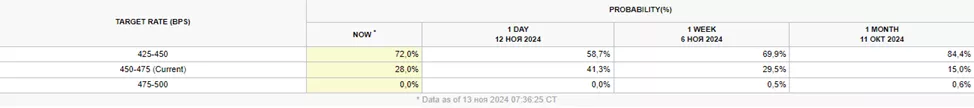

However, on the futures market, traders increased the probability of a rate cut by 25 bps. p. at the meeting in December, from 58.7% to 72%.

Source: CME Fed Watch.

The Ministry of Labor will present a report on the number of new jobs and unemployment for November on November 6.

Previously, Bernstein urged to add crypto-assets to the investment portfolio “as soon as possible”. They recommended buying a basket of digital assets including BTC, ETH, SOL, OP, ARB, POL, UNI, AAVE and LINK.

We will remind, ex-head of BitMEX Arthur Hayes repeated the forecast of bitcoin growth to $1 million.

The source