“Inflation Breakevens Head South Amid the Trump Trade War.”, – WRITE: www.coindesk.com

In his inaugural address on jan. 20, President Donald Trump Promissed to “Tariff and Tax Foreign Countries to Enrich Our Citizens,“ and Ten Fired The SHOT AGAINST CINA, Canada and Menxico on Feb. 1. Since Ten, The Trade Tensions Have Escalated to Such An Extant That As of Writing, The Us and China Have Imposed retaliatory Tariffs on each Other in Excess of 100%.

Tariffs Increase The Cost of Imported Goods, WHICH ARE THEN PASSED ON TO TO THE CONSUSUUMER AND COURCK

CONSEQUENTLY SINCE OF THE TRADE WAR BROKE OUT, Markets Have Been Worked About A Tariffs-Led Resurgence in the Us Inflation, with The Fed Adding to Those Concens Through ITSTAFLATION. Stagflation, repressenting a combination of Low Growth, High Inflation and Joblessness, is Seen As the Worst Outcome for Riskier Assets.

Bitcoin, Therefore, Has Dropped Nearly 20% Since Early February, Alongside Broad-Basted Risk Aversion On Wall Street that have seen investors concurtly Dump Stocks, Bonds And.

Breakevens Suggest DisinflationHowever, Market-Based Measures of Inflation, Such As the Breakevens, Suggest Tariffs Could Be Disinflationary Over The Long Run. In Other Words, The Fed Might Be Wrong in Fearing Stagflation and Will Soon Have a Leeway to Cut Rates.

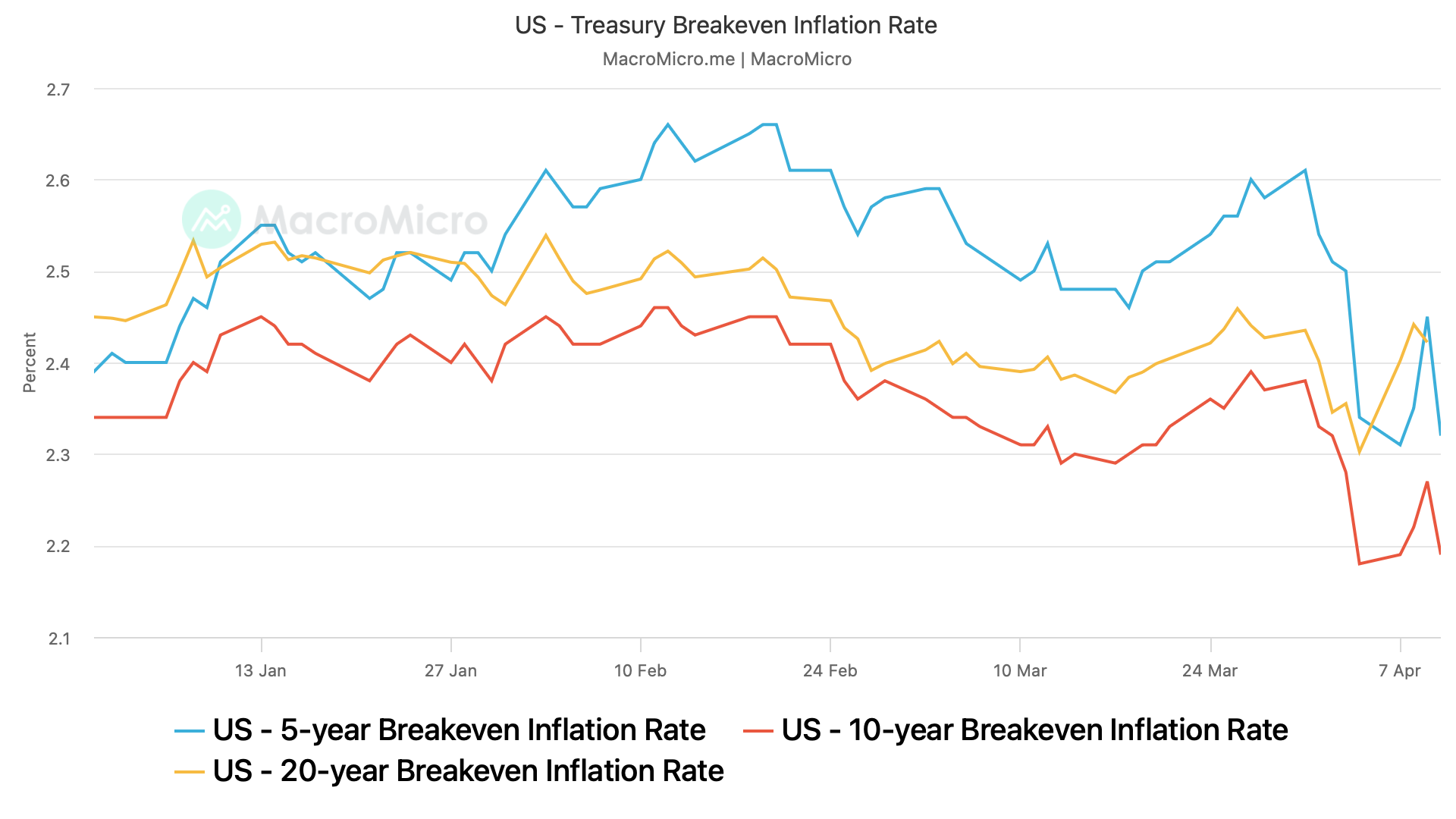

Inflation Breakevens Are Derived from the Yields on Traditional Treasury Bonds and Treasury Inflation-Protected Securities (Tips). The FIVE-YEAR BREAKEVEN INFLATION RATE PEAKED ABOVE 2.6% IN EARLY FEBRUARY AND HAS SINCE DROPPED TO 2.32%, accounting to data tracked by the federal reserve Bank of St. Louis.

The 10-YEAR BREAKEVEN RATE HAS DROPPED FROM 2.5% TO 2.19%. Meanwhile, The Federal Reserve Bank of Cleveland’s Expectioned Two-Year Inflation has Held at around 2.6%.

One Time CostAccorness to Obervers, The Impact of Tariffs, Viewed As A One-Time Cost Adjustment, Relies on the Reactations of Other Macroeconomic Variables and Temps to Be Disinflationary In.

WHEN PRODUCERS PASS The TARIFF INCREASE ONTO Consumers, Inflation Levels Rise. However, if there is no corresponde income in income, consumers are compelled to redeuce their consumption. This Reduction Can Lead to Inventory Build-Up and Ultimately Contribute to A Decline in the Prices of Goods and Service.

“Since The Days of Smoot-Hawley, Tariffs Have Never Been Inflationary. Racher They Deflationary and” Stimulative Themselves As Well.

A paper Publized by American Economist Ravi Batra in 2001 Made a Similar Observation, Saying, “Tariffs in The Us Wever Never Associated with Rising Prices, and Trade Liberal. Always Followed by Sharp Drops in the Cost of Living.

All Things Considered, The Recent Financial Market Turbulence Likely Resulted from Growth Fears Rater Than Inflation. The Bull Could Soon Remerge in Anticipation of A Dovish Stance from the Federal Reserve.

X Icon