“A $ 50 Million Trump-Linked Accuisation of A Doge Mining FIRM, WYOMING’S LAUNCH OF A STATE-Backed Stablecoin, and Comments from Federal Reserve Office Trigger Fresh Institutional Flows.”, – WRITE: www.coindesk.com

(Coindesk Data)

(Coindesk Data)

- Dogecoin Surged After A $ 50 Million Acquisition by a Trump-Linked Entity and Wyoming’s Launch of A State-Backed Stablecoin.

- Federal Reserve Officials Signrated A Softer Stance on Digital Assets, Boosting Institutional Interest in Cryptocurrencies.

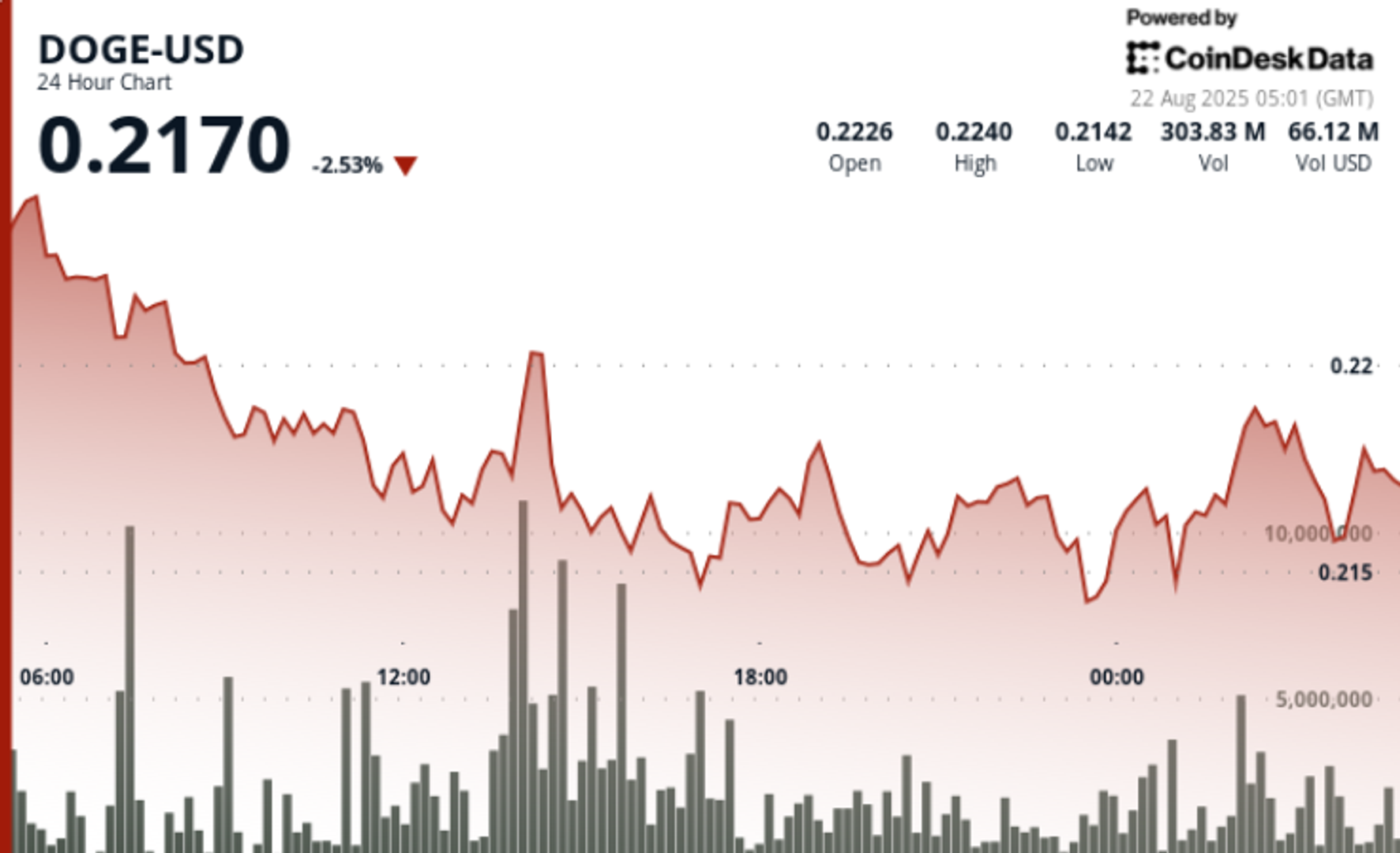

- Doge’s Price Fluctuated Between $ 0.21 and $ 0.22, with Significant Trading Volumes Indicating Strong Institutional Activity.

News Background• Thumzup, a Trump-affilied entity, AcquiDohash for $ 50 Million, Creating What Executives Descripted As The Largest Dog Mining Operation. The Deal Signals Deep-Pocketned Confidentnce in Dogecoin Infrastructure.

• Wyoming unveiled the Frontier Stable Token, The First Government-Backed State StableCoin, Reinforcing The Us Regulatory Pivot Town Digital Assets.

• Fed Vice Chair Michelle Bowman Warned Banks About Competitive Risks from Delaying Digital Asset Adopt, Signaling a More Crypto-Acccommodative Posture.

?

Price Action Summary• Doge traded in a $ 0.01 Band from $ 0.21 to $ 0.22 Between aug. 20 15:00 and AUG. 21 14:00, Marking ~ 4–5% Intrady Valativity.

• The token Rallied 5% from $ 0.21 to $ 0.22 Durying the aug. 20 Evening Session, Establishing $ 0.22 As Near-Term Resistance.

• A Late-Session 60-Minute Window (AUG. 21 13: 22-14: 21) SAW DOGE SURGE 1% from $ 0.22 to $ 0.22 with Volume Spikes Above 61.8 Million, Confirming Institute.

• Support Consuently Held in the $ 0.21– $ 0.22 Zone with Bounces on 320–380 Million Volume Across Key Testing Points.

Technical Analysis• Support: $ 0.21– $ 0.22 Establissed as Reliable Floor with Repeated High-Volume Retes.

• Resistance: $ 0.22 Key Pivot Cleared, But Bulls Need Follow-Thund Town $ 0.225 to Confirm Breakout.

• Volume: PEAK SURGES OF 61.8 Million and 378.6 Million Confirm Institutional Buying Interest.

• Pattern: Classic Consolidation Followed by Impulsive Breakout; Upward TradecyTory If Support Base Holds.

• Futures oi: Stable AROUND $ 3 Billion, Reflection Sustaned Levered Interest Despite Macro Volatility.

What Traders Are Watching• WHETHER DOGE CAN SUSTAIN ABOVE The $ 0.22 Pivot and Push Toward $ 0.225– $ 0.23 Resistance.

• The Market’s Reaction to Fed Policy Shifts and Wyoming’s Stablecoin Launch-Potential Sector-Wide Tailwind.

• WHALE ACCUMULATION PATTERNS, ALREADY TOTALING 2 BILLION DOGE ($ 500M) This Week.

• Mining Sector Expansion Via Thumzup’s Acquisition and Its Impact On Doge’s Hashpower Distribution.

Shaurya Holds Over $ 1,000 in Btc, Eth, Sol, Avax, Sushi, Crv, Near, YFI, YFI, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, CAKE, Vet, Vet, Vet RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, Banana, Rome, Burger, Spirit, and ORCA.

He Provides Over $ 1,000 to Liquidity Pools on Compound, Curve, Sushiswap, Pancakeswap, Burgerswap, Orca, AnaSwap, Spiritswap, Roki Protocol, Yearn Finance Olympusdao, Rome, Trader Joe, and Sun.

X Icon

All Content Produced by Coindesk Analytics is Undergoes Human Editing by Coindesk’s Editorial Team Before Publication. The Tool Synthesizes Market Data and Information from Coindesk Data and Other Sources to Create Timely Market Reports, with All External Sources Clearly Attributed Within Each.

Coindesk Analytics Operates Under Coindesk’s AI Content Guidelines, WHICH PRIORITIZE Accuracy, Transparency, and Editorial Oversight. Learn more about Coindesk’s Approach to Ai-Generated Content In Our Ai Policy.

SBI VC Trade, A Licensed Electronic Payment Instruments Exchange Service Provider, SAID IT Experts Rlusd to Go Live in Japan Dringing The First Quarter of 2026.

SBI VC Trade, A Licensed Electronic Payment Instruments Exchange Service Provider, SAID IT Experts Rlusd to Go Live in Japan Dringing The First Quarter of 2026.

- Ripple and SBI Holdings Plan to Introduce Ripple USD (Rlusd) in Japan to Capitalize on the Country’s Evolving Stablecoin Market.

- Rlusd, Fully Backed by US Dollar Deposits and Other Assets, AIMS for A 2026 Launch with Monthly Third-Party Attestations.

- The Partnership is Seen As A Significant Step in Enhancing Japan’s Digital Finance Infrastructure and Stablecoin Reliability.

Read Full Story