“Your day-ahead look for Jan. 17, 2025”, — write: www.coindesk.com

The crypto world is buzzing as President-elect Donald Trump’s inauguration nears. Bitcoin is holding above $100,000 and altcoins like SOL, ADA, LINK, XRP and LTC are shining as it’s not just about a potential strategic bitcoin reserve anymore. Reports suggest Trump could announce crypto as a policy priority.

Things are heating up for ether too. A blockchain address associated with Trump’s World Liberty Finance (WLF) project snapped up nearly $10 million of ETH this week, according to Arkham Intelligence. And keep your eyes on layer-1 blockchain Near Protocol’s NEAR. The token’s supply dynamics look bullish, with the ratio of staked to unstaked NEAR rising, according to data source Flipside.

Overall, the outlook for the crypto market is bullish, as Wednesday’s U.S. CPI report has eased inflation concerns, allowing traders to focus on Trump’s swearing-in. On-chain analysis from 21Shares shows there’s still plenty of upside left for BTC.

That said, consider the possibility of a price drop if a major announcement doesn’t materialize on Trump’s first day.

“The macroeconomic backdrop remains supportive, with unemployment trending downward, inflation showing signs of easing, and the market riding a wave of enthusiasm tied to Trump’s inauguration,” Valentin Fournier, an analyst at BRN, said. “We maintain a bullish outlook for Q1, though a correction could happen this week if the new administration doesn’t outline a solid action plan.”

Note that BTC is trading at a discount on Coinbase relative to Binance in a sign of weak demand from U.S. investors. Plus, Arkham Intelligence data shows a whale moved BTC worth over $1 billion to Coinbase on Thursday. Transfers to exchanges typically represent an investor intention to sell.

And watch out for inflation worries creeping back. The U.S. PPI, which shows price pressures building up in the pipeline, rose above the CPI in December for the first time since 2022. Stay alert!

What to Watch

- Crypto

- Jan. 17: Oral arguments at the Court of Appeals for the District of Columbia in KalshiEX LLC v. CFTC, where the CFTC is appealing the district court’s ruling favoring Kalshi’s Congressional Control Contracts.

- Jan. 23: First deadline for a decision by the SEC on NYSE Arca’s Dec. 3 proposal to list and trade shares of Grayscale Solana Trust (GSOL), a closed-end trust, as an ETF.

- Jan. 25: First deadline for SEC decisions on proposals for four new spot solana ETFs: Bitwise Solana ETF, Canary Solana ETF, 21Shares Core Solana ETF and VanEck Solana Trust, which are all sponsored by Cboe BZX Exchange.

- Feb. 4: MicroStrategy Inc. (MSTR) reports Q4 earnings before the market opens.

- Macro

- Jan. 17, 8:30 a.m.: The U.S. Census Bureau releases December’s Monthly New Residential Construction report.

- Building Permits (Preliminary) Est. 1.46M vs. Prev. 1.493M.

- Building Permits MoM (Preliminary) Prev. 5.2%.

- Housing Starts Est. 1.32M vs. Prev. 1.289M.

- Housing Starts MoM Prev. -1.8%.

- Jan. 17, 8:30 a.m.: The U.S. Census Bureau releases December’s Monthly New Residential Construction report.

Token Events

- Governance votes & calls

- ApeChain is voting on a revamped governance process for 75% of the on-chain treasury to be directed to DAO treasury contract and the remaining 25% to the Ape Foundation for administrative and support purposes. Voting began Jan. 17 and will last for 13 days.

- The Aave DAO is discussing a joint incentive program with Polygon that would require $3 million to enhance liquidity and adoption of Aave on the Polygon blockchain.

- Unlocks

- Jan. 17: ApeCoin (APE) to unlock 2.16% of its circulating supply, worth $18.1 million

- Jan. 17: QuantixAI (QAI) to unlock 4.79% of its circulating supply, worth $21.28 million

- Jan. 18: Ondo (ONDO) to unlock 134% of its circulating supply, worth $2.19 billion.

- Jan. 21: Fasttoken (FTN) to unlock 4.6% of circulating supply worth $76 million.

- Token Launches

- Jan. 17: Solv Protocol (SOLV) to be listed on Binance.

Conferences:

- Day 12 of 14: Starknet, an Ethereum layer 2, is holding its Winter Hackathon (online).

- Day 5 of 12: Swiss WEB3FEST Winter Edition 2025 (Zug, Zurich, St. Moritz, Davos)

- Jan. 18: BitcoinDay (Naples, Florida)

- Jan. 20-24: World Economic Forum Annual Meeting (Davos-Klosters, Switzerland)

- Jan. 21: Frankfurt Tokenization Conference 2025

- Jan. 25-26: Catstanbul 2025 (Istanbul). The first community conference for Jupiter, a decentralized exchange (DEX) aggregator built on Solana.

- Jan 30-31: Plan B Forum (San Salvador, El Salvador)

- Feb. 3: Digital Assets Forum (London)

- Feb. 18-20: Consensus Hong Kong

Token TalkBy Oliver Knight

- Litecoin (LTC) led the pack over the past 24 hours after a Nasdaq 19B-4 filing paved the way to roll out an LTC exchange traded-fund (ETF). The token rose 17% to overtake bitcoin cash (BCH) in terms of market cap.

- Ethereum developers confirmed that the mainnet Pectra upgrade will take place in March, with a series of hard forks planned on Ethereum testnets in February. The upgrade will improve wallet functionality and increase the native staking limit to 2,048 ETH from 32 ETH. This increase means larger stakers like Coinbase and restaking protocols will be able to control fewer validators, reducing complexity. Coinbase currently has tens of thousands of validators.

- Altcoin whales are aggressively buying solana (SOL) in the lead-up to Donald Trump’s inauguration. One particular wallet, reported by Lookonchain, bought $2.49 million worth of SOL and withdrew an additional $3.94 million worth out of Binance. It then deposited a total of 144,817 SOL ($30.4 million) into lending platform Kamino before borrowing $20 million of stablecoins. This is effectively taking a long position on SOL as when the value of the underlying asset rises, the user will have to pay less stablecoin.

Derivatives Positioning

- Litecoin is the best-performing coin in terms of futures open interest growth and positive CVD readings that imply net buying pressure.

- HYPE stands out as overheated, with annualized funding rates in excess of 100%, according to Velo Data. The elevated funding rate indicates overcrowding in bullish bets.

- BTC’s annualized one-month futures basis on the CME has climbed above 12%, surpassing ETH’s 11%. BTC, ETH CME futures open interest, however, remains little changed and well below December highs.

- BTC, ETH options on Deribit show bias for calls.

Market Movements:

- BTC is down 2.17% from 4 p.m. ET Thursday at $102,319.71 (24hrs: +3.15%)

- ETH is up 3.13% at $3,424.04 (24hrs: +3.22%)

- CoinDesk 20 is up 1.36% at 3,960.57 (24hrs: +4.36%)

- Ether staking yield is unchanged at 3.1%

- BTC funding rate is at 0.0092% (10.12% annualized) on Binance

- DXY is unchanged at 109.02

- Gold is up 0.67% at $2,730.60/oz

- Silver is down 1.3% at $31.28/oz

- Nikkei 225 closed -0.31% to 38,451.46

- Hang Seng closed +0.31% to 19584.06,

- FTSE is up 1.06% at 8,481.19

- Euro Stoxx 50 is up 0.66% at 5,140.87

- DJIA closed on Thursday -0.16% to 43,153.13

- S&P 500 closed -0.21% to 5,937.34

- Nasdaq closed -0.89% to 19,338.29

- S&P/TSX Composite Index closed +0.23% to 24846.2

- S&P 40 Latin America closed -1.41% to 2,230.95

- U.S. 10-year Treasury is down 2 bp at 4.6%

- E-mini S&P 500 futures are unchanged at 5,993.50

- E-mini Nasdaq-100 futures are down 0.32% at 21,332.25

- E-mini Dow Jones Industrial Average Index futures are unchanged at 43,496.00

Bitcoin Stats:

- BTC Dominance: 57.49

- Ethereum to bitcoin ratio: 0.0334

- Hashrate (seven-day moving average): 784 EH/s

- Hashprice (spot): $57.0

- Total Fees: 7.34 BTC/ $731,223

- CME Futures Open Interest: 178,755 BTC

- BTC priced in gold: 37.8 oz

- BTC vs gold market cap: 10.75%

Technical AnalysisDollar Index’s daily chart. (TradingView/CoinDesk)

- The dollar index’s (DXY) rally has stalled, but the bullish trendline characterizing the uptrend from 100 is still intact.

- A renewed bounce from the trendline support could create a headwind to risk assets.

Crypto Equities

- MicroStrategy (MSTR): closed on Thursday at $367 (+1.77%), up 3.26% at $378.98 in pre-market.

- Coinbase Global (COIN): closed at $281.63 (+2.44%), up 2.68% at $289.28 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$28.77(+3.01%).

- MARA Holdings (MARA): closed at $18.3 (+0.83%), up 3.17% at $18.88 in pre-market.

- Riot Platforms (RIOT): closed at $13.29 (-1.29%), up 3.24% at $13.72 in pre-market.

- Core Scientific (CORZ): closed at $14.63 (+0.69%), up 1.71% at $14.88 in pre-market.

- CleanSpark (CLSK): closed at $11.18 (-0.18%), up 3.58% at $11.58 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $24.60 (+0.12%), up 2.93% at $25.32 in pre-market.

- Semler Scientific (SMLR): closed at $58.24 (+3.8%), up 2.76% at $59.85 in pre-market.

- Exodus Movement (EXOD): closed at $37.87 (+7.1%), up 5.62% at $40 in pre-market.

ETF FlowsSpot BTC ETFs:

- Daily net flow: $527.9 million

- Cumulative net flows: $38.04 billion

- Total BTC holdings ~ 1.14 million.

Spot ETH ETFs

- Daily net flow: $166.59 million

- Cumulative net flows: $2.64 billion

- Total ETH holdings ~ 3.57 million.

Source: Farside Investors

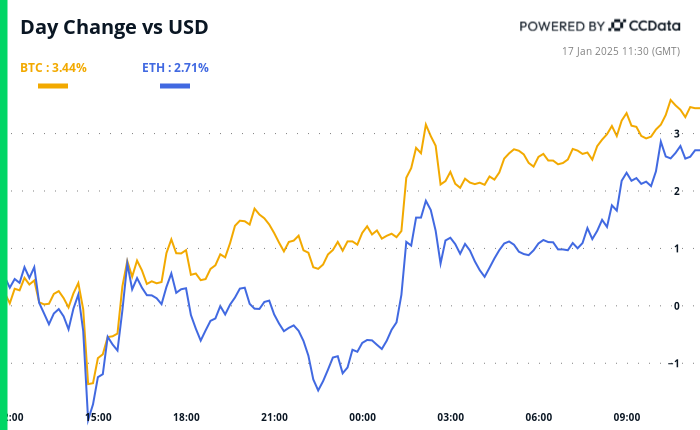

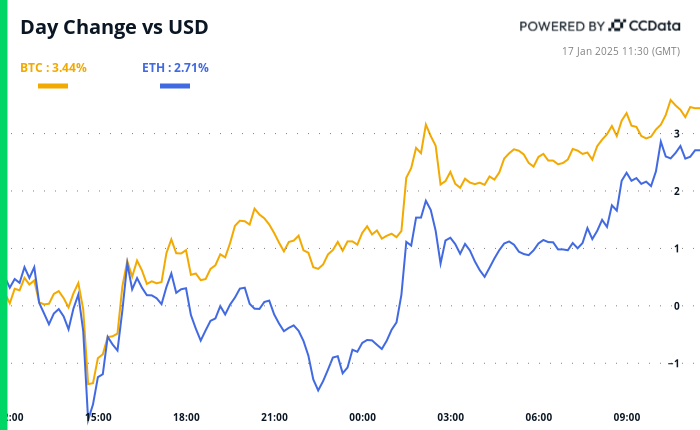

Overnight FlowsChart of the Day

NEAR: The amount of circulating supply staked versus unstaked. (Flipside)

- The chart shows trends in NEAR’s circulating supply staked or locked in the blockchain in return for rewards, versus supply unstaked.

- The rate at which NEAR holders are staking their coins is increasing, creating a bullish demand-supply dynamic for the token.

While You Were Sleeping

- Bitcoin’s ‘Coinbase Premium’ Muted Amid Reports Trump Plans to Designate Crypto a National Policy (CoinDesk): President-elect Trump is reportedly planning to prioritize cryptocurrency with an executive order, but the BTC price differential between Coinbase and Binance signals a lack of enthusiasm among U.S. investors ahead of his Jan. 20 inauguration.

- XRP Volume Overtakes Bitcoin on Coinbase as U.S. Investor Interest Grows (CoinDesk): XRP accounted for 25% of Coinbase’s trading volume in the past 24 hours, driven by rising U.S. interest and speculation about an XRP ETF.

- Bitcoin Miners Have Started 2025 on a Strong Footing, JPMorgan Says (CoinDesk): JPMorgan notes that 12 of 14 monitored mining stocks delivered stronger returns than bitcoin early this year, supported by a 51% annual hashrate surge.

- BOJ Likely to Keep Hawkish Policy Pledge, Raise Rates Next Week, Sources Say (Reuters): Markets predict an 80% likelihood the Bank of Japan will raise the interest rate to 0.5% next week, the highest since 2008.

- China Hits 5% GDP Target but Trump Tariffs Threaten Further Growth (Bloomberg): China achieved 5% GDP growth in 2024, driven by stimulus and strong exports. Upcoming U.S. tariffs and weak domestic demand may hinder future progress.

- European Markets Near an All-Time High Ahead of Earnings Season (Euronews): European stocks rose this week, with Germany’s DAX hitting record highs over the past two sessions. The Euro Stoxx 600 gained 0.81%, driven by strong luxury and technology earnings and expectations of looser ECB policy.

In the Ether

X icon

X icon