“WHEN Adjusted for Asset Market Capitalization Sol’s Relative Futures Volume Looks Better, K33 Research Noted.”, – WRITE: www.coindesk.com

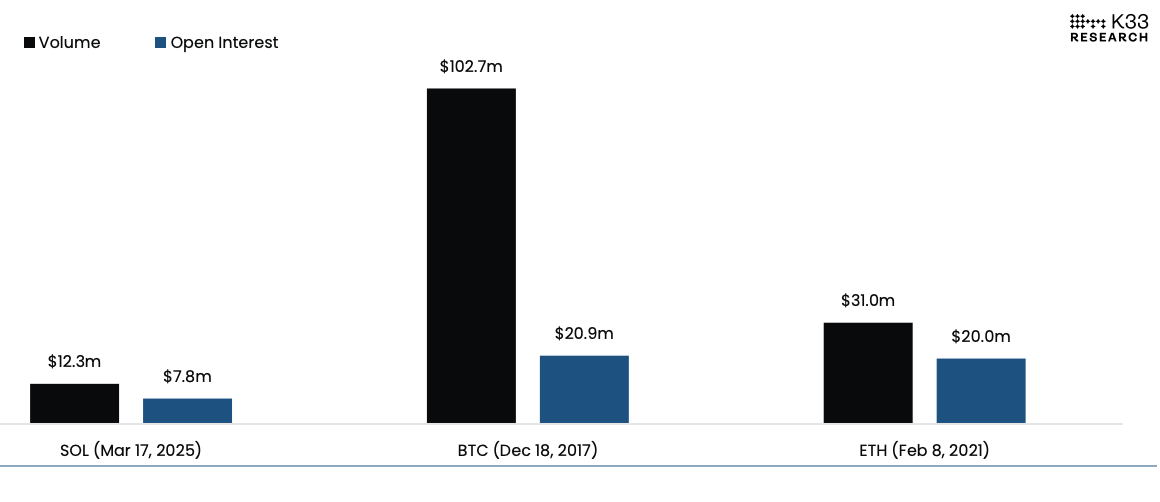

The Product BOOKED $ 12.3 Million in Nocial Daily Volume on Day One and Closed with $ 7.8 Million in Open Interest, Well Falling Short of Similar Dbuts of BTC and Eth Products, Access to Tota. For Context, BTC Futures Launched in December 2017 WITH $ 102.7 Million First-Day Volume and $ 20.9 Million in Open Interest, While Eth Futures DEBUTED IN FEBRUARY Interest, per K33.

Already Under Pressure by the Implosion of Special Memocoin Activity, Bearish Crypto Action and Even A Botched Commercial, Sol Tumbled Roomhly 10% FROM ITSEKEND (UNEKEND ( And Ether’s (ETH) 4.5% and 3.8% Declines, Respectively.

While Sol’s Debut May Seem Lackluster in Absolute Terms, It Is More in Balance With Btc’s and Eth’s First-Day Figures WHEN Adjusted to Market Value, K33 Analysts Vet. Solana’s Market Capitalization Stood at AT AUND $ 65 Billion on Monday, A Fraction of Eth’s $ 200 Billion and BTC’s $ 318 Billion at Cme Launch.

First-day Volume and Open Interest for Sol, BTC and Eth, Adjusted to Market Capitalization. (K33 Research)

First-day Volume and Open Interest for Sol, BTC and Eth, Adjusted to Market Capitalization. (K33 Research)

Solana’s CME Launch Also Had Unfavorable Timing, As Market Conditions Play A Crucial Role in Futures Activity, K33 Added.

Bitcoin’s Cme Futures Arrived at the Peak of the 2017 Bull Market as Special Fervore Was Pushing to The Extremes Announcement, Fueling Institutional Participation. In Contrast, Sol Futures Started Trading as Crypto Markets Turned Bearish, Without Any Hype or Majoor Catalyst Driving Immediate Demand for the Product, According To The K3 Demand for Altcoins May Be SHALLOW, ALTHOUGH WE NOTE THAT Sol’s Launch Has Come in A Comparatively Risk-Off Environment, “K33 Analysts Said.

Read More: Multicoin’s Samani Explands WHY SOL ETF COURCK

Derivatives Trader Jump Lim, Founder of Arbelos Markets that was Recently Accuffe from Prime Broker FalConx, SAID THAT The CME PRODUCT OPENS UPSAC Regardless of the first-day Demand. Falconx executed the FIRST SOL FUTures Block Trade on CME on Monday with Financial Services Firm Stonex.

“There’s Enthusiasm for this New Cme Product Launch,” Lim Said in a Telegram Message. Liquid Funds Will Be Able to Manage Around Their Sol Holdings, Including Those that Boughht Locked Tokens in the FTX Liquidation Process, He Said. Additionally, Exchange-Traded Fund Issuers with Plans to Introduce Sol Products Could Start with CME Futures-Based ETFS.

“People Are Missing The Big Picture on the New Cme Products,” Lim Said. “It’s Going to Change the Access That Hedge Funds Have Into Altcoins.”

X Icon

X Icon