“Tracing AVERAGE Exchange withdrawal Prices Reveals Signs of Capitulation and A Shift Town Recovery.”, – WRITE: www.coindesk.com

Tracing The “Realized Price,” or The AVERAGE PRICE AT WHICH BITCOIN

is withdrawn from all exchanges to estimate a market-wide cost basis is a more Valuable Tool for Gauging Investor Profitability and Potential Inflection Points in Market Sentiment.

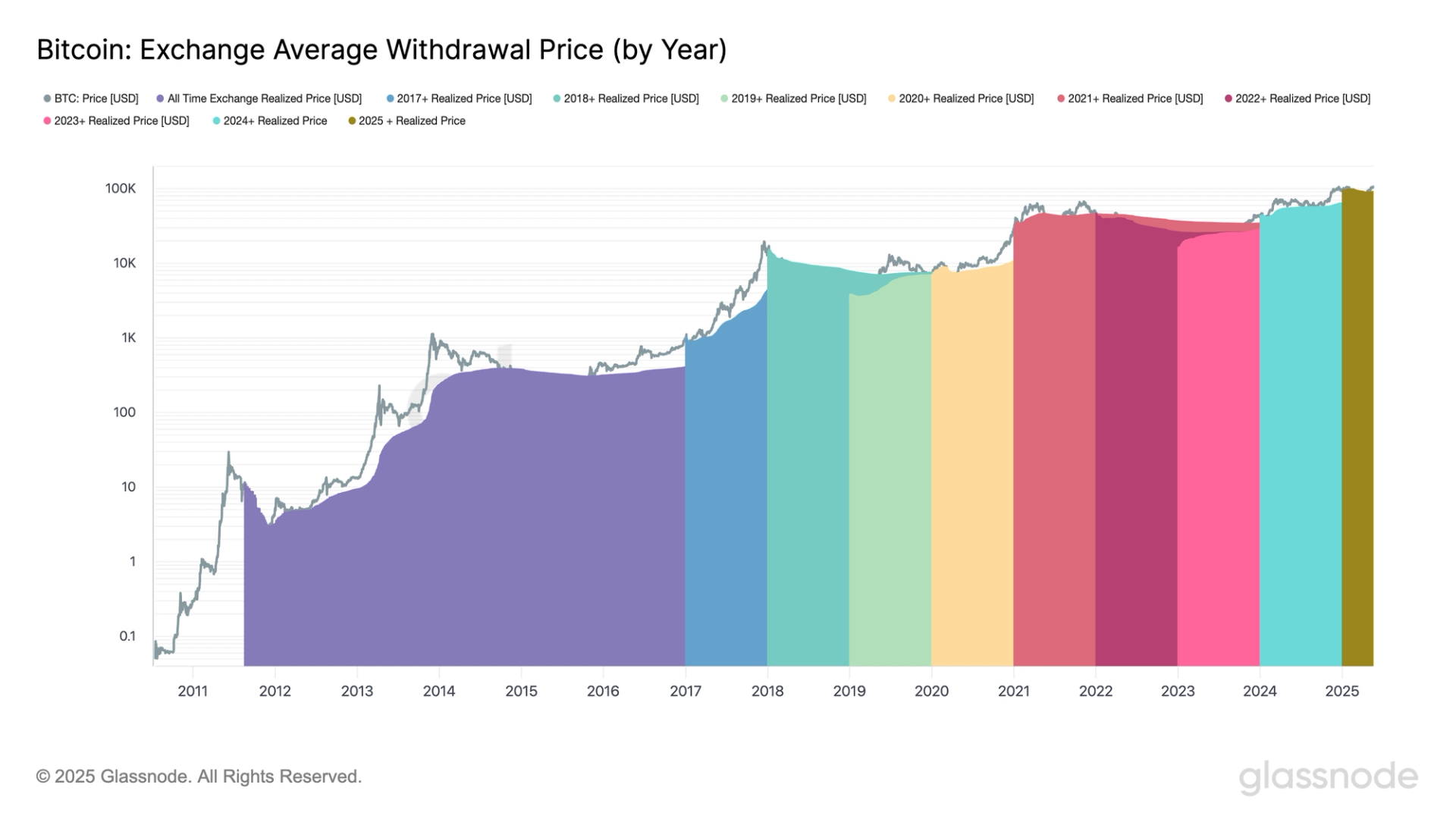

The Charts (Above and Below) Illustrate the AVITHDRAWAL PRICES FOR DIFFERENT INVESTOR COHORTS, SEGMENTED by the year they entered the Market Starting Jan. 1 of Each Year From 2017 to 2025.

The AVERAGE REALIZED PRICE FOR THE 2025 SO FAR IS $ 93,266. With Bitcoin Currently Trading AT $ 105,000, Tese Investors Are Up Approximately 12% on AVERAGE.

WHEN BITCOIN BEGAN ITS Decline from the All-Time High of $ 109,000 in Late January, It Briefly Fell Bell The 2025 Realized Price, A Historical Signal of Capitulation. This Period of Stress Lasted Until April 22, WHEN The PRICE RECLAIMED THE COHORT’s COST BASIS.

Historical Context: Capitulation PatternsHistorically, WHEN PRICE FALLS BLOW A COHORT’s Realized Price, IT Onthen Marks Market Capitulation and Cyclical Bottoms:

- 2024: After the etf Launch in January, Bitcoin Dipped Below The AVERAGE COST BASIS BEFORE REBOUNDING. A more Significant Capitulation followed in the summer, Linked to the Yen Carry Trade Unwind Who Bitcoin Plunged to $ 49,000.

- 2023: Price tracked close to the averaage cost basis during Support Levels, Only Briefly Breaking Below During the Silicon Valley Bank Crisis in March.

The Data Suggests that A Capitulation Phase Has Likely Occurred, Positioning the Market for a More constructive phase. Historically, Recoveries from Such Events Mark Transitions Into Healthier Market Conditions.

BTC: Exchange AVERAGE WITHDRAWAL PRICE (By Year) (Glassnode)

BTC: Exchange AVERAGE WITHDRAWAL PRICE (By Year) (Glassnode)

Realized, Not RecordWHEN BITCOIN FIRST SURPASSED $ 20,000 Dringing The 2017 Bull Market, It Marked A Significant DiverGence Between the Market Price and The Realized Price of Just. Unsurpringly, prices very shortly after Went Into A brutal reversal.

In contrast, by the depths of the 2018 Bear Market WHEN BITCOIN BOTTOMED AROUND $ 3,200, PRICE AT THAT POINT CONVERED WITH Across Cycles.

This Long-Term Cost Basis Acts As A Foundational Support Level in Bear Markets and Gradually Rises Over Time As New Capital Enters The Market. Therefore, Evaluating Bitcoin Solely by Comparing Cycle Peaks, for Example, from $ 69,000 in 2021 to Just Over $ 100,000 in 2025, Misses The Bigger Picture.

The more relevant insight is that the Aggregate Cost Basis of All Investors Continues to Climb, UndersCoring The Long-Term Maturation of the Asset and the Increasing DEPTH.

In addition to his professional endeavors, James Serves as an Advisor to Coinsilium, A UK Publicly Traded Company, WHERE HE PROVides Guidance on Their Bitcoin Treasury Strategy. He Also Holds Investments in Bitcoin and Strategy (MSTR).

X Icon