“Bitcoin holdings for public U.S.-listed companies have more than doubled since January 2024.”, — write: www.coindesk.com

The biggest amount, almost half of the total, is held by MARA Holdings (MARA) with 44,893 BTC. MARA has the second-largest stash among publicly listed companies, surpassed only by MicroStrategy’s (MSTR) 450,000 BTC.

The strategy of investing in bitcoin and keeping it for the long term, known as HODL after a typing error made more than a decade ago, has grown in popularity in the past 12 months.

Three other miners hold more than 10,000 BTC: Riot Platforms (RIOT) with 17,722 BTC, Hut 8 (HUT) with 10,171 BTC and CleanSpark (CLSK) with 10,097 BTC, according to Bitcoin Treasuries.

Not all miners subscribe to the HODL playbook. IREN (IREN), TeraWulf (WULF), and Core Scientific (CORZ) all keep very little bitcoin or none at all. Due to the competitive nature of the business, these companies have pivoted into the artificial intelligence (AI) and high-performance computing (HPC) industries.

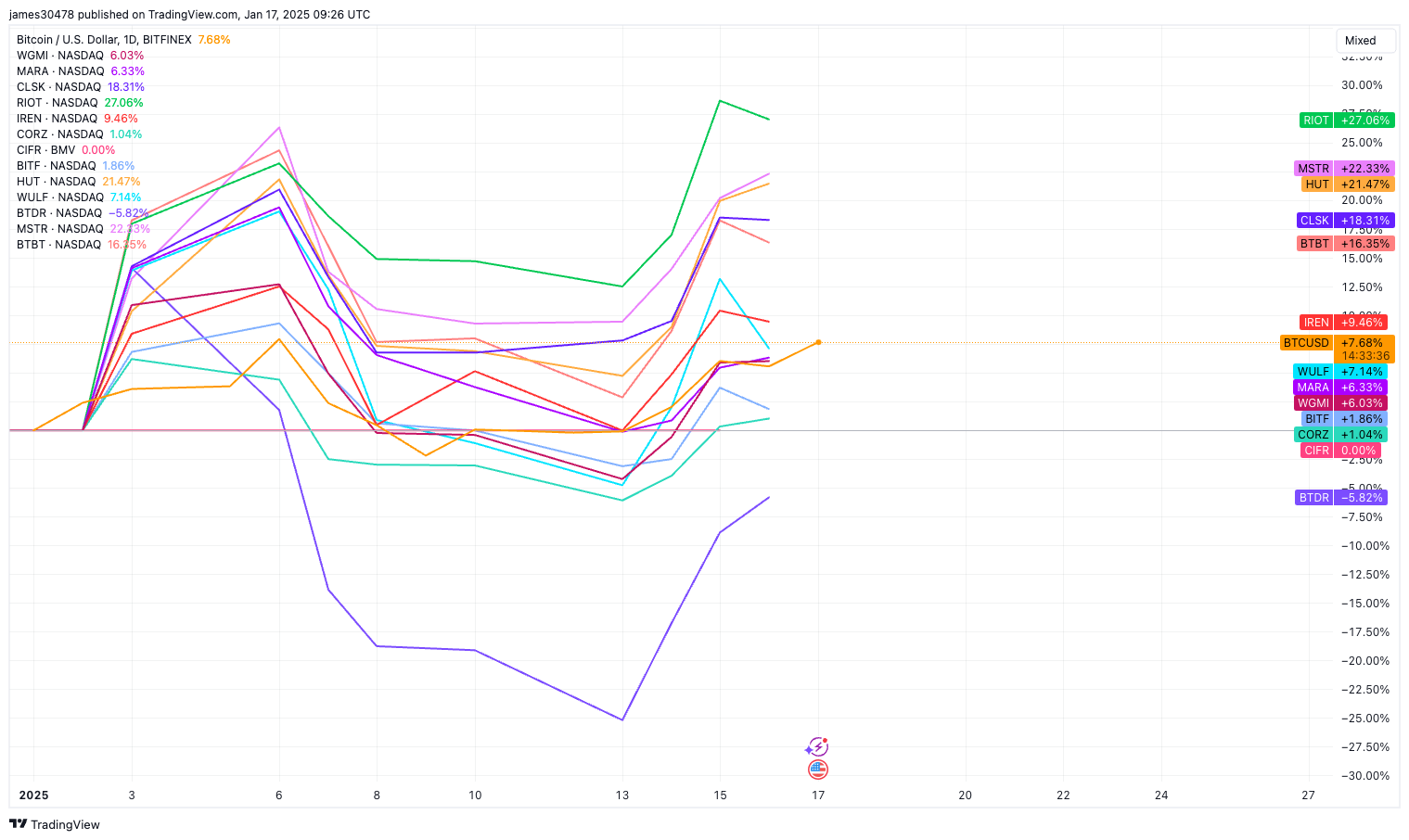

Share prices haven’t matched bitcoin’s trajectory. In general, the miners underperformed bitcoin and other crypto-related equities, such as MicroStrategy. Standout performers Core Scientific and Terawulf, with their new AI focus, both saw over 300% returns.

This year, though, the miners that HODL bitcoin have strongly benefited, with RIOT, HUT and CLSK all outperforming bitcoin. Only Bitdeer (BTDR) has generated negative returns, after seeing a strong performance in 2024.

X icon