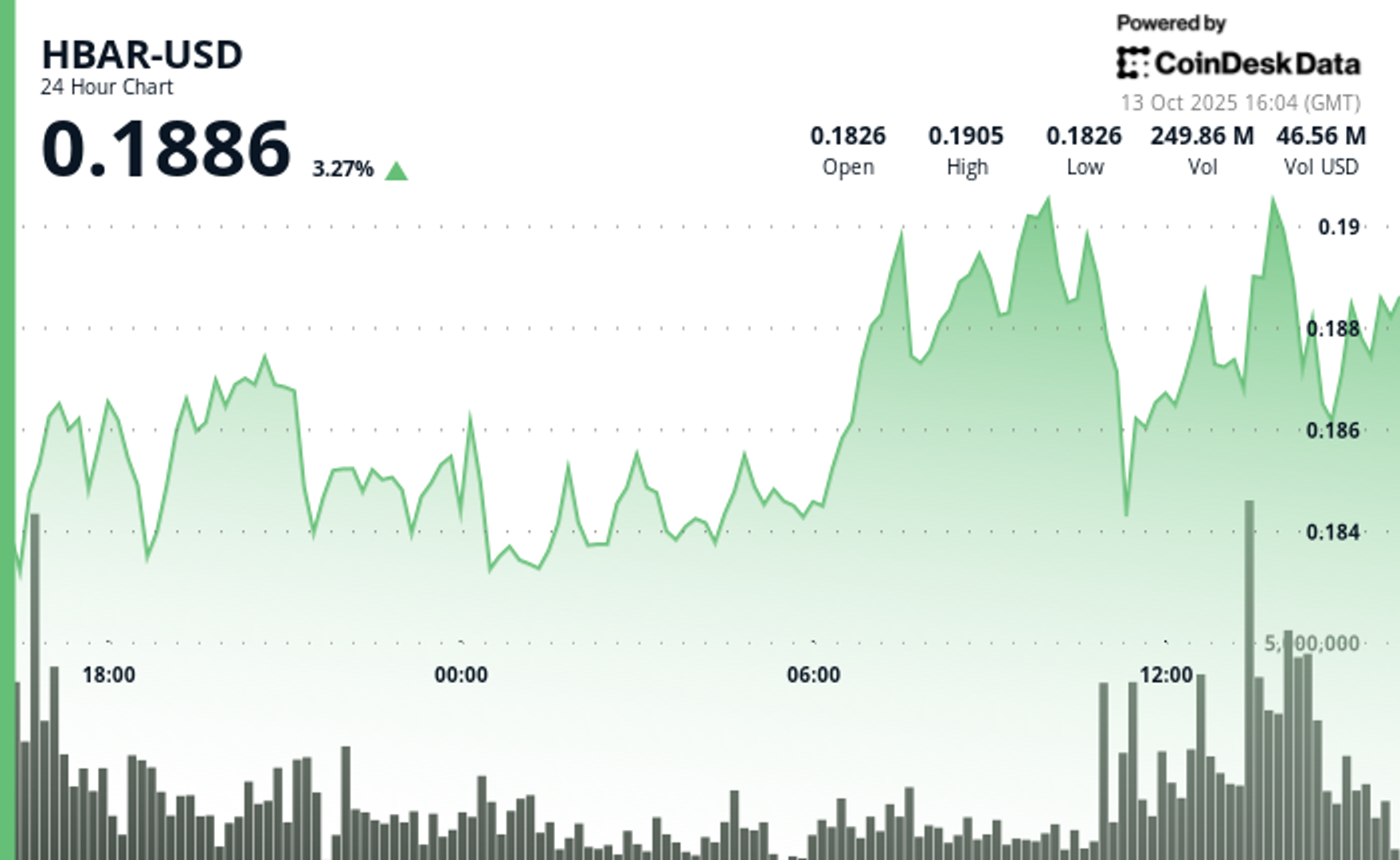

“HBAR SURGED PAST Key Resistance at $ 0.19 AMID A DRAMATIC VOLUME SPIKE, SIGNING RENEWED INSTITATIONAL INTEREST AND REINFORCING BULLISH MOMENTUM AFTER A 9% RECOVERY STRITCH.”, – WRITE: www.coindesk.com

The Move Was Driven by a Dramatic Surge in Trading Activity, With A Standout 15.65 Million Tokens Excised AT 13:31, Signaling Strong Institutional Participation. This Decisive Volume Breakout Propelled the Asset Beyond Its Prior Resistance Range of $ 0.190– $ 0.191, Establishing A New Technical Footing Amid Bullish Momentum.

The Surge Capped A Broader 23-Hur Rally from Oct. 12 to 13, During WHICH HBAR Advanced Roughly 9% Within A $ 0.17– $ 0.19 Bandwidth. This Sustaned Upward Tradery Was Characterized by Consistent Volume Inflows and A Firm Recovery from Earlier Lows Near $ 0.17, UndersCoring Robust Market Convision. The Asset’s Ability to Preserve Support Above $ 0.18 Through the Period Reinforced Confidentnce Among Traders Eyeing Continued Bullish Action.

Strong Institutional Engagement Was Evident as Consecutive High-Volume Intervals Extended Through The Breakout Windows, Suggesting Renewed Accuumulation and Positioning for Potential Contentination. HBAR’S PRICE STRUCTURE NOW SHOWS SUPPORT AROUND $ 0.189– $ 0.190, Signaling The Possibility of Further Upside If Mmentum Perses and Broader Market.

HBAR/USD (TradingView)

HBAR/USD (TradingView)

Technical Indicators Highlight Bullish Sentiment

- HBAR OPERATED WITHIN A $ 0.017 Bandwidth (9%) SPANNING $ 0.174 and $ 0.191 Througout the Previous 23-Hur Period from 12 October 15:00 to 13 October 14:00.

- Substantial Volume Surges Reaching 179.54 Million and 182.77 Million Dringing 11:00 and 13:00 SESSIONS ON 13 OCTOBER VALIDATED POSITIVE MARKET SENTIMENT.

- Critical Resistance Materialized at $ 0.190- $ 0.191 Thresholds WHERE PRICE MOVEments Encounted Persenti Selling Activity.

- The $ 0.183- $ 0.184 territory establized dependable Support Throup Volume-Supported Bounces.

- Extraordinary Volume Explosion at 13:31 Registering 15.65 Million Units Signaled Decisive Breakout Event.

- High-Volume Intervals Surpassing 10 Million Units Through 13:35 Substantated Significant Institutional Engase.

- Asset Preserved Support Above $ 0.189 Despite Moderate Profit-Taking Activity.

Disclaimer: Parts of this Article Were Generated with the Assistance from Ai Tools and Review by Our Editorial Team to Enseure Accucy and Adherence to Our Standards. For more information, See Coindesk’s Full Ai Policy.

Combined Spot and Derivatives Trading on Centralized Exchanges Surged 7.58% to $ 9.72 Trillion in August, Marking The Highest Monthly Volume of 2025

Combined Spot and Derivatives Trading on Centralized Exchanges Surged 7.58% to $ 9.72 Trillion in August, Marking The Highest Monthly Volume of 2025

- Combined Spot and Derivatives Trading on Centralized Exchanges Surged 7.58% to $ 9.72 Trillion in August, Marking The Highest Monthly Volume of 2025

- Gate Exchange Emerged As Major Player With 98.9% Volume Surge to $ 746 Billion, Overtaking Bitget to Become Fourth-Largest Platform

- Open Interest Across Centralized Derivatives Exchanges Rose 4.92% to $ 187 Billion

View Full Report

Bitfarms, Cipher Mining and Bitdeer Posted Double-Digit Gains on Monday as Mines Keep Benefiting from Artificial Intelligence’s Surging Demand for Computing Power.

Bitfarms, Cipher Mining and Bitdeer Posted Double-Digit Gains on Monday as Mines Keep Benefiting from Artificial Intelligence’s Surging Demand for Computing Power.

- Crypto Mining Stocks Led The Rebound from FRIDAY’s Market Downturn As Bitfarms, Cipher Mining and Bitdeer Posted Double-Digit Gains on Monday.

- Optimism for the Sector Was Bolstored by Openai’s Deal with Broadcom to Build Custom Chips and Bloom Energy’s $ 5 Billion Agreement with Brookfield Asset Management To.

- Coinbase, Strategy and Robinhood Boobed Modest Gains.

Read Full Story