“The relative advantage of Bitcoin bulls has weakened, resulting in a more dominant position for sellers. FalconX came to this conclusion, writes CoinDesk. This is a sign that the growing momentum that took prices to ~$100,000 after the US election is not supported by new buying interest. The 3 DMA smoothed supply/demand imbalance within 1% of average has approached levels seen only three times since 2022. […]”, — write: businessua.com.ua

The relative advantage of Bitcoin bulls has weakened, resulting in a more dominant position for sellers. FalconX came to this conclusion, writes CoinDesk.

This is a sign that the growing momentum that took prices to ~$100,000 after the US election is not supported by new buying interest.

Smoothed 3 DMA the supply-demand imbalance within 1% of the average approached levels seen only three times since 2022.

According to analysts, minor negative news can lead to a noticeable correction.

“Although this does not threaten the medium-term rally, the fight for a break above the $100,000 level will be intense,” experts explained.

FalconX warned that a potential correction or possible break above $100,000 would be swift as the overall depth or liquidity of the market decreased amid the rally, despite increased trading volumes.

Growth potentialBitwise founder and CEO Hunter Horsley expressed confidence that Bitcoin’s growth potential has not been exhausted.

#Bitwise CEO Hunter Horsley says, “It feels like Bitcoin has been around forever now… Investors are engaging now. They view it as finally having matured enough, having the regulatory clarity they need.” pic.twitter.com/0KaQaN1jpm

— cryptothedoggy (@cryptothedoggy) November 23, 2024

In his opinion, the year 2024 marks the end of the early chapter and the beginning of the next one – the transition to the mainstream. Investors are beginning to see cryptocurrencies as an asset class ripe enough for regulatory transparency. They no longer see obstacles after the victory of Donald Trump.

Horsley attributed the current fluctuations in digital gold to profit locking by retail investors and hedging by fund managers.

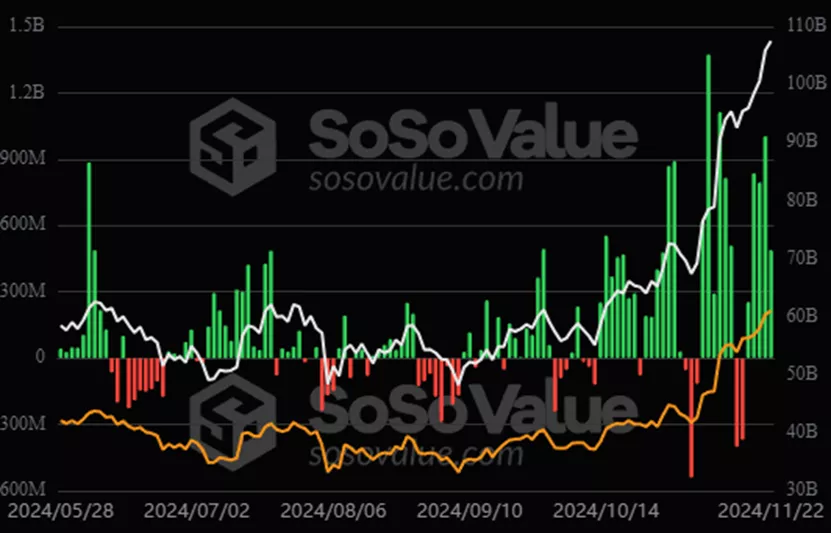

ETFsOn November 22, inflows into spot bitcoin ETFs totaled $490.35 million, according to SoSoValue. Positive dynamics continued for the fifth day in a row.

Source: SoSoValue.

Cumulative inflows since the approval of the BTC-ETF in January have increased to $30.8 billion. The volume of assets under management jumped to $107.5 billion.

We will remind, on November 24, the rate of the first cryptocurrency fell below $96,000. This was preceded by a jump in daily realized profit to a record $443 million, according to CryptoQuant.

Previously, Bernstein named the catalysts for Bitcoin’s growth to $200,000.

The source