“Technical Indicators Suggest Potential for a Bullish Reversal, Thought Market Sentiment Remains Divides Between Risks of a Breakdown and Optimism for a Rebound.”, – WRITE: www.coindesk.com

(Coindesk Data)

(Coindesk Data)

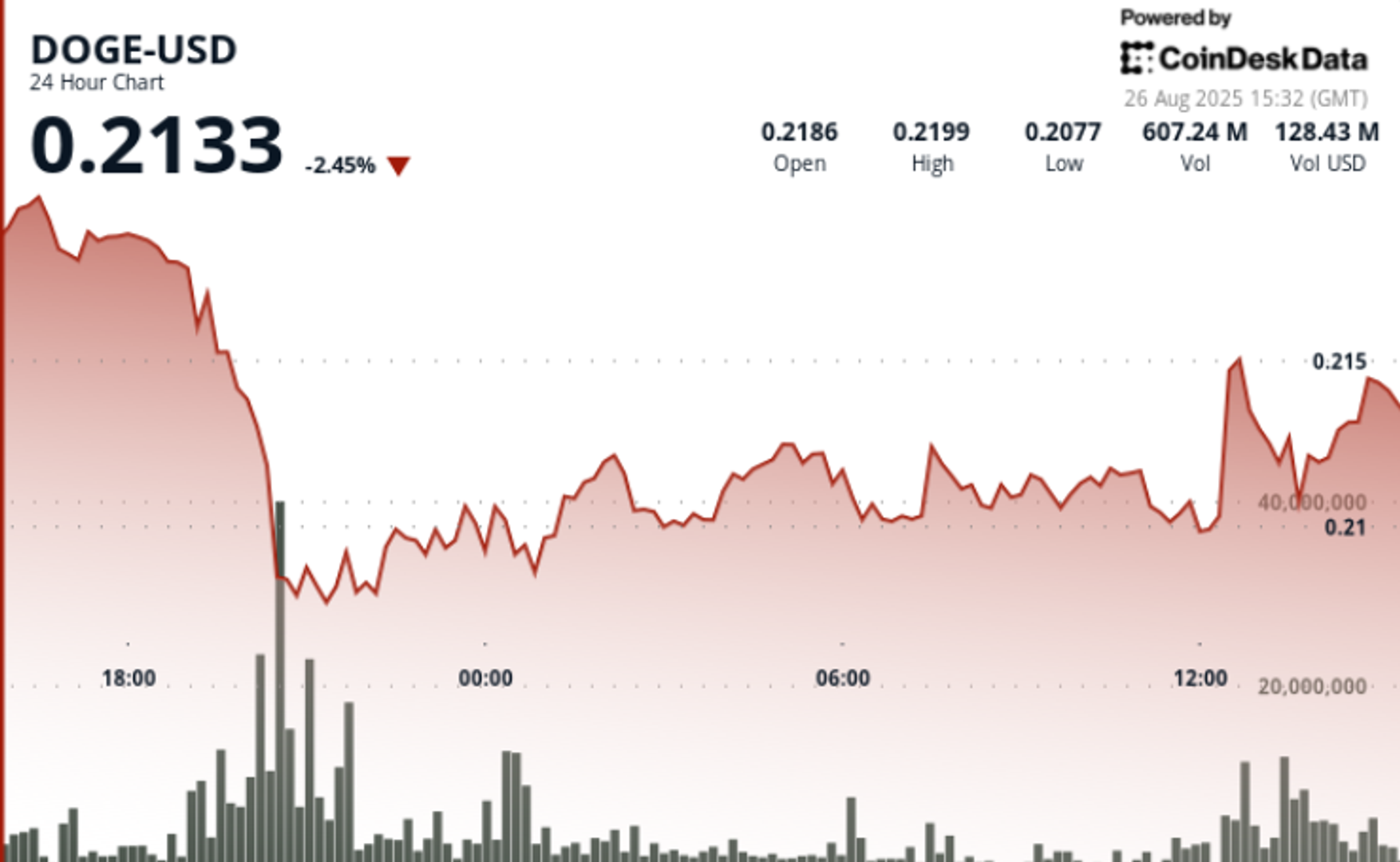

- Dogecoin ExperienCed Significant Valativity Between August 24–26, with Prices Swing Within A $ 0.013 Range Before Stabilization Near $ 0.21.

- A Massive Transfer of 900 Million Doge to Binance Contributed to Market Uncertainty, Despite Ongoing Acumulation by Large Holders.

- Technical Indicators Suggest Potential for a Bullish Reversal, Thought Market Sentiment Remains Divides Between Risks of a Breakdown and Optimism for a Rebound.

Despite Near-Term Caution, Whales Continue Accuumulating, Leaving Sentiment Split Between Breakdown Risks and Dip-Buying Optimism.

News Background

- WHALE Transfers Added Fuel to Volatility: Between August 24–25, A Single 900 Million Doge ($ 200+ Million) Was MOVED TO BINANCE FROM A Long-Term Holding Wallet.

- Market Sentiment Sourda on Fears of All-Off, With Open Interest in Doge Futures Droping 8% AS SPECULATIVE TRADERS PARED EXPOSURE.

- Despite The Inflow, On-Chain Data Shows Whales Accuumulated Over 680 Million Doge in August, Countering Retail Distribution.

- Fed Chair Powell’s Jackson Hole Comments Sparked A 12% Meme Coin Sector Rally, Aligning Doge with Broader Risk-on Momentum.

Price Action Summary

- Doge posted A 6.06% SPREAD IN THE 23-HURS SESSION ENDING AUGUST 26 AT 12 PM, Trading Between $ 0.221 and $ 0.208.

- The Sharpest Move Came Dringing 19: 00–20: 00 GMT on August 25, WHEN DOGE FELL FROM $ 0.218 to $ 0.208 On 1.57 Billion Volume.

- PRICE ALSO WIPSAWED AFTER The Whale Transfer, Swing from A $ 0.25 High To Test $ 0.23 Support Before Stabilization.

- A rebound Lifonded Doge from $ 0.210 Session Lows to $ 0.211– $ 0.212 In The 11: 27–12: 26 GMT Window on August 26, AIDED BY A 17.85 Million Volume Spike at 11:588.

Technical Analysis

- Support Establized at $ 0.208 Following the High-Volume Drop.

- Resistance Holds at $ 0.218– $ 0.221, Capping Rallies.

- Current Consolidation Between $ 0.210– $ 0.212 Suggests Accuumulation.

- RSI Recovered from Oversold Levels Near 42 to MID-50S, SHOWING STABILIZING MOMENTUM.

- MacD Histogram Narrowing Town Bullish Crossover, Signaling Potential Upside Reversal.

- Open Interest Decline of 8% Points to Reduced Speculatory Leverage, Limiting Volatility But Also Dampening Near-Term Upside.

- Sustaned Trading Above $ 0.21 with Elevated Volumes (+16% Vs. 30-Day Averages) StrengThens Bullish Case.

What Traders Are Watching

- Bulls Target a Breakout Toward $ 0.23– $ 0.24 IF Consolidation Resolidation Upward and Whale Buying Perses.

- Bears Highlight $ 0.208 As The Key Downside Trigger, With A Break Opening Risk Toward $ 0.200.

- The Tug-of-War Between Exchange Inflows (Distribution Risk) and WHALE ACCUMULATION (SUPPORATIVE DEMAND) REMAINS The DECISIVE FACTOR.

Shaurya Holds Over $ 1,000 in Btc, Eth, Sol, Avax, Sushi, Crv, Near, YFI, YFI, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, CAKE, Vet, Vet, Vet RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, Banana, Rome, Burger, Spirit, and ORCA.

He Provides Over $ 1,000 to Liquidity Pools on Compound, Curve, Sushiswap, Pancakeswap, Burgerswap, Orca, AnaSwap, Spiritswap, Roki Protocol, Yearn Finance Olympusdao, Rome, Trader Joe, and Sun.

X Icon

All Content Produced by Coindesk Analytics is Undergoes Human Editing by Coindesk’s Editorial Team Before Publication. The Tool Synthesizes Market Data and Information from Coindesk Data and Other Sources to Create Timely Market Reports, with All External Sources Clearly Attributed Within Each.

Coindesk Analytics Operates Under Coindesk’s AI Content Guidelines, WHICH PRIORITIZE Accuracy, Transparency, and Editorial Oversight. Learn more about Coindesk’s Approach to Ai-Generated Content In Our Ai Policy.

Solana, Dogecoin, and Ether Also Rallied, While CME Crypto Futures Hit $ 30b in Open Interest, Signaling Growing Institutional Demand.

Solana, Dogecoin, and Ether Also Rallied, While CME Crypto Futures Hit $ 30b in Open Interest, Signaling Growing Institutional Demand.

- XRP LED A BROAD Crypto Rebound Tuesday, Gaining 6% AS Traders Jumped Back in After Monday’s Sell-Off.

- CME Crypto Futures Hit $ 30b in Open Interest, with Xrp Become The Fastest Contract To Cross The $ 1B Mark.

- Analysts Warn of OverHeted Sentiment Ahead of Friday’s PCE Inflation Data, A Key Signal for The Fed’s Next Move.

Read Full Story