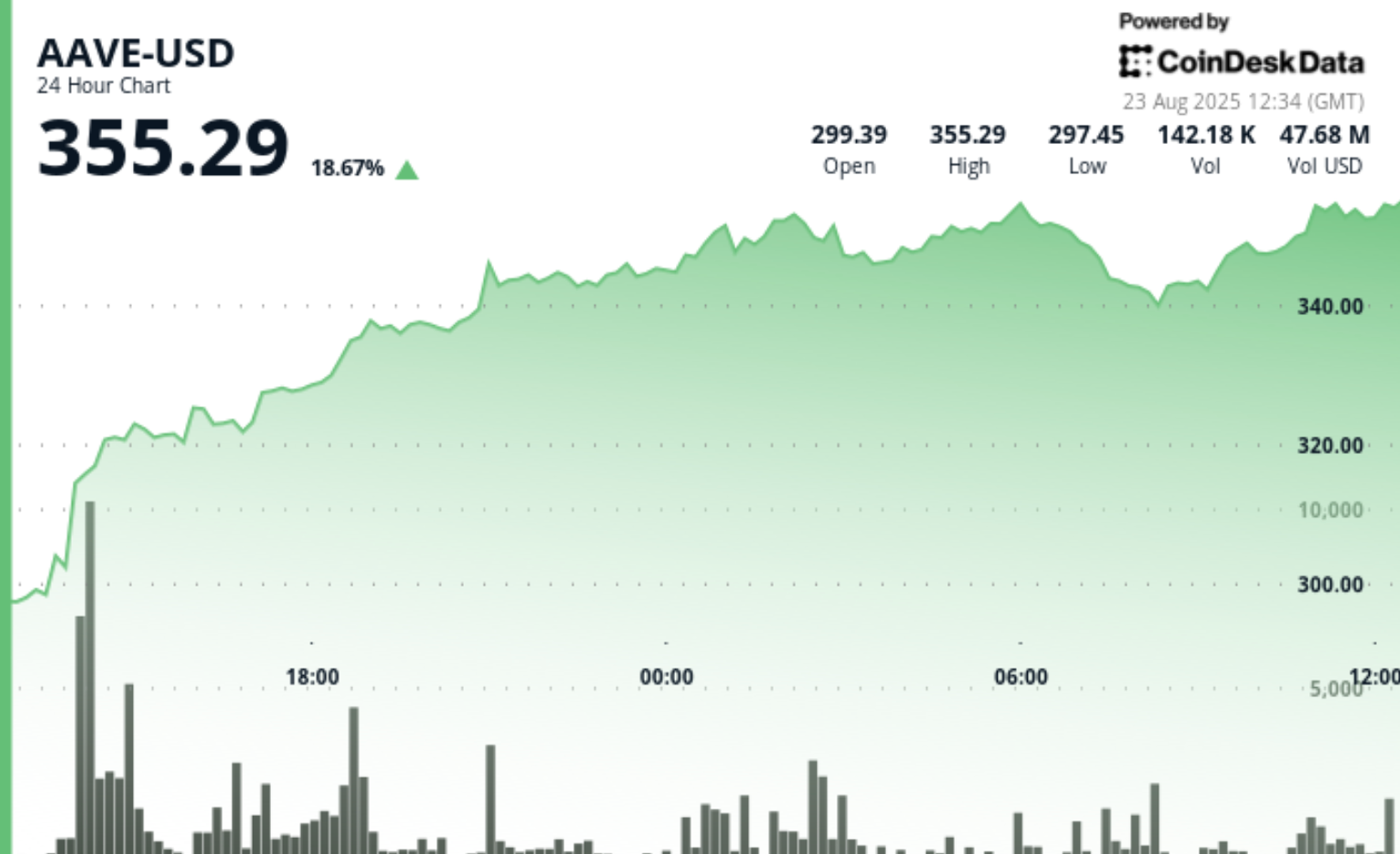

“Aave Jumped 19% to $ 355.29, Leading The Top 40 Cyrptocurrencies As Investors Weighed ITS APTOS Expansion, Powell’s Dovish Tone and Renewed Focus on WLFI Exposure.”, – WRITE: www.coindesk.com

WHAT AAVE IS AND WHY IT MATTERSAave is a Decentralized Finance Protocol That Lets Users Lend and Borrow Cryptocurrencies Without InterMediaries. Loans Are Managed by Smart Contracts, with Borrowers Required to Post Collalateral ValUED ABOVE THEIR LOANS.

The Aave Token Underpins this System. It can be staged to Support Security and Earn Rewards, USD COLLATERAL FOR BORROWING AND GRANTS HOLDERS GOVERNANCE RIGHTS. In Return, Tokenholders Gain Voting Power and Fee Beefits, Making Aave Central to Protocol Operations.

Aptos ExpansionOn aug. 21, Aave Labs AnnounCed that Aave v3 Had Gone Live on Aptos, Its First Deployment on a Non-Evm Blockchain. Developers Rewrote the Codebase in the Move Language, Rebuilt the User Interface and Adapted the Protocol for the Aptos Virtual Machine.

The Launch Was Supported by Audits, A Mainnet CAPTURE-The-FLAG COMPETITION, AND A $ 500,000 Bug Bounty. The First Market Supports Assets Including Apt, Susde, USDT and USDC, with Supple and Borrow Caps to be Raised Gradually. Chaos Labs and Llama Risk Conducted Risk Assessments, and Chainlink Provided Price Feeds.

Aave Labs Founder and CEO Stani Kulechov Called The Launch “An incredible Milestone,” Highlighting the Shift Beyond Evm CHAINS AFTER FIVE YEARS OF EXCLUSIVITY.

Jerome Powell’s Jackson Hole SpeechFed Chair Jerome Powell’s Speech on Friday Morning at the Jackson Hole Economic Policy Symposium Added Momentum. Powell Said the Balance of Risks Between Inflation and Employment Had Shifted, Signaling That Interest Rate Cuts Cuts Could Begin in September.

Markets Viewed His Remarks As Dovish, with CME Fedwatch Data Showing Expectations for a Quarter-Point Cut in September Rising to 83% from 75% Earlier in The Week. US Eequities and Crypto Have Broadly Since Powell’s Speech, with Aave Among The Biggest Movers.

Wlfi Exposure ResurfacesAnother Factor Analysts May Not Be Fully Priced In Is Aave’s Stake In World Liberty Financial (WLFI). In October 2024, Wlfi Proped Launcing ITS OWN AAVE V3 Instance on Ethereum Mainnet. As part of the arrangement, aavedao was allocated 20% of wlfi’s protocol fees and 7% of itts governance tokens.

Simon, an Analyst at Delphi Digital, Noted On Saturday that with wlfi’s token set to begining trading Sept. 1 at an IMPLIED $ 27.3 Billion Valification, Aave’s Allocation Could Be Wrth AROUND $ 1.9 Billion – More Thrad of ITS CURRENT $ 5 Billion Fully Diluted Valination. He argued that this exposure May be Contribution to Aave’s Rally, Even If Investors Are Only Now Revisating ITS SIGNFICANCE.

Technical Analysis Highlights

- Accorging to Coindesk Research’s’s Technical Analysis Data Model, Aave Posted Significant Gains Durying The 24-Hour Trading Period from Aug. 22 at 12:00 UTC to Aug. 23 AT 11:00 UTC, Climbing from $ 297.75 to $ 353.22 – An 18.65% Increase That Reflects Growing Confidentnce in the Platform’s Expancing Strategy.

- The Digital Asset Traded WitHin A $ 62.11 Range, Fluctuating Between $ 294.50 and $ 356.60, with The MOST PRONUNCED PRICE MOVEMENT OCCURRING AT 14:00 UTC on Aug. 22 WHEN TRADING VOLUME REACHED 340,907 UNITS, SIGNFICANTLY EXCEEDING The Daily Average of 102,554 UNITS.

- Sustaned Buying Pressure Was Observed Durying the Final Hour of the Analysis Period from 10:49 UTC to 11:48 UTC on Aug. 23, with Aave Advancing from $ 349.61 to $ 353.79.

- Trading Volumes Consistentally Exceeded 3,000 Units Durying Key Price Levels at $ 352.55, $ 353.98, and $ 355.52, Compared to The Sermonion of 1.647 Units, Indicating Wating. Methodical Institutional Positioning.

Disclaimer: Parts of this Article Were Generated with the Assistance from Ai Tools and Review by Our Editorial Team to Enseure Accucy and Adherence to Our Standards. For more information, See Coindesk’s Full Ai Policy.

All Content Produced by Coindesk Analytics is Undergoes Human Editing by Coindesk’s Editorial Team Before Publication. The Tool Synthesizes Market Data and Information from Coindesk Data and Other Sources to Create Timely Market Reports, with All External Sources Clearly Attributed Within Each.

Coindesk Analytics Operates Under Coindesk’s AI Content Guidelines, WHICH PRIORITIZE Accuracy, Transparency, and Editorial Oversight. Learn more about Coindesk’s Approach to Ai-Generated Content In Our Ai Policy.

Doge’s Price Action Shows Potential for Further Gains, with Support at $ 0.21 and Resistance at $ 0.24.

Doge’s Price Action Shows Potential for Further Gains, with Support at $ 0.21 and Resistance at $ 0.24.

- Meme token Surged to $ 0.24 with Trading Volume Nearly Doubling, Indicating Institutional Interest.

- The Federal Reserve’s Softer Crypto Stance and Wyoming’s Stablecoin Launch Boosted Digital Asset Sentiment.

- Doge’s Price Action Shows Potential for Further Gains, with Support at $ 0.21 and Resistance at $ 0.24.

Read Full Story