“Analysts Highlight Hyperliquid’s Strong Fundamentals But Caution About Potential Risks from Schemeduled Token Unlocks and Its High Valuation.”, – WRITE: www.coindesk.com

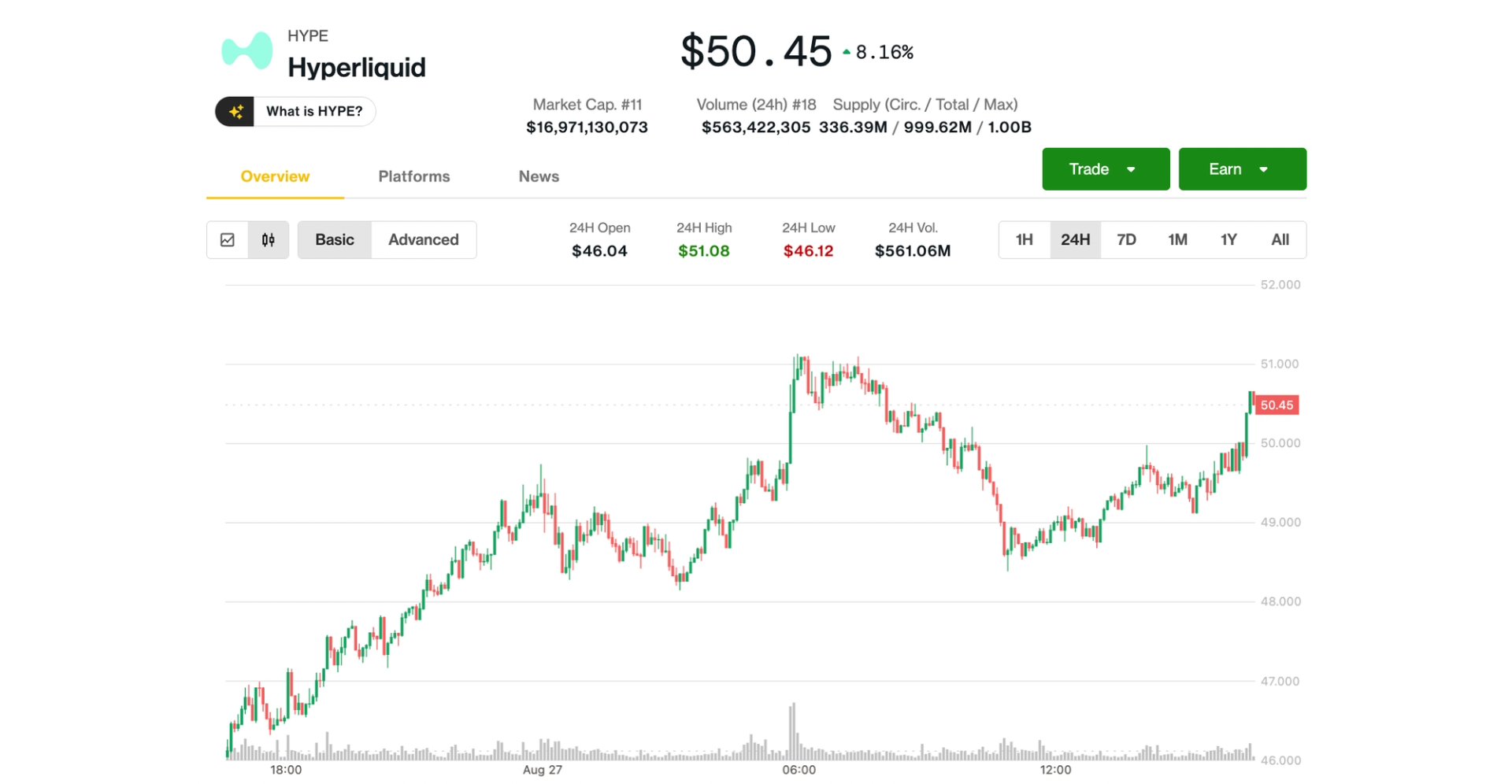

The token broke the $ 50 Mark for the first time, ginging about 8% in the past 24 hours. Hype is Now up 430% Since ITS April Nadir and Up Roughly 15x Since It Began Trading in Late November at At Aund $ 3.

The Rally Has Been Fueled by Record Trading Activity Across The Exchange and Its Automated Buack Mechanism, Whoadily Absorbs Tokens from The Market and Roduces Circulating.

Read More: Hyperliquid Now Dominates defi Derivatives, Processing $ 30b A Day

Trading BoomThe DECENTRALIZED Exchange Recorded More Than $ 357 Billion in Derivatives Volume in August, accounting to defillama Data, Up from $ 319 Billion in July and Nearly Ten Ten. Spot Trading Volumes Also Set A Record, Surpassing $ 3 Billion for The Week Ending Aug. 24, BlockWorks Data Shows.

These Flows Translated Into a Windfoll for the Protocol. Hyperliquid BOOKED $ 105 Million in Trading Fees Dringing August, The Highest This Year, Per Defillama Data.

Hyperliquid Monthly Protocol Fees and Perpetuals Trading Volume (Defillama)

Hyperliquid Monthly Protocol Fees and Perpetuals Trading Volume (Defillama)

Much of Those Earnings Are Funneled Directly Into Purchasing Hype on the Market Through Hyperliquid’s Assistance Fund. The facility is an automated on -chain mechanism that buys back tokens on the Open Market, Creating Sustaned Buy Pressure for Hype and Effectvely Reducing the Circulating Supply.

Since ITS LAUNCH IN JANUARY, The Fund’s Holdings Balloooneded From 3 Million Tokens to 29.8 Million Hype, Now Worth Over $ 1.5 Billion, Fueling The Token’s Rally.

On the News Front, Digital Asset Custodian Bitgo Added Support on Tuesday for the Hyperevm Network, Which Underpins the Hyperliquid Ecosystom, Unlocking Institutal ACCEMENTAL ACCEMENT.

Analysts Flag Risks Amid Strong FundamentalsIn a recent Research Note, Bytetree Analysts Shehriyar Ali and Charlie Morris Described Hyperliquid as a “Powerhouse” that was the Largest Decentralized perpetual Futual Futual Fut.

“All Things Considered, Hyperliquid Is Among The MOST COMPELING PROTOCOLS IN DEFI TODAY,” They Wrote. “ITS STRONG Fundamentals, Record-Breaking FEE Generation and Dominant Market Share Make It Impossible to Ignore.”

Despite The Bullish Fundamentals, The Report Also Flanged Concerns About the Token’s Valination. Hype Currently Trades at A Fully Diluted Valuation (FDV) of Over $ 50 Billion, with Only About Third of Supple in Circulation with a 16.8 Billion Market Capitalization.

Schereduled Token Unlocks Starting in November Could Also Introduce Selling Pressure, Potentally Testing The Strenguth of Demand, The Report Noted.

“The Although The Token Has Already Seen A Sharp Run-Up in Recent Months, Its Robust on -chain Activity Continutes to Underpin ITS VALUATION,” The Analysts Said.

Read More: XPl Futures on Hyperliquid See $ 130m Wiped Out Ahead of the Plasma Token’s Launch

X Icon

Solana’s Sol Surged Past $ 208, Outpacing Broader Markets As Analysts Weight Breakout Signals, Treasury Demand, and New Institutional Validtor Activity.

Solana’s Sol Surged Past $ 208, Outpacing Broader Markets As Analysts Weight Breakout Signals, Treasury Demand, and New Institutional Validtor Activity.

- SOL GAINED 7.68% in 24 Hours, OutperForming The Coindesk 20 Index and Broader Crypto Market.

- Analysts Point to Breakout Levels, Treasury Demand and Potential Spot Etf Approval by the US Sec As Key Drivers.

- Staking Service Provider Corus One, In Partnership with Crypto Research Firm Delphi Digital, Launched A New Institutes-Grade Solana Validator.

Read Full Story