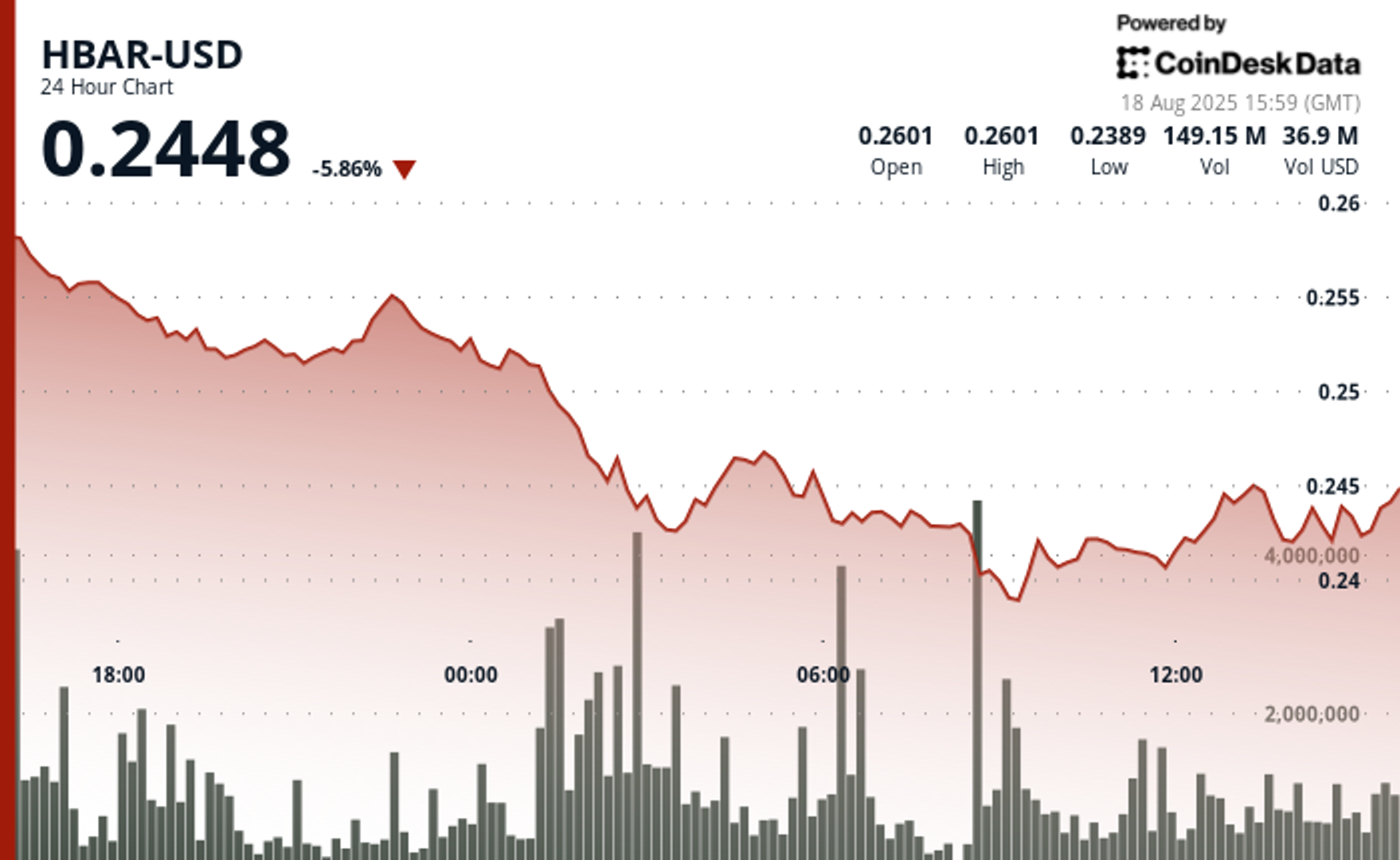

“Hbar Tumbled On Heavy Volume As Broader Market Liquidations Fueled Sharp Volatility, But Long-Term Bullish Targets Remain Intact.”, – WRITE: www.coindesk.com

Despite Near-Term Weakness, Market Strategists Maintena A Bullish Long-Term Outlook for Hedra’s Native Token. Targets Remain Set Between $ 0.40 and $ 0.50, Thought Traders Are Being Warned of Potential Turbulence in the Interim. With Sentiment Gauges Pointing to Overheated Conditions, Technical Watchers Cauckers What Sharp Swings Remain Likely As the Market Digests Both Macroeconomic Headwinds.

Meanwhile, Binance Has Moved to Integrate Hbar Within ITB Smart Chain Infrastructure, A Step Designed to Improve Cross-Cheain Inteipekability. The Development Will Enable Smoother Asset Transfers and Expand Access to Smart Contracts Across Blockchain Ecosysystems, Bolstering Hedra’s Utility. Still, The Integration Arrives As Hbar Consolidates Under Resistance, UndersCoring The Challenge of Balanging Long-Term Adoption Narratives with Short-Term Market Pressures.

HBAR/USD (TradingView)

HBAR/USD (TradingView)

Technical Metrics

- HBAR REGISTED AN AGGregate Trading of Range of $ 0.018, Constituting 6.93% of Peak Valuation Durying The Session.

- Robust Resistance Consolidated Proximate the $ 0.252 Thresold with Multiple Reject Attempts.

- Support Infrastructure Identified Near $ 0.240, Furning Tempoury Price Stabilization.

- Trading Volumes Exceeded 109 Million Tokens, Markedly Surpassing the 24-HOUR AVERAGE OF 58.5 MILLION.

- The terminal 20-minute periood exhibited compleed market paralysis at $ 0.243 on Negligible Volume, Suggesting Potential Technical Disruptions or Acute Illique Comity.

- Distinct Resistance Consolidation Emerged Armond $ 0.245 Durying The Final Trading Hour.

- Provisional Support Materialized Near the $ 0.242 Level Preceding Market Stagnation.

Disclaimer: Parts of this Article Were Generated with the Assistance from Ai Tools and Review by Our Editorial Team to Enseure Accucy and Adherence to Our Standards. For more information, See Coindesk’s Full Ai Policy.

All Content Produced by Coindesk Analytics is Undergoes Human Editing by Coindesk’s Editorial Team Before Publication. The Tool Synthesizes Market Data and Information from Coindesk Data and Other Sources to Create Timely Market Reports, with All External Sources Clearly Attributed Within Each.

Coindesk Analytics Operates Under Coindesk’s AI Content Guidelines, WHICH PRIORITIZE Accuracy, Transparency, and Editorial Oversight. Learn more about Coindesk’s Approach to Ai-Generated Content In Our Ai Policy.

X Icon

The Move Follows A Confidential Sec Submission Earlier Its and Comes Amid A Surge of Digital Asset Firms Taping The Equity Markets.

The Move Follows A Confidential Sec Submission Earlier Its and Comes Amid A Surge of Digital Asset Firms Taping The Equity Markets.

- Figure, A Blockchain Lender Founded by Sofi Co-Funder Mike Cagney, Has Field for an IPO Amid A Surge in Crypto Offings.

- The Company Plans to List Its Shares on Nasdaq Under The Ticker Figr, with Major Banks Like Goldman Sachs as Lead Underwriters.

- Financials Reveal A 22.4% Revenue Increase in the First Half of 2025, with Net Income of $ 29 Million, Marking A Turnaround from A Loss The Previos Year.

Read Full Story