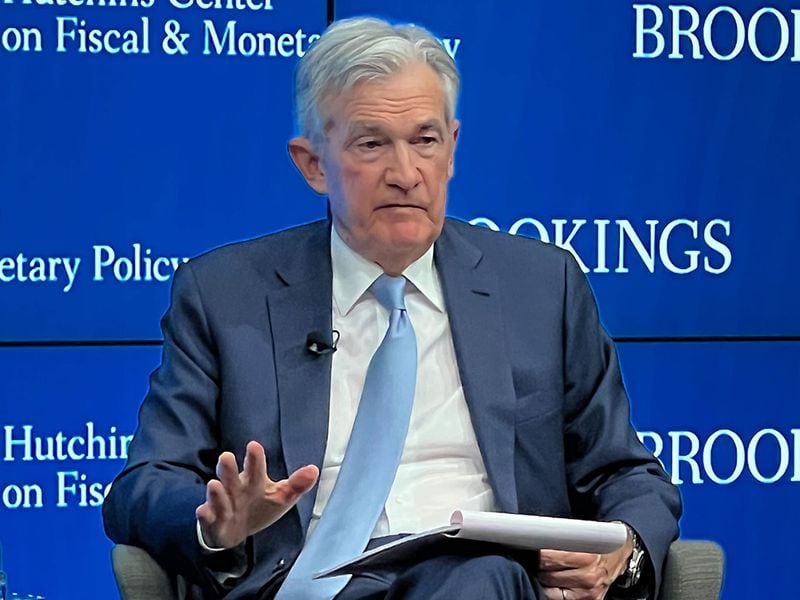

“Market participants were uncertain about the size of rate cut prior to the Fed meeting, laying the groundwork for volatility on the markets.”, — write: www.coindesk.com

- Bitcoin traded near $60,000 after Fed cut rates by 50 basis points.

- Fed members expect median benchmark rates to come down to 4.4% by year-end.

- Markets’ appetite for risk assets would be key to watch , analysts say

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/R2V7SM4GMFCMFDQBI5UUGIDH5A.png) CoinDesk Bitcoin Price Index on 09 18 (CoinDesk)

CoinDesk Bitcoin Price Index on 09 18 (CoinDesk)Edited by Aoyon Ashraf.

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/8b1395a8-12af-4705-9fe5-b862b248250d.png)