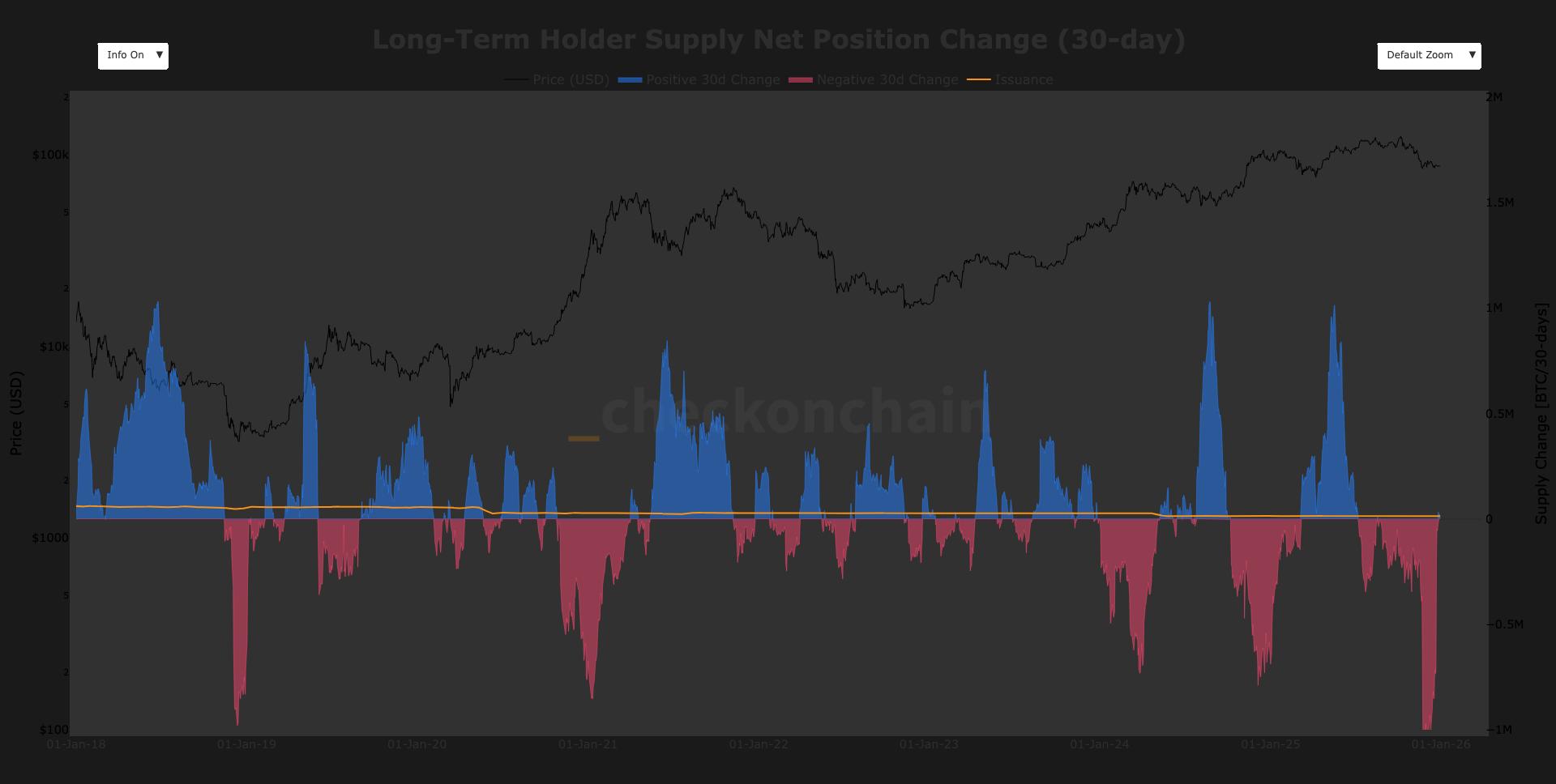

“During this current correction, long-term holders have sold over 1 million BTC, the largest sell pressure event from this cohort since 2019.”, — write: www.coindesk.com

LTHs, defined as entities that have held bitcoin for at least 155 days, have accumulated roughly 33,000 BTC on a 30-day net basis, according to onchain data analysts checkonchain.

Selling from LTHs has been one of the two largest sources of sell pressure this year along with miner capitulation.

LTHs were a major source of distribution, while miners are typically forced to sell bitcoin while mining at a loss.

Since it takes 155 days for short-term holders to transition into long-term holders, this suggests that buyers from the past six months are now becoming long-term holders and are outpacing the distribution.

LTHs sold more than 1 million BTC during the 36% correction from October, marking the largest sell-pressure event from this cohort since 2019, a period that ultimately coincided with the bear market low that year, with bitcoin at around $3,200.

The October sell-off was the third LTH distribution phase since the current cycle began in 2023. The first occurred in March 2024 when bitcoin reached $73,000 and over 700,000 BTC were sold, while the second took place that November when bitcoin reached $100,000 and more than 750,000 BTC were distributed by LTHs.

L1 tokens broadly underperformed in 2025 despite a backdrop of regulatory and institutional gains. Explore the key trends defining ten major blockchains below.

L1 tokens broadly underperformed in 2025 despite a backdrop of regulatory and institutional gains. Explore the key trends defining ten major blockchains below.

This report analyzes the structural decoupling between network usage and token performance. We examine 10 major blockchain ecosystems, exploring protocol versus application revenues, key ecosystem narratives, mechanics driving institutional adoption, and the trends to watch as we head into 2026.

View Full Report

Open interest data suggests the advance is likely short-covering, rather than fresh longs entering the market.

Open interest data suggests the advance is likely short-covering, rather than fresh longs entering the market.

- Bitcoin was trading higher during US market hours, marking a notable shift after a month in which BTC fell roughly 20 percent cumulatively while American stocks were open.

- Declining open interest suggests the move is driven by short-covering rather than fresh leveraged longs.

- Broader crypto markets remain fragile as ETF outflows, tax-related positioning, and light holiday liquidity pressure prices.

Read full story