“Your day-ahead look for feb. 21, 2025”, – WRITE: www.coindesk.com

Cryptocurrency prices are rising after the US Securities and Exchange Commission’s Former Crypto Enforcement Unit Transcy President Raphael Bostic.

Renaming the crypto assets and cyber unit is signifyant because It Shows of the Agency Is Moving Away from Its Crypto Focus that’s Major Industry Participants.

“In the Near to Medium Term, Cleerner Regulations Will Likely Boost Institutional Participation, Leading to Improvements in Market Infrastructure,“ Backpack Founder and Ceo ARMANI. Bitcoin is Now Above $ 98,000 After Adding 1.2% in 24 Hours, while the Broader Coindesk 20 Index Rose 1.35%.

Yet, Volatility Is Still Relative Low. “TheSe Environments May Feel Slow and Freustration, But they Rarely Persist for Long – Volatility Tends to Mean Reverter,” Wintermute Otc Trader Jake O Told Condesk.

With Tensions Between the US and Its European Allies Growing, Investors Are Hoking Germany’s Election on Sunday Will Lead to A Stable Coalition Government Defense spending. Germany is Europe’s Largest Economy and A Positive Result Could Lead to A More Risk-on Approach.

Open Interest Has Already Moved Up Ahead of the Election. Still, The Crypto Market Lacks Positive Catalysts in the Near Term, JPMorgan Analysts Led by Nikolaos Panigirtzglou Wrote in A Report.

In Fact, The Market is Nearing Backward – WHERE SPOT PRICES Rise Above Futures Prices – In A “Negative Development” that’s “Indicative of Demand Weakness” Contracts to Gain Exposure to the Market. Stay Alert!

What to Watch

- Crypto:

- Feb. 21: Ton (The Open Network) Becomes the Exclusive Blockchain Infrastructure for Messaging Platform Telegram’s Mini App Ecosystem.

- Feb. 24: At Epoch 115968, Testing of Ethereum’s Petus Upgrade on the Holesky Testnet Starts.

- Feb. 25, 9:00 am: Ethereum Foundation Research Team Ama on Reddit.

- Feb. 27: Solana-Based L2 Sonic SVM (Sonic) Mainnet Launch (“Mobius”).

- Macro

- Feb. 21, 9:45 AM: S&P Global Releases February’s (Flash) US Purchasing Managers’ Index (Flash) Reports.

- Composite pmi prev. 52.7

- Manufacturing PMI Est. 51.5 Vs. Prev. 51.2

- Services PMI est. 53 Vs. Prev. 52.9

- Feb. 24, 5:00 AM: Eurostat Releases Eurozone’s (Final) Consumer Inflation Data for January.

- Core Inflation Rate Yoy Est. 2.7% Vs. Prev. 2.7%

- Inflation Rate Yoy Est. 2.5% Vs. Prev. 2.4%

- Feb. 21, 9:45 AM: S&P Global Releases February’s (Flash) US Purchasing Managers’ Index (Flash) Reports.

- Earnings

- Feb. 24: Riot Platforms (Riot), Post-Market, $ -0.18

- Feb. 25: Bitdeer Technologies Group (BTDR), Pre-Market, $ -0.17

- Feb. 25: CIPPHER MINING (CIFR), Pre-Market, $ -0.09

- Feb. 26: Mara Holdings (Mara), Post-Market, $ -0.13

TKEN EVENTS

- Governance Votes & Calls

- Sky Dao is Discussing withdrawing A PORTION OF THE SMART BURN ENGINE’S LP TOKENS TO STOP MALICIES ACTORS FROM ACQUERING THEM.

- Dydx Dao Is Discussing Increase The Limit on the Maximum Nocial Value of Liquidations that Can Occur Within A Given Block on the Dydx Protocol to Enhanceida Laucida.

- Unlocks

- Feb. 21: Fast Token (FTN) to Unlock 4.66% of Circulating Supple Worth $ 78.6 Million.

- Feb. 28: Optimism (OP) to Unlock 1.92% of Circulating Supple Worth $ 34.23 Million.

- Mar. 1: sui (sui) to unlock 0.74% of circulating Supple worth $ 81.07 Million.

- TKEN LAUNCHES

Conferences:Coindesk’s Consensus to Take Place in Toronto on May 14-16. Use Code Daybook and SAVE 15% ON PASSES.

- Feb. 23-March 2: Ethdenver 2025 (Denver)

- Feb. 24: Rwa London Summit 2025

- Feb. 25: Hederacon 2025 (Denver)

- March 2-3: Crypto Expo Europe (Bucharest, Romania)

- March 8: Bitcoin Alive (Sydney, Australia)

Token TalkBy oliver Knight

- With a botched Launch from Argentine President Javier Milei and A Token Proped by Self-Processed Nazi Kanye West, Now Known As Ye, This Week In Memocoin Land Land Has Been Been Been Tong.

- Castle Island Ventures Partner Nic Carter Said the Craze Is “UNQUESTIONABESTIONABLY OV Planning to introduce Yzy Token – and Will Own 70% of the Supple.

- The REST OF THE CRYPTO MARKET REMAINS RELATIVELY UNPERTURTURBED by the Potential Demise of the Sector: Eth and Ltc Are Up by 3% this Week whilast trx have risen by 7.7% Tokens Back to More Utilitarian Projects.

- Near Leads The Pack on Friday, Surging by 11% After Announcing the “First Trly Autonomous” AI Agents. The agents will be able to autonomously Own, Trade and Manage Assets On-Chain.

Derivatives Positioning

- BTC Open Interest on Centralized Exchanges Rose Nearly 5% to $ 37.3 Billion in the Past 24 Hours. This, Coupled with The Reversal in FUNDING FROM POSITIVE TO NEGATIVE, SUGGESTS A PETENTIAL Short Squeze Scenario. Short Liquidations have dominated the Futures markets over that period, nearing a total of $ 110 Million Compared with $ 6.11 Million in Longs.

- Among The Assets With Over $ 100 Million in Open Interest, Maker Dao, Virtuals Protcol and Artificial Super Intelligence Saw The Highest One-Day Increase, Rising by 39.2%, 35.5.5.5.5.5.5.5.5.5.5.5.5

- Among the Options Instruments, The Call Option on BTC With A Strike Price of $ 99,000 and Expiring Feb. 22 Has Traded with The Most Volume on Deribit. The NEXT MOST POPULAR OPTIONS INSTRUMENT IS THE CALL ON BTC WITH A STRIKE PRICE OF $ 108,000, Expiring on Feb. 28. The Action Hints at the Optimistic Short-Term Sentiment in the Market Over the Past Cupple of Days.

Market Movements:

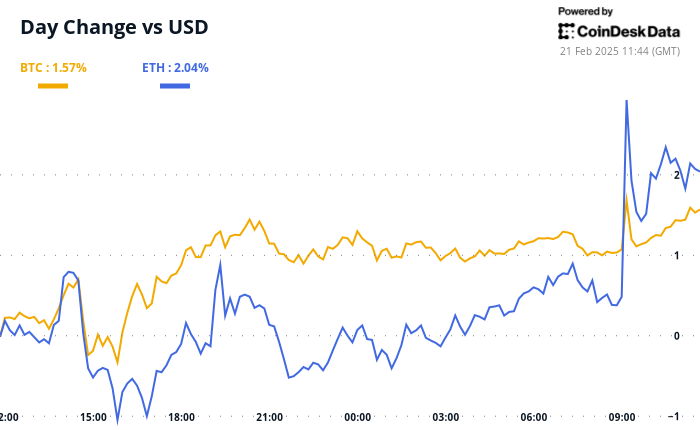

- BTC IS UP 0.28% FROM 4 PM ET Thursday to $ 98,632.42 (24hrs: +1.35%)

- ETH IS UP 2.09% AT $ 2,800.02 (24hrs: +2.15%)

- Coindesk 20 is up 0.92% to 3.298.29 (24hrs: +1.49%)

- Ether Cesr Composite Staking Rate Is Unchanged AT 2.99%

- BTC FUNDING RATE IS AT 0.0010% (1.0961% Annualized) on Binance

- DXY IS UP 0.29% AT 106.68

- Gold Is Down 0.31% AT $ 2,929.76/OZ

- Silver is Down 0.12% to $ 32.91/Oz

- Nikkei 225 Closed +0.26% AT 38,776.94

- Hang Seng Closed +3.99% AT 23.477.92

- Ftse is up 0.20% AT 8,680.19

- Euro Stoxx 50 IS Up 0.18% AT 5.471.08

- Djia Closed Thursday Down -1.01% AT 44,176.65

- S&P 500 CLOSED -0.43% AT 6,117.52

- NASDAQ CLOSED -0.47% AT 19,962.36

- S&P/Tsx Composite Index Closed -0.44% AT 25,514.08

- S&P 40 Latin American Closed +0.76% AT 2.480.21

- US 10-YEAR Treasury Rate Was Down 2 BPS at 4.49%

- E-mini S&P 500 Futures Are UnChanged AT 6,138.25

- E-mini NASDAQ-100 Futures Are Up 0.13% AT 22,170.75

- E-mini Dow Jones Industrial Average Index Futures Are Up 0.10% to 44.309

Bitcoin Stats:

- BTC Dominance: 61.02 (-0.35%)

- Ethereum to Bitcoin Ratio: 0.02842 (2.01%)

- Hashrate (Seven-Day MOVING AVERAGE): 807 eh/s

- HashPrice (Spot): $ 54.92

- Total Fees: 5.34 BTC / $ 526,892

- CME FUTures Open Interest: 178,500 BTC

- BTC PRICED IN GOLD: 33.4 OZ

- BTC VS Gold Market Cap: 9.49%

Technical Analysis

- Tao has emerged as one of the strongest-performing assets over the past week, Fueled by the launch of the Dynamictao Upgrade. This Momentum has Propelled the Price Above All Key Exponential MOVING AVERASES ON THE DAILY TIME FRAME, SIGNALING RENEWED STREEGTHth.

- Adding to the Bullish Sentiment, The Price Action Has Formed An Inverse Head and Shoulders Pattern.

- Tao’s recenting on Coinbase Provides An Extra Catalyst, Driving ITS PRICE UP Nearly 20% to a High of $ 495 Since the Initial Announcement.

Crypto equities

- Microstrategy (Mstr): Closed On Thursday at $ 323.92 (+1.65%), Up 0.37% AT $ 324.85 In Pre-Market

- Coinbase Global (Coin): CLOSED AT $ 256.59 (-0.80%), Up 0.86% AT $ 258.80

- Galaxy Digital Holdings (GLXY): CLOSED AT C $ 25.65 (+1.30%)

- MARA HOLDINGS (MARA): CLOSED AT $ 15.95 (+1.08%), Up 0.38% AT $ 16.01

- Riot Platforms (RIOT): CLOSED AT $ 11.60 (+0.35%), Up 0.52% AT $ 11.66

- Core Scientific (Corz): CLOSED AT $ 11.84 (-1.50%), Up 0.51% AT $ 11.90

- Cleanspark (CLSK): CLOSED AT $ 10.06 (+1.72%), Up 0.80% AT $ 10.14

- Coinshares Valkyrie Bitcoin Mines Etf (WGMI): Closed At $ 22.49 (-1.27%), Down 0.31% AT $ 22.42

- Semler Scientific (SMLR): CLOSED AT $ 52.24 (+0.04%), Unchanged

- Exodus Movement (Exod): Closed At $ 47.80 (-1.26%), Down 2.72% AT $ 46.50

ETF FlowsSPOT BTC ETFS:

- Daily Net Flow: -$ 364.8 Million

- Cumulative Net Flows: $ 39.63 Billion

- Total BTC Holdings ~ 1.169 Million.

Spot eth etfs

- Daily Net Flow: -$ 13.1 Million

- Cumulative Net Flows: $ 3.16 Billion

- Total Eth Holdings ~ 3.807 Million.

Source: Farside Investors

Overnight FlowsChart of the day

- Bitcoin’s Price Action Has Trigger Liquidations Totling $ 97.9 Million at the $ 98.890 Level, Accounting To CoingLas. The Next Key Resistance Levels, Based on the Liquidation Heat Map, ARE $ 99,185 and $ 99.332, Whore Liquidations WORTH $ 65.2.2 Million and $ 67.9 Million, Respectvely, Are CLUSTIVELY.

- On the Downside, Significant Long Liquidations Are Positioned AT $ 97.415 and $ 97.194, Amounting to $ 69.3 Million and $ 70.7 Million, Respectively. THESE Key Levels Highlight Potential Areas of Volatility As Bitcoin Navigates It Current Price Range.

While You Were Sleeping

- Crypto Market Faces Weak Demand, Needs Trump Initiatiats to Kick In, Jpmorgan Says (Coindesk) Initiatsi from the Trump Administration Unlikely to Emerge Until the Second Half of the Year.

- South African Firm to Amass Bitcoin Hoard in First for Continent (Bloomberg): Altvest Capital Adapted Bitcoin to Be A Treasury Reserve Asset. IT BOUGHT ONE BTC AND IS CONSIDERING A $ 10 MILLION Share Sale to Expand ITS Digital Holdings.

- Block Shares Fall on Profit, Revenue Miss (CNBC): AT ITS Q4 2024 Earnings Call, Block (XYZ) Executives Commented On Proto, Their Bitcoin Mining Initiative. CFO Amrita Ahuja Said the Project Should Drive Growth in the Second Half.

- Japan Yields Fall as Ueda Warns Boj Can Step in to Smooth Market (Bloomberg): Bank of Japan Governor Kazuo Ueda Vowed to BUY GOVERNMENT BONDS SPIK. Earlier, 10-Yelds Hit 1.455%-The MOST SINCE 2009.

- UK Retail Sales Rise for First Time in Five MONHS (The Wall Street Journal): In January, Retail Sporting in The UK Rose 1.7% From December, Led By A 5.6% Jump in Food Sale.

- New Microsoft Chip Shortens Timeline to Make Bitcoin Quantum-Resistant: River (Cointel EGRAPH): Bitcoin-Focused Financial Services Firm River SAID Microsoft’s Majorana-Thought not Yet A Threat-Could Reach A 1-Million-Qubit Scale BYACALOCALACALACALACAL.

In the Ether

X Icon