“Bitcoin’s Hashrate Collapse Triggers A Projected 9% Dificulty Adjustment, Offering Mines of Tempoury Relief Amid Seasonal and Post-Halving Pressure.”, – WRITE: www.coindesk.com

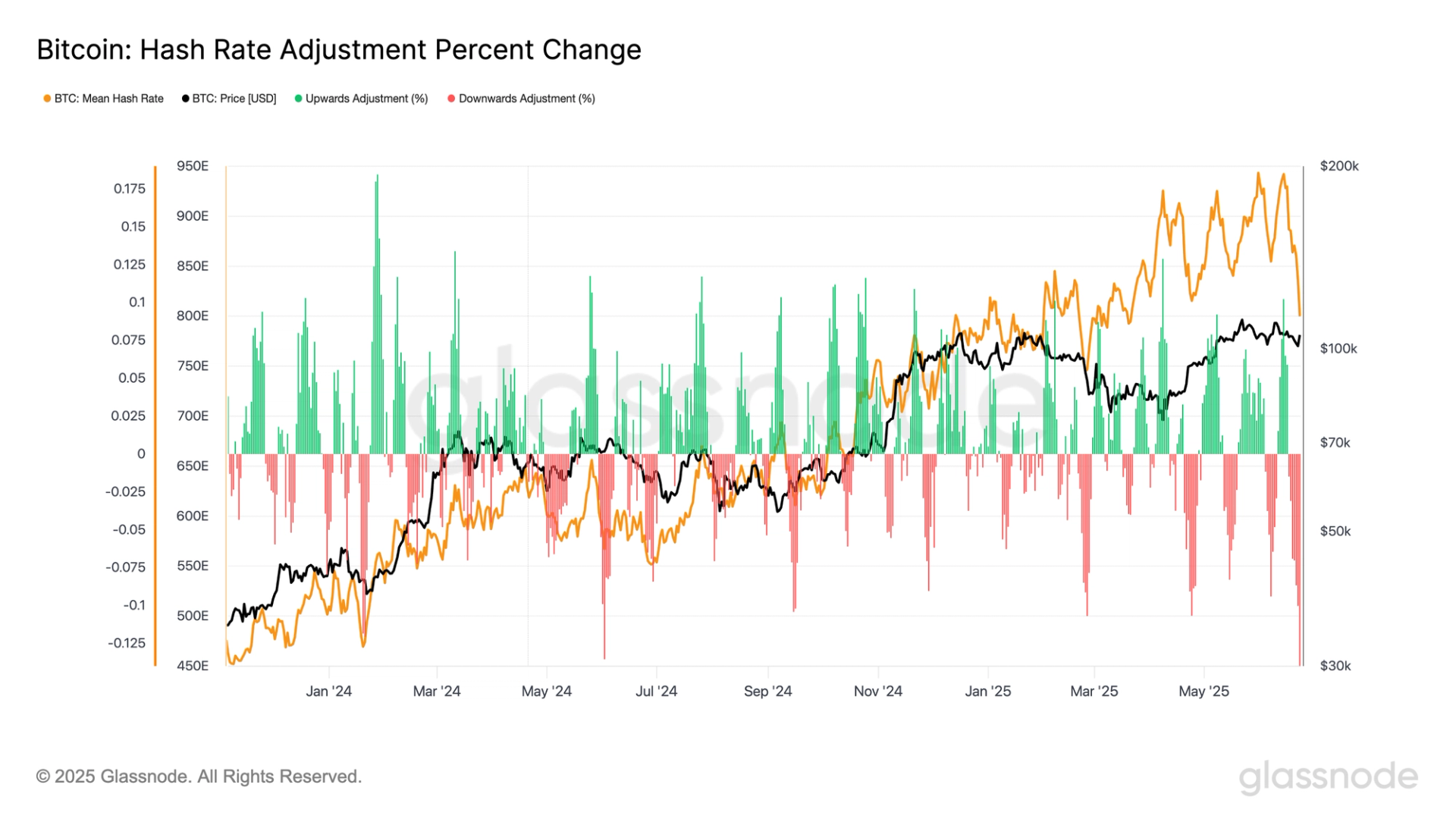

Blockchain Is On Course to Drop by the Mosc July 2021 After the Amount of Mining Power Securing the Network SLID ABOUT 30% in Two Weeks.

Accorging to Data from mempool.space, A downward difficulty adjustment of around 9% IS Projected with the Next Five Days. That would be the most of the theater Mining Ban Four Years Ago, WHEN The HASHRATE, The Total Computational Power USED TO MINE BLOKS, PLUMMETED 50% TO 58 exahashes per Second (Eh/S) And BitCond.

The Dificulty Adjusts Every 2,016 BLOKS TO ENSURE THAT BLOKS Continue to be Mined at Roomhly 10-Minute Intervals. After the recent Decline, The Hashrate is Now Just Under 700 Eh/S, Account to Glassnode Data. The Largest Cryptocurrency by Market Cap Was Trading Recently AROUND $ 105,300.

Significant Hashrate and Difficulty Corrections Are Not Unusual Durying The Nortorn Hemisphere’s Summer. Elevated Electricity Prices, Driven by Higher Air Conditioning Demand and Strained Power Grids, Onthen Lead Mines to Temporiarily Shaut Off Machines, Especialy Older Older. This Seasonal Pattern Has Been Oserved in Several Previous Years.

The anticipated Drop in Mining Dificulty Will Provide Meaningful Relief for Mines. The HashPrice, or Miner Revenue Per Exahash, Currently Sits at $ 51.9. This Metric Reflects of the Estimated Daily Income in Dollars A Miner Earns Per Eh/S Contributed to the Network, Based On Block Rewards and Transaction FEES.

As Difficulty Decreases, Mining Becomes Easier, Meaning Mines Can Earn More Revenue for the Same Amount of Computational Effort. Assuming Bitcoin’s Price and Transaction Fees Remed or Increase, The Hashprice Should Rise Significantly in the Coming Days, Helping to Offset Recentability Pressure.

In addition to his professional endeavors, James Serves as an Advisor to Coinsilium, A UK Publicly Traded Company, WHERE HE PROVides Guidance on Their Bitcoin Treasury Strategy. He Also Holds Investments in Bitcoin and Strategy (MSTR).

X Icon