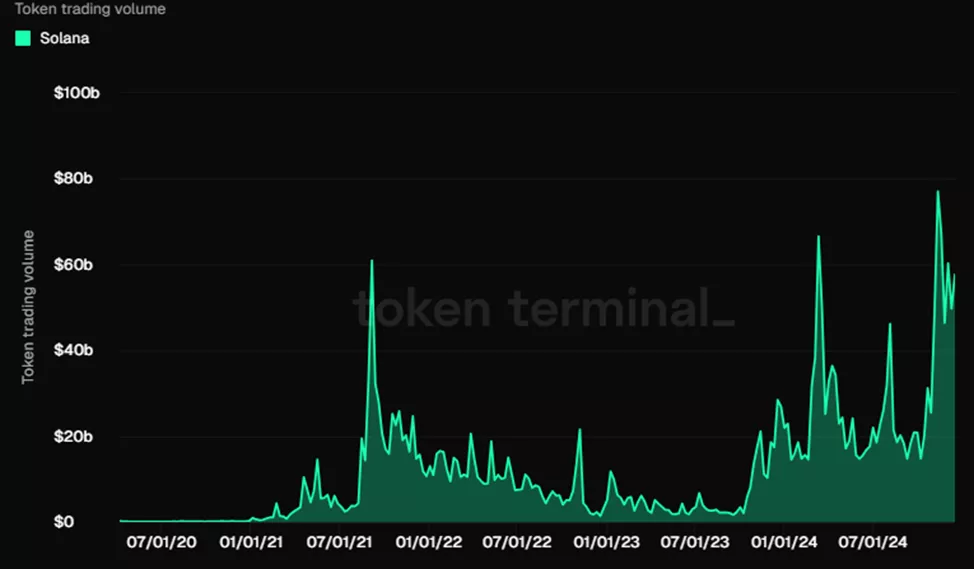

“Solana’s turnover in November reached a record $243 billion. In terms of the number of active users, the blockchain took the leading positions with an indicator of 132 million. The expert noted the formation of a “bullish pullback” pattern as a long entry point. The turnover of Bitcoin and Solana in November reached a record $2.2 trillion and $243 billion, respectively. Ethereum has risen to $1.1 trillion, down 50% from its 2021 peak, according to Token Terminal. BREAKING: Monthly trading volume for BTC […]”, — write: businessua.com.ua

- Solana’s turnover in November reached a record $243 billion.

- In terms of the number of active users, the blockchain took the leading positions with an indicator of 132 million.

- The expert noted forming a “bullish pullback” pattern as a long entry point.

The turnover of Bitcoin and Solana in November reached a record $2.2 trillion and $243 billion, respectively. Ethereum has risen to $1.1 trillion, down 50% from its 2021 peak, according to Token Terminal.

BREAKING: Monthly trading volume for BTC and SOL is at all-time highs, ETH is still down ~50% from its ’21 peak.

Trading volumes for BTC, ETH, and SOL in November ’24 were $2.2 trillion, $1.1 trillion, and $243 billion, respectively. pic.twitter.com/eCj1rUdm7T

— Token Terminal (@tokenterminal) December 19, 2024

Solana’s weekly average volume is 46% above its 2021 peak, while Bitcoin and Ethereum metrics are below their previous bullrun levels.

Solana’s turnover is approximately 20% of Ethereum’s and corresponds to a similar proportion of the capitalization of the two assets.

Source: Token Terminal.

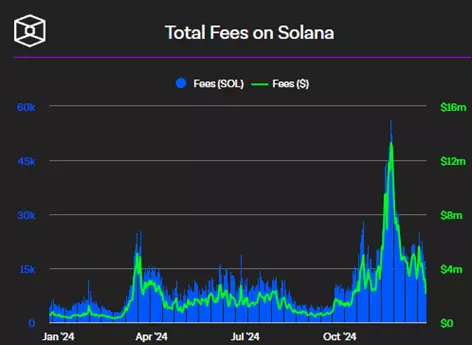

In terms of commissions, the share of Ethereum in November was 18% (61% in 2021), Solana – 18.5% (0.2%).

Source: Token Terminal.

In terms of the number of active users, Solana took the leading position with an indicator of 132 million. As of November 2021, the indicator jumped by 81 million and was twice as high as the combined value of all blockchains at that time.

Source: Token Terminal.

In December, there is a weakening of on-chain metrics.

Glassnode’s opinionGlassnode noted the persistence of net inflows in Solana since September 2023. Earlier, the daily value reached a record $776 million.

We observe that #Solana has consistently maintained a positive net capital inflow since early September 2023, with only minor outflows during this period.

This sustained influx of liquidity has assisted in stimulating growth and price appreciation, achieving a remarkable peak… pic.twitter.com/ypuwTdhrmc

— glassnode (@glassnode) December 24, 2024

According to the analysis of the realized profit in terms of the “age” of the coins, about 51.6% of the total volume is for coins purchased in three time ranges: one day to a week, one week to one month, and half a year to a year.

According to experts, this indicates the perception of Solana as an investment opportunity for all categories of market participants.

Source: Glassnode.

The sharp recovery in Solana’s price after the FTX crash reflected a significant influx of new funds into the asset.

As of December 2022, when Solana reached its minimum, it is 30 DMA relative changes in realized capitalization exceeded the dynamics of Bitcoin and Ethereum in 389 out of 727 trading days.

Source: Glassnode.

The indicator of realized capitalization in relation to active inflows in the last seven days in Solana has overtaken Ethereum for the first time in history. This underscores the stable demand profile for the asset, Glassnode said.

Source: Glassnode.

In conclusion, the experts analyzed the degree of “overheating” of the asset based on the MVRV ratio.

It serves to identify price ranges that indicate extreme divergences in investor returns to the long-term average. Historically, breakouts above one standard deviation coincide with long-term tops.

Currently, the price is consolidating between the average and the +0.5 standard deviation range. This indicates opportunities for a continuation of the bull run.

Source: Glassnode.

Technical pictureCoinDesk analyst Omkar Godbowl reported the emergence of a “bullish pullback” pattern.

The formation is seen as a low-risk trade opportunity for breakout traders.

In the financial markets, the best entry point is often short-lived and easy to miss. Solana now “provides a timely second chance for those who missed the bullish breakout.”

Since December 23, the rate has increased by more than 7% — to $193, resp bulging from former resistance, which has become support.

This line connecting the highs of March and July, as well as the line drawn through the lows of April and August, formed a large descending channel that remained relevant from March to October.

Source: CoinDesk.

In early November, quotes broke out of the range, confirming the bullish trend. The price quickly rose above $260, followed by a pullback to the breakout point.

The expert emphasized that the signal will lose relevance if the rate falls back into the channel.

We will remind, CEO Two Prime Digital Assets Oleksandr Blum predicted the launch of SOL-ETF by the end of 2025.

On November 21, the CBOE sent a SEC related applications from VanEck, 21Shares, Canary Funds and Bitwise Asset Management.

The source