“Beijing isn’t going to allw Crypto Exchanges to Directly Operate Btc in China, But There Might Be a Way That Hong Kong Crypto Etfs Can Be Traded in The Mainland.”, – WRITE: www.coindesk.com

Now, with Hong Kong Offering Regulated Crypto Markets, Insiders Say a Loophole Is Emerging.

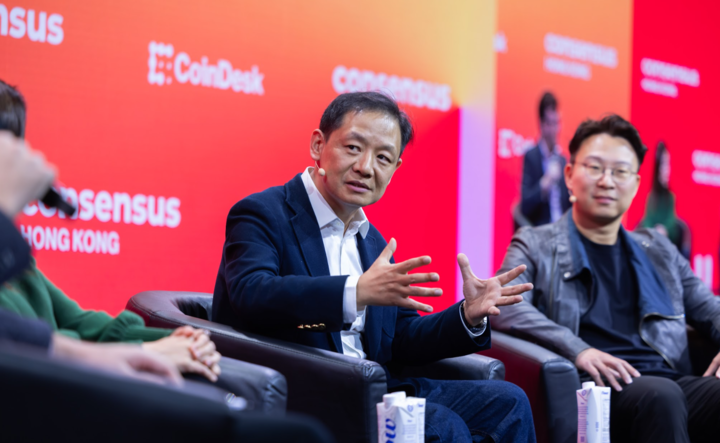

If China Already ALLOWS INVESTORS TO BUY US SKES THRUGH ITS QUALIFIED DOMESTIC INSTITATIONAL INVESTOR (QDII) PROGRAM, WHY NOT BITCOIN? The Key, One Expert Argued On Stage at Consensus Hong Kong, is Control, and Beijing Maya Have Just Found a Way to KEEP IT.

In china, there are Two Systems for Mainland Investors to Buy and Sell Stock Outside the Country. First, There’s QDII, WHICH ALLOWS SELECT INVESTORS TO BUY US ETFS Using RMB.

THEN There’s Also The Shanghai-Hong Kong Connect and Shenzhen-Hong Kong Connect, Which Let Chinese Investors Buy and Sell Hong Kong Stocks Thorugh Mainland Securms Fiers.

“The Key [with these systems] is that capital never Flows Frely Out of China, and if you Apply this Same Logic to Crypto, There’s No Reason It Couldnn’Tn’t Work The Same Way, “Yifan He, CEO of ROD DONE. Consensus Hong Kong.

He Emphasized that Biggest Regulatory Hurdle isn’t Crypto Itlf, But Capital Controls, Enzuring that Funds Don’t Move Frely in and Out of China.

These Capital Controls Are In Place to Prevent Excessive Currency Fluctuations and Capital Flight, In Order to Mainten the Stability and Value of the RMB. They are also One of the Reasons WHY HONG’S CRYPTO ETFS, with Their In-Kind Redemptions, Were Not Allowed On the Mainland.

“What’s The Differentnce Between A Hong Kong-Regulated Stock and A HONG Kong-Regulated Crypto Asset?” HE Continued. “If they have a synem for you to buy and sell in RMB, But Never Move Money Outside China, THEN IS JUST Another Regulated Investment Product.”

This System Wuld Not Alev Chinese Investors to Self-Custody Their Crypto. Insthead, Purchases would be held by an intermediary, Such as a licensed securities FIRM.

“They Buy Crypto Directly, But Is Not Like They Holding Itselves,” He Said, Noting That “The Security Company in the Middle Actual Holds It.”

This Model Aligns with China’s Approach to Stock and etf Investments.

Just As Mainland Investors Can Trade US Etfs Through Qdii Buti But Never Take Direct Custody, They Could Gain Exposure To Crypto Without OWNING The UNDERLYing Assets – No Money Money Money.

For a Nation with 200 Million retail investors and an economy in need of stimulus, regulated Crypto Access Through Hong Kong’s Sandbox Might Offer Beijing A Calculated Compromise

Blockchain Versus CryptoChina has long been a proportion of blockchain technology, While Taking a Cold Approach to Crypto.

“WE DON’T ALLOW GUNS IN CHINA, But We Can Still Make Steel,” He Explained As and Analog. “The Technology is not regulated so that you can buil all Kinds of Applications. But WHEN Some Application Triggers Regulations, that’s Different.”

But Based on his Conversations with Financial Regulators, This Could Be Changing.

“I See Some Signal From Financial Regulators,” He Said. “They’re beginning to Talk About Bitcoin, Saying We Need to Pay More Attmentation and DO More Research on Digital Assets.”

Could this Lead to Broader Adoption? Two Years Ago, HE would have said ‘zero chance.’

“Now, I’d Say There’s More than A 50% Chance in Three Years,” HE concluded.

And you can take thoss Odds to Polymarket, Which Currently Stands at 2% CHANCE OF CHINA UNBANNING BITCOIN IN THE COUNTRY.

X Icon