“Hedera Hashgraph Faces Significant Selling Pressure Amid Regulatory Uncertainty and Shifting Institutional Sentiment in Digital Asset Markets.”, – WRITE: www.coindesk.com

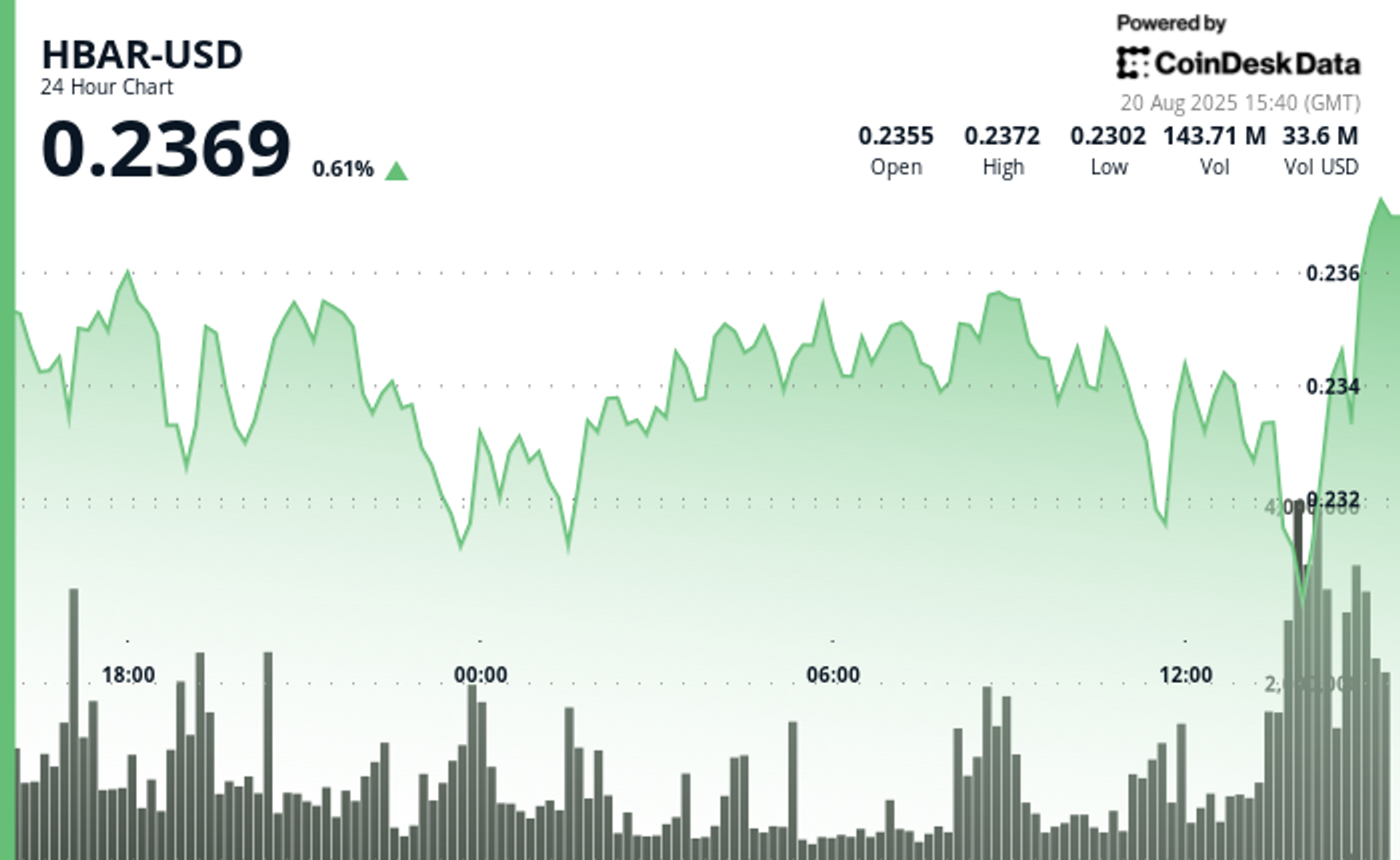

The Token Traded Within A Tight $ 0.01 Band, Marking A 4% Spread Between Its Session High And Low, AS Traders Adjusted Exposure Across Alternative Digital Assets. Analysts Highlighted the $ 0.24 Level As A Key Point of Resistance, WHERE BUYING MOMENTUM FADED AND DOWNARD PRESSURE INTENSIFIED.

The MOST PRONUNCED ACTIVITY CAME Durying the Final Hour of Trading on August 20, WHEN VOLUMES SURGED TO 85.82 Million Hbar.

Market Observers Noted that token Tumbled to $ 0.23 Before Staging A Modest Recovery Into the Close, A Pattern that Underscored the Elevated Volatility. The Heavy Turnover During this Window Suggests Selers Were Dominant, Creating Short-Term Weakness and Testing Key Support Levels.

Between 13:45 and 14:06, More Than 3.8 Million Tokens Changed Hands, Coinciding with The Sharpest Part of the Decline. Prices Briefly Dipped to Session Lows Before Bouncing, As Buying Interest Re-Emerged to Stabilize the Market.

By the Final Minutes, Hbar Recovered Enough To Close Near $ 0.23, Signaling That While Downside Risks Remain, Short-Term Support Is Holding For Now.

HBAR/USD (TradingView)

HBAR/USD (TradingView)

Technical Indicators Analysis

- Token Declined 3% from Opening Price of $ 0.24 to Closing Price of $ 0.23 Over 23-HUr Institutionalal Selling Period.

- Trading Range of $ 0.01 Represents 4% SPREAD BETWEEN ABSOLUTE SESSION High and Low.

- Resistance Level Establized AROUND $ 0.24 WHERE INSTITUATIONAL BUYING INTEREST DIMINISHED SIGNFICANTLY.

- Support Level Emerged Near $ 0.23 with Retail Buying Providing Technical Floor.

- Elevated Volume of 85.82 Million During Final Hours Confirms Institutional Distribution Patterns.

- Volume Exceeded 3.8 Million Dringing Peak Selling Period Between 13: 45-14: 06 Indicating Coordinated Liquidation.

- Final 14 Minutes Showed Technical Recovery from $ 0.23 Support Level Suggesting Retail Buying Interest.

Disclaimer: Parts of this Article Were Generated with the Assistance from Ai Tools and Review by Our Editorial Team to Enseure Accucy and Adherence to Our Standards. For more information, See Coindesk’s Full Ai Policy.

All Content Produced by Coindesk Analytics is Undergoes Human Editing by Coindesk’s Editorial Team Before Publication. The Tool Synthesizes Market Data and Information from Coindesk Data and Other Sources to Create Timely Market Reports, with All External Sources Clearly Attributed Within Each.

Coindesk Analytics Operates Under Coindesk’s AI Content Guidelines, WHICH PRIORITIZE Accuracy, Transparency, and Editorial Oversight. Learn more about Coindesk’s Approach to Ai-Generated Content In Our Ai Policy.

X Icon

Mstr Fell To a Five-Month Low Wednesday, Testing Key Technical Support.

Mstr Fell To a Five-Month Low Wednesday, Testing Key Technical Support.

- MSTR is Down 30% from ITS 2025 PEAK OF $ 457 HIT LAST MONTH AND NOW TRADES JULOW The 200-DMA AT $ 340, A Level That Has Historically Acted As Support.

- Bitcoin Has Dipped 3.5% Over The Past Month, While Strategy Has Sizably Underformed, Plunging 21%.

- Jim Chanos Previously Open Up A Short Mstr/Long Btc Bet that’s Looking Like A Winner at The Moment.

Read Full Story