“A Year After Its Launch, The Ethereum Resta Protocol is Rolling Out the Critical Accountability Measure Meant to Address Lingering Security Concerns.”, – WRITE: www.coindesk.com

Eigen Labs Hopes Slashing-Eigenlayer’s System for Keping “Restakers” HONEST BY REVOKING COLLATERAL IFSI ACT MALICIOUSLY-WILL FINALLY REALIZE The YEAR-ELD PROTOCol

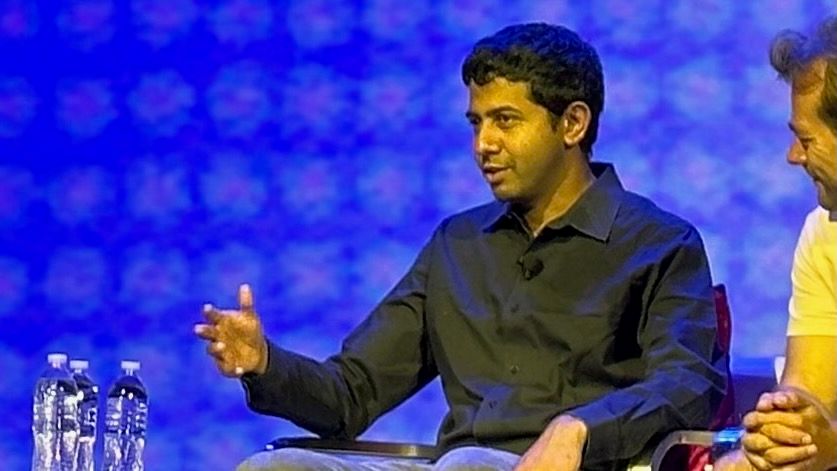

“We are happy to say now the Whole Promise Has been deliver,” Said Eigenlayer Founder Sreeeram Kannan.

Eigenlayer Became One of the Buzziest Protocols in Ethereum History Who IT introduced investors to the concept of resting, an evolution of “proof-of-state” on ethareum.

Ethereum’s “Proof-of-Stake” System Lets Users “Stake” ETHER (ETH) Collateral With The Chain to Help Run and Secure It In Exchange for Interest. Eigenlayer lets users stake ethh on ethereum and then reStake It Again With Other Protocols for Even More Interest.

Despite Launcing Its Main Network Last Year, Slashing, A Primary Component of Eigenlayer’s Shared Security Technology, Was Missing Until Thursday. This Led to Criticism That Eigenlayer’s Ambitious Pitch Didn’s Match ITS Technical Reality.

Today, Eigenlayer Boasts More Than $ 7 Billion in Restated Assets, Making IT One of the Largest Decentralized Finance (Defi) Apps. IT ALSO SUPPORTS An EcoSystem of 39 Actively Validated Services (AVSS) that USE ITS Security Model.

The New Slashing System Will Roll Out on Thursday, But Avs Teams Will Need to Opt-in, Meaning It May Take Some Time Before Slashing Is Live in Any Applications. Eigen Labs AnnounCed April 17 as The Launch Date for Slashing Earlier this month.

Redesigning for SafetyEigenlayer USers Restake Ether (ETH) and Other Tokens Through Third-Party “Operators”-Infrastructure Providers Who Delegate Their Pooled Eigenlayer Deposits Across DIVFERENT DIVFERT.

Operators that delegate stake to an avs help Run It in Exchange for Rewards: The More They Stake, the Higher the Rewards.

In Theory, Slashing Ensures Tese Operators Are Running Avss CorRECTLY. If operators “are proven to be malicious accounting to an on -chain ethereum contract, then they may see their their stake or a parity of their stake,” Explained Kannan.

WHEN SLASHING GOES LIVE ON Thursday, Avss Will Have the Option to Set Slashing Conditions and Begin Penalizing Bad Actors.

“Other than Ethereum and Cosmos, MOST PROof-Off-Stake Systems, Including Solana, Are Running Live Without Any Slashing,” Said Kannan. “Even thorough it is the Core Accountability Mechanism, It’s Not Like Everi Proof of Stake System Already Has This – Tatt’s Not True. That’s What’s What We’re Building.”

As for Who Eigenlayer Received So Much Blowback Compared to Other Incomplete Proof-of-Stake Systems: “We’ve Talked A Lot About Slashing, So Wek.

REMOVING LEVERAGEEigenlayer’s Slashing System Was Redesigned Last Year to Address Fears that The Protocol introduced an Unsafe Form of Leverage to the Ethereum Ecosystom.

“I Think We Completely Cured That Problem With This Redesign,“ Said Kannan.

The Entire Idea Beyind Eigenlayer is to Alow New Protocols to Immedialate Tap Into A Large Security Pool – The Total Pool of Restked Assets.

In proof-of-stake systems, the AMUnt of Assets Staged with a protocol Roughly Corresponds to How Secure It Is. In General, Attacking A Protocol Like Ethereum Requires Controlling Half or More of the Assets Stake, Which Can Run Into Billions of Dollars.

Eigenlayer’s Pooling Model Has Led To Fears That A Poorly Built Slashing System Could Expose The Entire Protocol to New Risks, Where a Single Bad Actor on On.

The Version of Eigenlayer Going Live Thursday, WHICH HAS BEEN TESTED ON ETHEREUM’S DELEPER NETWORKS SINCE DECEMber Won’t Necessarily Impact Another.

“You have unique Attributability of Stake to A Particular AVS,” Explained Kannan. “AS An AVS, I KNOW I HAVE, LIKE, 10 MILLION OF ‘SLASHable’ STAKE THAT IS NOT DOBLE COUNTED – SO there is no leverage.”

Additionally, The System Has Been Configured So that “Even IF My Avs Has A Small Amount of Slashable Stake, It Is Still Protected in Some Sense, by The Large Ant Capita Systems in Place to Enseure of the Cost of Attacking A System Increases with The Total Value of the Pool of Restated Assets.

X Icon