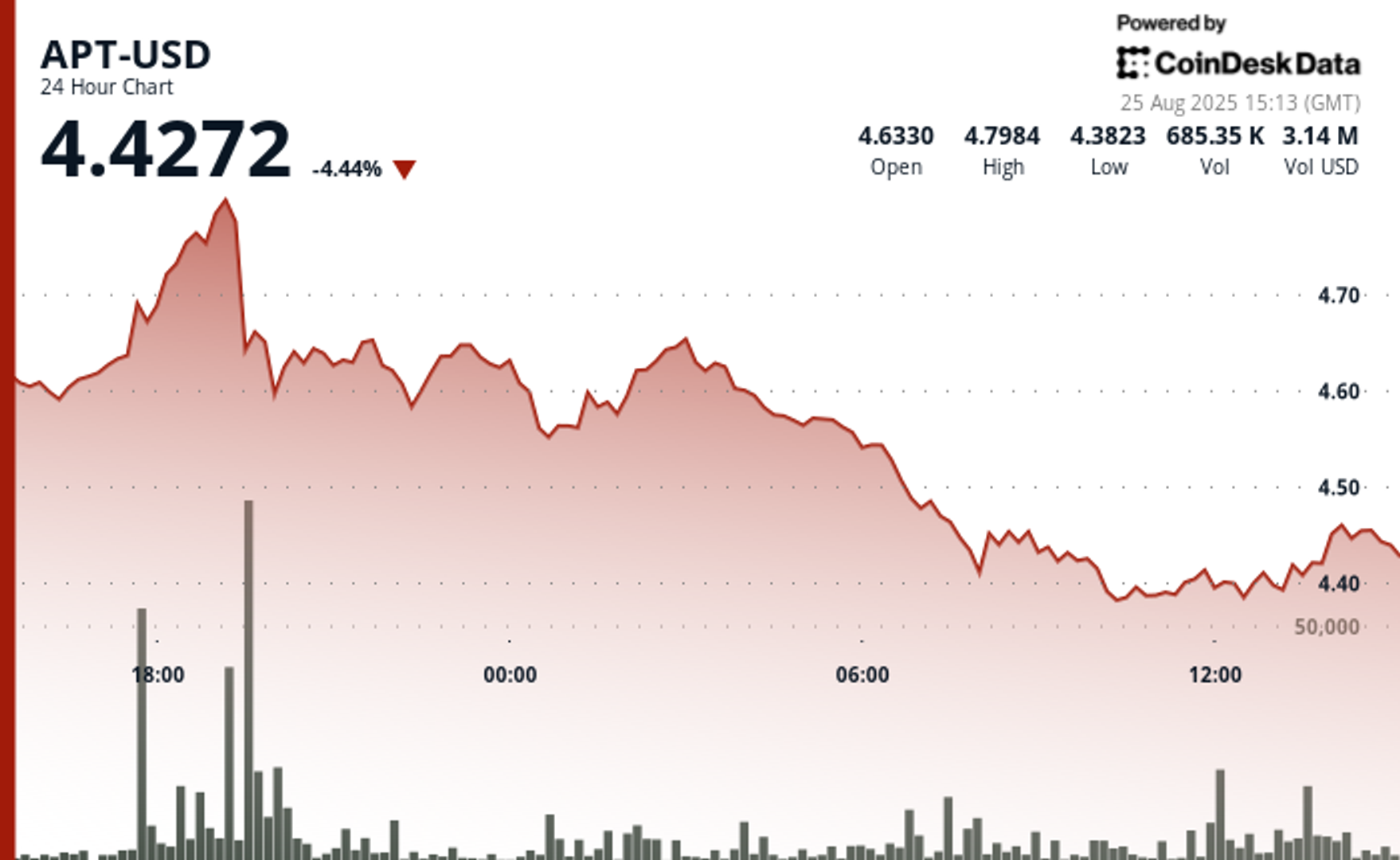

“Support Has Formed in the $ 4.38- $ 4.41 Zone, with Resistance AT $ 4.50.”, – WRITE: www.coindesk.com

The Token Made a session High of $ 4.80 and A Low of $ 4.38, Initially Advance to $ 4.80 Before Deckling Sharply to $ 4.43 by Morning Hours Trading Hour, The Model Showed.

Significant Volume-Backed Support Materialized Around The $ 4.38- $ 4.41 Price Zone, WHERE INSTITATIONAL BUYING EMERGED, WITH The Final Hour Demonstrating Recovery Mmentum Tower. Market Stabilization Following the 9% Decline from Peak to Trough, Account to the Model.

The Drop in Apt Came As the Wider Crypto Market Also Fell, with The Broader Market Gauge, The Coindesk 20, Down 3.2%.

In recent trading, Aptos Was 3.7% Lower Over 24 Hours, Trading AROUND $ 4.43.

On the News Front, The Expo2025 Digital Wallet, Powered by Aptos, Had Half A Million New Accouns and 4.4 Million Transactions, Accounting To a Recent Pos launched on aptos. This Marked’s First-Aver Deployment on a Non-Evm (Ethereum Virtual Machine) Compatible Blockchain.

Technical Analysis:

- Exceptional Trading Volume of 6.6 Million Dringing 19:00 Hour Supported Initial Rally, Followed by Sustaned Volume Support Around $ 4.38- $ 4.41 Price Zone.

- Clear Ascending Channel Formation with Successive Higher Lows at $ 4.39, $ 4.42, and $ 4.45 Levels Durying The Recovery Pase.

- Three Distinct Volume-Driven Rallies During the Final Hour Breakout Above $ 4.41 Resistance Level.

- Strong Institutional Buying Interest Emerged AT $ 4.38- $ 4.41 Zone, Establishing Key Support Following 9% Decline from Peak.

- The Next Psychological Resistance Level Was Identified At $ 4.50 Following A Successful Breakout Above $ 4.41.

Disclaimer: Parts of this Article Were Generated with the Assistance from Ai Tools and Review by Our Editorial Team to Enseure Accucy and Adherence to Our Standards. For more information, See Coindesk’s Full Ai Policy.

All Content Produced by Coindesk Analytics is Undergoes Human Editing by Coindesk’s Editorial Team Before Publication. The Tool Synthesizes Market Data and Information from Coindesk Data and Other Sources to Create Timely Market Reports, with All External Sources Clearly Attributed Within Each.

Coindesk Analytics Operates Under Coindesk’s AI Content Guidelines, WHICH PRIORITIZE Accuracy, Transparency, and Editorial Oversight. Learn more about Coindesk’s Approach to Ai-Generated Content In Our Ai Policy.

X Icon

Despite The Major Partnership, Link Declined 5% Over The Past 24 Hours Alongside the Broader Crypto Weakness.

Despite The Major Partnership, Link Declined 5% Over The Past 24 Hours Alongside the Broader Crypto Weakness.

- Chainlink’s Native Token, Link, Fell Over 6% To $ 24.4 Despite A New Partnership with SBI Group.

- SBI Group and CHAINLINK AIM to DELOP TOKENized Assets and Stablecoin Solutions in Japan.

- Technical Analysis Shows Resistance at $ 26.61 and Support at $ 24.37, Indicating Bearish Momentum.

Read Full Story