“Miners that look like infrastructure companies may win, while those that rely on pure mining margins face a tougher 2026.”, — write: www.coindesk.com

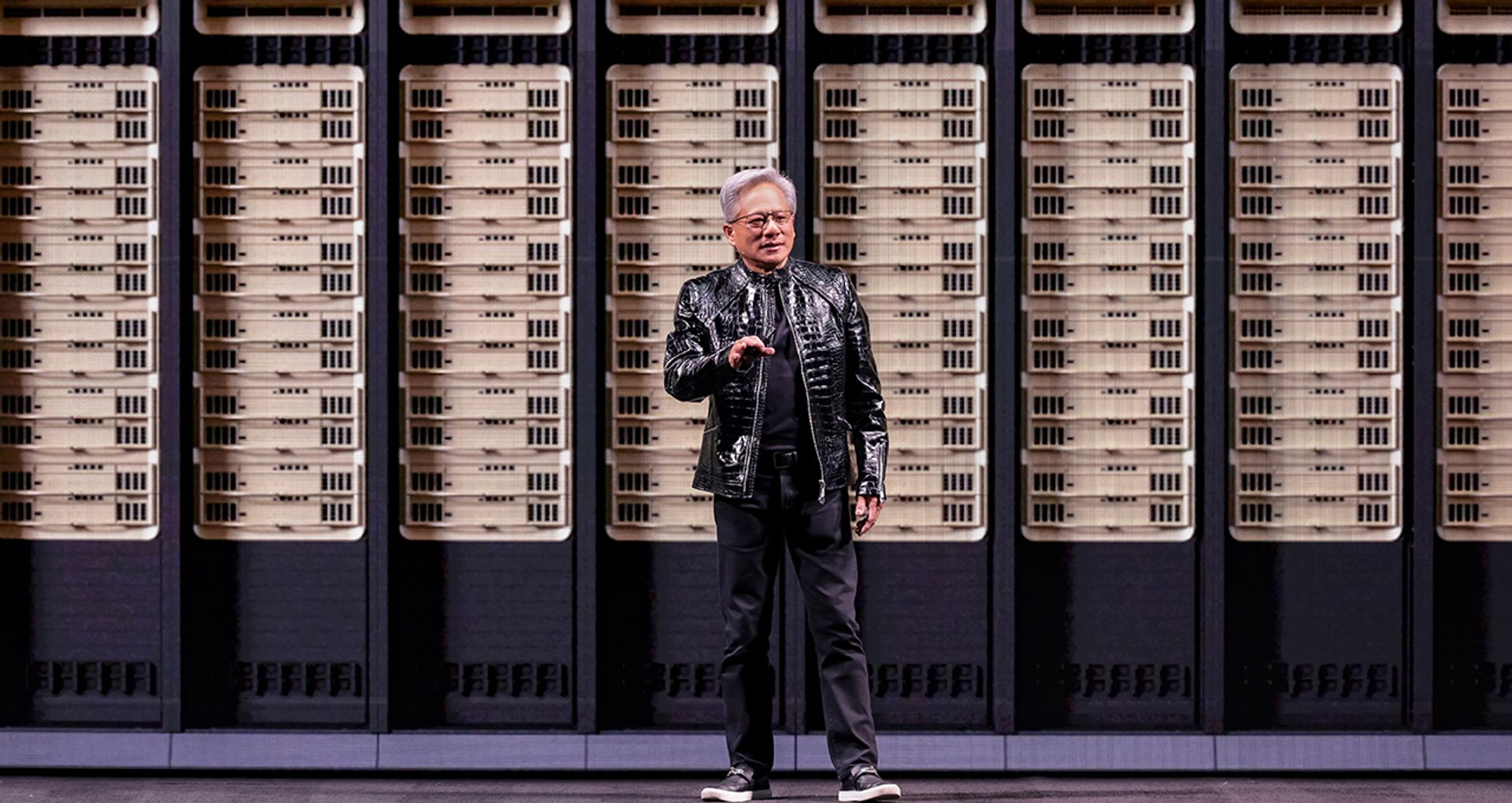

Rubin is expected to arrive later this year and is aimed squarely at the fastest-growing part of the AI business, helping to deliver outputs from trained models.

Huang said Rubin’s flagship server will include 72 of Nvidia’s graphics processing units and 36 central processors, and can be linked into larger “pods” containing more than 1,000 Rubin chips.

Much of the talk was about efficiency. Huang said Rubin systems could improve the efficiency of generating AI “tokens” — the basic units produced by language models — by roughly 10 times, helped by a proprietary type of data the company wants the broader industry to adopt. He added that the performance jump comes despite only a 1.6-times increase in transistor count.

Huang described AI development as a race where faster processing means reaching the next milestone sooner, forcing competitors to spend aggressively on chips, networking and storage.

How bitcoin miners are affectedThat same infrastructure race has been reshaping parts of the crypto market too.

Bitcoin miners have increasingly marketed themselves as power-and-rackspace operators rather than pure crypto plays, pitching their energy contracts, cooling capacity and data-center footprints to AI customers.

Hosting AI workloads can generate steadier cash flows than bitcoin mining during down cycles, especially for firms with cheap power, existing sites and cooling capacity.

But the AI boom also raises the bar. Data-center space is becoming a premium asset, and the best sites get bid up by hyperscalers, cloud firms and AI startups.

That can raise rents, equipment costs and financing hurdles for smaller miners. In other words, miners that look like infrastructure companies may win, while those that rely on pure mining margins face a tougher 2026.

Meanwhile, Nvidia also highlighted new networking switches using a connection method called co-packaged optics, a key technology for linking thousands of machines into a single system.

The company said CoreWeave will be among the first to receive Rubin systems, and expects Microsoft, Oracle, Amazon and Alphabet to adopt them as well.

KuCoin captured a record share of centralized exchange volume in 2025, with more than $1.25tn traded as its volumes grew faster than the broader crypto market.

KuCoin captured a record share of centralized exchange volume in 2025, with more than $1.25tn traded as its volumes grew faster than the broader crypto market.

- KuCoin recorded over $1.25 trillion in total trading volume in 2025equivalent to an average of roughly $114 billion per monthmarking its strongest year on record.

- This performance translated into an all-time high share of centralized exchange volumeas KuCoin’s activity expanded faster than aggregate CEX volumeswhich slowed during periods of lower market volatility.

- Spot and derivatives volumes were evenly spliteach exceeding $500 billion for the year, signaling broad-based usage rather than reliance on a single product line.

- Altcoins accounted for the majority of trading activityreinforcing KuCoin’s role as a primary liquidity venue beyond BTC and ETH at a time when majors saw more muted turnover.

- Even as overall crypto volumes softened mid-year, KuCoin maintained elevated baseline activityindicating structurally higher user engagement rather than short-lived volume spikes.

View Full Report

The 90-day correlation between bitcoin and JPY has risen to a record high of over 0.85.

The 90-day correlation between bitcoin and JPY has risen to a record high of over 0.85.

- Bitcoin’s correlation with the Japanese yen has reached a record high.

- Both BTC and the yen took a beating in the final months of 2025, with sell-offs in both running out of steam after mid-December.

- The tight correlation weakens BTC’s appeal as a portfolio diversifier.

Read full story