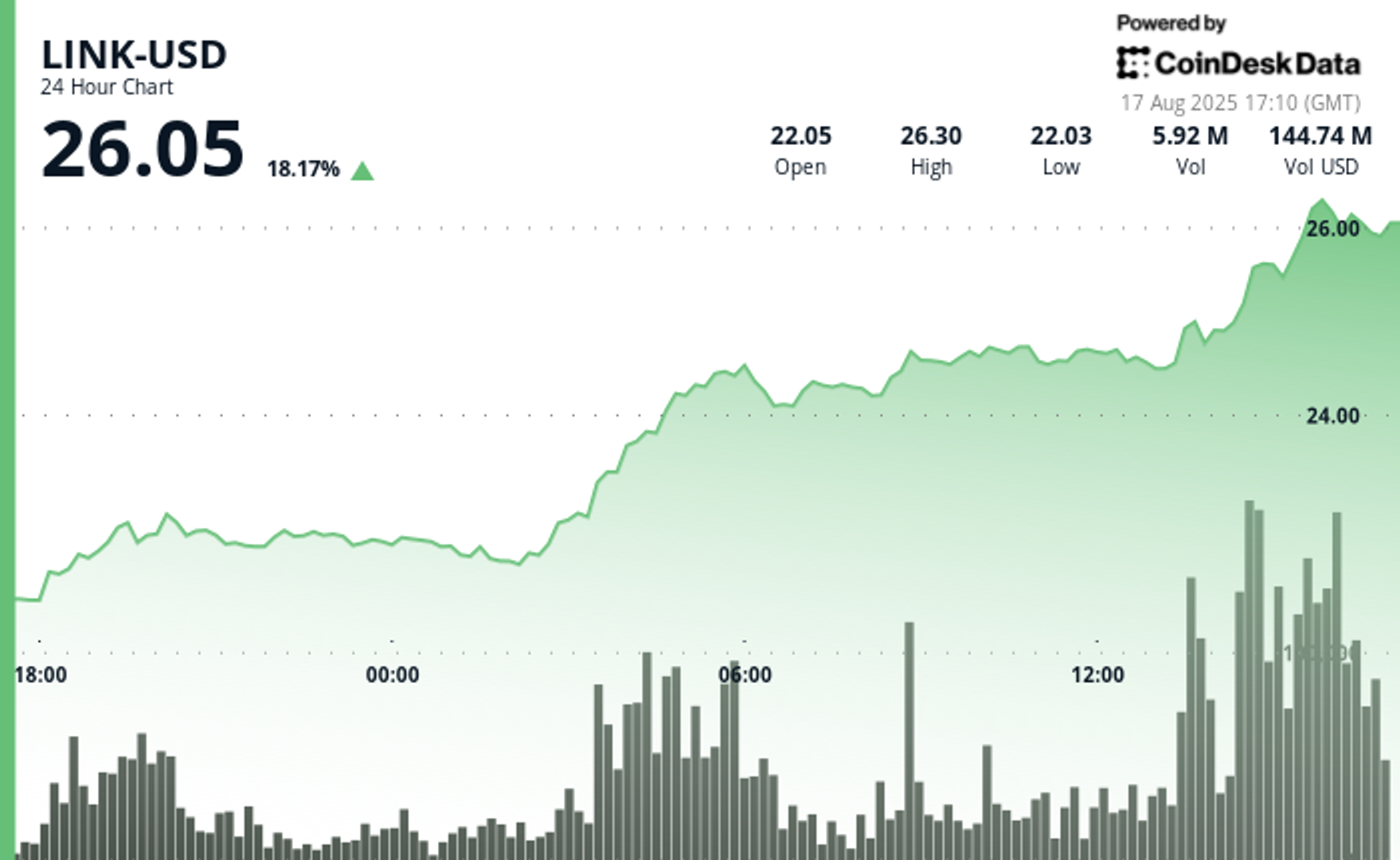

“Link Surged 18% to $ 26.05, Outpacing Peers As Analysts Highlight Undervaluation, Strong Chart Signals and Chainlink’s August Product AnnounCements.”, – WRITE: www.coindesk.com

What Analysts Are SayingAltcoin Sherpa Described Link As “One of the Best Coins Right Now,” Pointing to Chart Strength that Could Carry Town $ 30. He Explained that Round-Number Levels Like $ 30 Onthen Act As Psychological Barriers WHERE SELLERS TAKE PROFITS, SO Traders Should Be Cautious About Chassing The Move Too Late.

Zach Humphriers, Another Analyst, Argued that Link Remains “Very Undervalued” at Current Prices. He Emphasized that Chainlink Underpins Much of Decentralized Finance by Delivering the Price Feeds and Cross-Chain Services Many Protocols Rely on. From his person persons, the token should be treated as a bet on Critical Infrastructure Racher than Just Another Special Special Acculatory Asset.

Milk Road Highlightned the Strong Trading Backdrop. The Publication Noted A 66% Surge in 24-Hour Trading Volume and Said Link’s Clean Breakout Above $ 24.50 Added CONVICtion for Momentum Traders. They Tied The Bullish Tone Back to Two Key August Developments: The Launch of Chainlink’s New Onchain Reserve and Its Data Partnership with Intercontinental Exchange (ICE).

Chainlink ReserveOn aug. 7, Chainlink Introduced The CHAINLINK Reserve, A Smart Contract Treasury Designed to Steadily Accuumulate Link Over Time. The Mechanism Works by Converting the Project’s Revenue – Paid in Stablecoins, Gas Tokens, or Fiat – Into Link and THEN Locking Those Tokens Onchain for Multiple Years.

The Conversion Process, Called Payment Abstration, Automates this Worksflow. IT USE CHAINLINK’S OWN SERVICES – PRICE FEEDS FOR FAIR CONVERSION RATES, AUTOMATION TO TRIGGer Transactions, and Ccip to Consolidate Fees from Different CHAINS

Chainlink Says the Reserve Has Already Accuumulated More Than $ 1 Million Wrth of Link, With No withdrawals Planned for Several Years. IT ALSO EARMARKS 50% OF Fees from Staking-Secured Services Suchs Such as Smart Value Recapture to Feed The Reserve, Creating A Recurring Stream of Inflows.

The Initiative Serves Two Strategic Purposes.

FIRST, IT STREEGTHETS BETWEEN ADOPTION AND TOKEN DEMAND BY ENSURING USAGE REVENENES CONVERLY DIRECTLY INTO LINK.

Second, IT Provides Transparency: Anyone Cans View Inflows, Balans, and The Timelock at Reserve.hain.Link.

Chainlink Has Framed The Reserve As One Piece of a Broader Economic Design Design That Includes User-Fee Growth and Cost Reductions Via The Chainlink Runtime Environment. For investors, The Practical Takeaway Is That Network Growth Can Now Translate Into Stedy, Programmatic Accuumulation of Link On the Open Market.

Chainlink’s Dashboard Shows the Reserve Now Holds About 109.663 Link Tokens, with A Market Value of Roughly $ 2.8 Million. The Data Also Highlights that the AVERAGE COST BASIS OF TESE HOLDINGS IS $ 19.65 per Token, UndersCoring the Program Early Accuumulation Strategy.

Ice PartnershipOn aug. 11, Chainlink Announced A Partnership with Intercontinental Exchange (ICE), The Operator of the New York Stock Exchange. The Collaboration Integrates Ice’s Consolidated Feed, Which Provides Foreign-Exchange and Precoses-Metals Rates from More than 300 Venues, Into Chainlink Data Streams.

Ice is One of Several Blue-CHIP CONTRIBUTORS TO THESE DATASETS, WHICH are Aggregated by Chainlink to Create Fast, Tamper-Resistant Data Feeds for Use ONCHAIN. By incorporating Ice’s Market Coverage, Chainlink Aims to Make Its Feeds More Attractive for Banks, Asset Managers, and Developers Building Tokenized Assets or AutoMated Stle.

Chainlink Labs Described the Integration As A Watershed Moment for Institutional Adoption. The Thinking Is that Traditional Finance Players Need Proven, High-Quality Data to Interact With Blockchain Applications, and Bringing Ice’s Feeds Onchain Helps MEet that Standard.

The Partnership Marked One of the Clearest Examples Yet of A Major Wall Street Market Data Provider Engaging with Blockchain Infrastructure. By giving decentralized applications Direct Access to Ice’s Financial Data, IT Positioned Chainlinka As A Bridge Between Traditional Markets and Decentralized Finance.

Looking AheadAnalysts Highlight Link’s Strong Trend, Undervaluation and Acceleration Momentum, Suggesting The Token Is In A Position of Strengt As Investors Digest Chainlink’s Recentk’s.

The decline in volatility accounts asset classes Likely Reflects for Easy Monetary Policy and Economic Stability; However, Some Analysts Are Warning of Potential Downside Risks.

The decline in volatility accounts asset classes Likely Reflects for Easy Monetary Policy and Economic Stability; However, Some Analysts Are Warning of Potential Downside Risks.

- Asset Classes Are Experienceing A Significant Decline in Valativity Ahead of Federal Reserve Chairman Jerome Powell’s Speech at the Jackson Hole Symposium.

- The Federal Reserve is Expert To Resume Cuts in September, with A Potential 25 Basis Point Reduction Anticipated.

- Despite Low Valativity, Some Analysts Warn of Market Complacence Amid Ongoing Economic Uncertainties and Potential Downside Risks.

Read Full Story