“The token’s 4.62% rally and strong volume confirmed growing institutional interest, although a sharp end-of-session reversal highlighted emerging resistance and short-term volatility.”, — write: www.coindesk.com

The session’s price action pointed to genuine institutional participation rather than retail-driven speculation. HBAR’s 6.37% outperformance versus the CD5 benchmark highlighted strong, asset-specific demand catalysts.

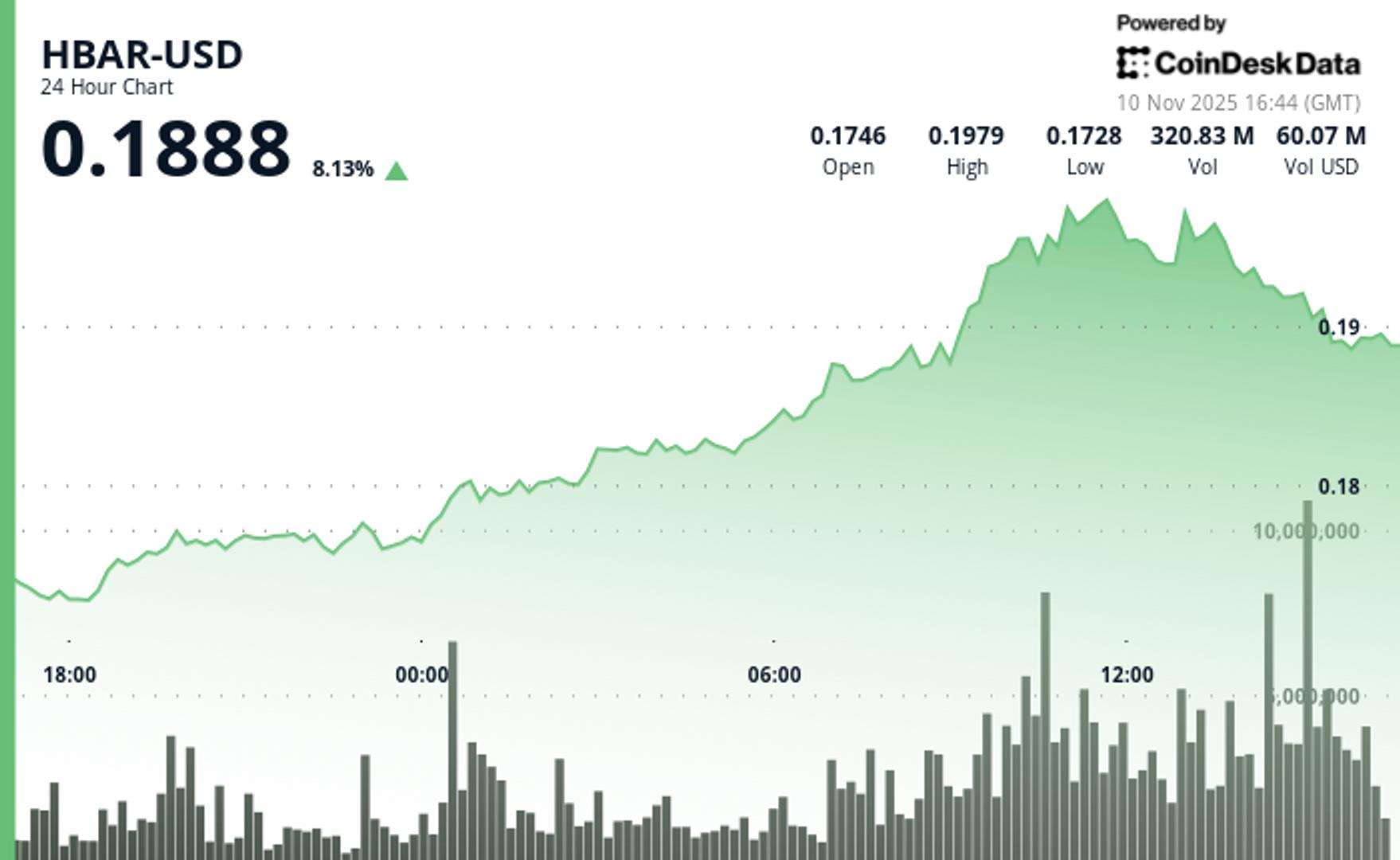

Technically, HBAR advanced from $0.1736 to $0.1894, forming ascending trendlines marked by higher lows and demonstrating solid upward momentum. The total range of $0.0255 reflected 13.2% volatility, while volume reached 215.6 million, confirming a decisive breach above the $0.1950 resistance zone. Strong short-term support consolidated near $0.1880, suggesting a healthy retracement structure within an overall bullish setup.

However, the final hour saw a sharp reversal as institutional profit-taking triggered a technical correction. Price fell from a $0.1925 peak to $0.1892, breaking through $0.1911 support on nearly triple the average hourly volume.

The failed breakout attempt above $0.1920 established lower highs and bearish intraday channels, with temporary support now forming near $0.1890 — a level traders should monitor closely as the market digests recent gains.

HBAR/USD (TradingView)

HBAR/USD (TradingView)

Key Technical Levels Signal Mixed Outlook for HBARSupport/Resistance: Primary support sits at $0.1880 with resistance at $0.1920-$0.1950 zone

Volume Analysis: 24.2% surge above weekly average confirms institutional flows, while 10.8M hourly spike shows profit-taking

Chart Patterns: Ascending trendlines developed before late reversal created bearish channel structure

Targets & Risk/Reward: Break above $0.1950 targets $0.200 level, while $0.1880 failure risks decline toward $0.1750

Disclaimer: Parts of this article were generated with the assistance of AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

A deep dive into Zcash’s zero-knowledge architecture, shielded transaction growth, and its path to becoming encrypted Bitcoin at scale.

A deep dive into Zcash’s zero-knowledge architecture, shielded transaction growth, and its path to becoming encrypted Bitcoin at scale.

- Shielded adoption surgedwith 20–25% of circulating ZEC now held in encrypted addresses and 30% of transactions involving the shielded pool.

- The Zashi wallet made shielded transfers the default, pushing privacy from optional to standard practice.

- Project Tachyonled by Sean Bowe, aims to boost throughput to thousands of private transactions per second.

- Zcash surpassed Monero in market share, becoming the largest privacy-focused cryptocurrency by capitalization.

View Full Report

Internet Computer (ICP) slides 11.2% to $6.69 after breaching key support at $7.00, with volume surging 94% above average amid heightened volatility.

Internet Computer (ICP) slides 11.2% to $6.69 after breaching key support at $7.00, with volume surging 94% above average amid heightened volatility.

- ICP slid 11.2% to $6.69, breaking through the $7.00 support level.

- Trading volume surged 94% above the 24-hour average at the breakdown point.

- Final-hour acceleration pushed prices to session lows near $6.67.

Read full story