“It is noted that Hungarian companies can benefit from peace in Ukraine and warming relations with Moscow.”, — write: www.unian.ua

It is noted that Hungarian companies can benefit from peace in Ukraine and warming relations with Moscow.

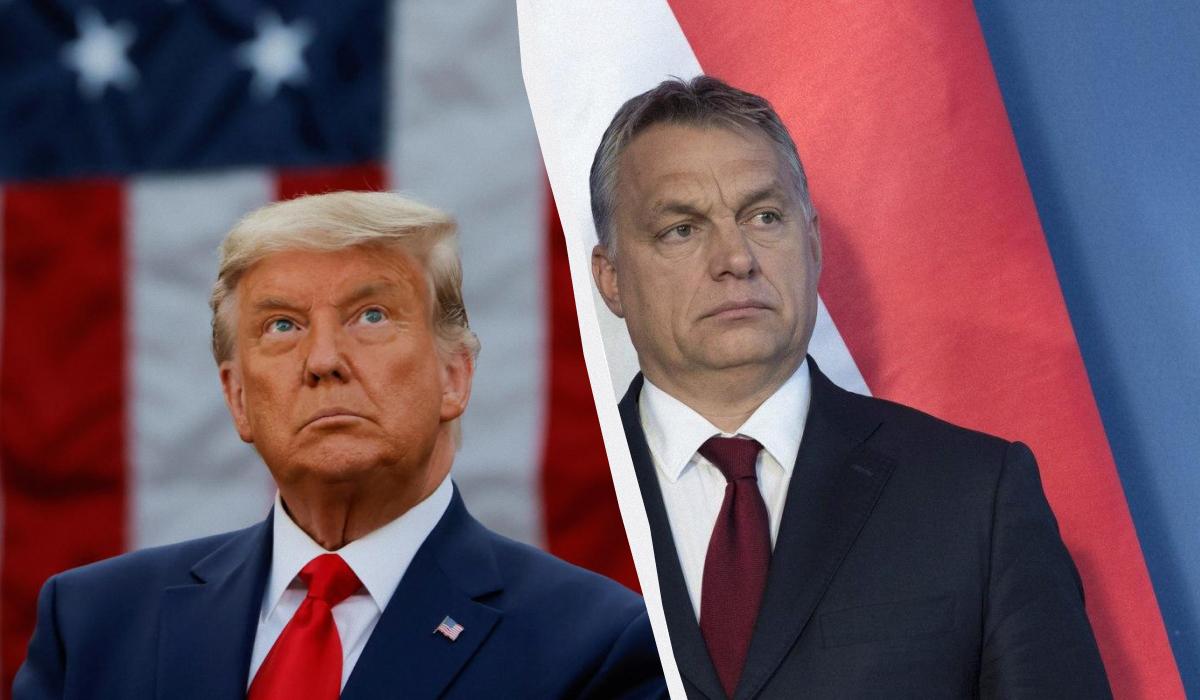

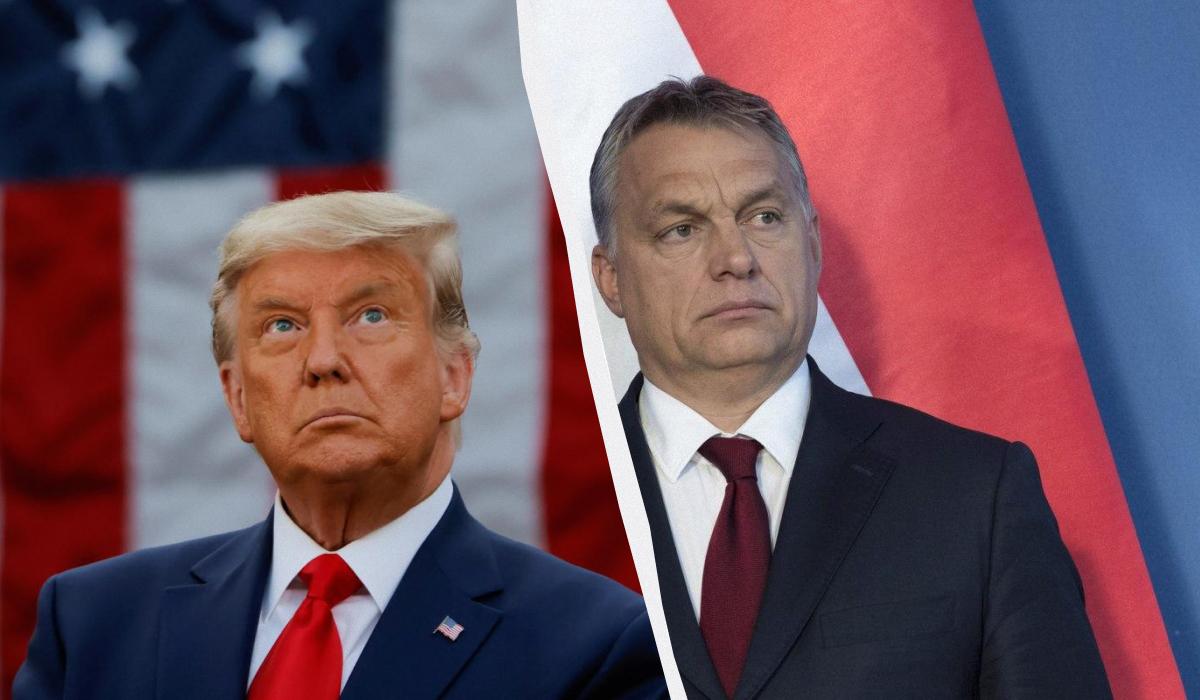

Trump can save Hungary’s economy / UNIAN collage, photo REUTERS, UNIAN Anastasia SyrotkinaHungarian companies, unlike their counterparts in other European countries, are not afraid of the presidency of Donald Trump. A new US president could breathe life into Hungary’s stifling economy and its stock market.

Trump can save Hungary’s economy / UNIAN collage, photo REUTERS, UNIAN Anastasia SyrotkinaHungarian companies, unlike their counterparts in other European countries, are not afraid of the presidency of Donald Trump. A new US president could breathe life into Hungary’s stifling economy and its stock market.Bloomberg writes that if Trump manages to quickly end the war between Russia and Ukraine, the shares of Hungarian companies will rise significantly.

The war increased geopolitical risks and led to lower stock prices across Eastern Europe. Unlike the vast majority of European companies, the biggest companies in the Hungarian market, such as OTP Bank Nyrt, drugmaker Richter Gedeon Nyrt and oil group Mol Nyrt, have not cut ties with Moscow, which could benefit from any warming in relations and the rise of the Russian economy.

Not everyone in Budapest is optimistic about Trump’s return, especially whether there will be enough real investment to help Hungary’s ailing economy. Another obstacle is the relatively small size of the Budapest stock market, which has a market capitalization of about $41 billion – smaller than the markets of Romania, Colombia, Pakistan, Kazakhstan and Egypt. Only five companies registered on the market are worth at least 1 billion dollars.

The Hungarian telecommunications company, which has been eyed by Trump and Musk, embodies Orbán’s business model. 4iG is run by allies of the prime minister and is growing through government-backed acquisitions, government contracts and subsidized debt. However, foreign investors own less than 1% of the company’s shares due to questionable transparency. Compared to OTP’s nearly 20%, Richter’s 40% and Mol’s 60%.

Even with a potential “tailwind” from Trump, the Hungarian stock market still faces the fallout from years of Orbán’s policies, including a struggle for EU funding, as well as a loose fiscal policy, according to East Capital portfolio manager Egle Fredriksson on the stability of the forint.

Peter Kiss, head of portfolio management at Amundi SA’s Hungarian unit, said that even if Trump’s tariffs rock Europe and weaken the continent’s currencies, Hungary’s biggest stocks will remain relatively protected because they derive most of their income from neighboring countries in eastern and southern Europe.

Rollo Roscoe, head of EM funds at Schroders Plc in London, says much depends on what type of peace is achieved. If it contains strong security guarantees for Ukraine that will help prevent a resumption of war, then this will be a positive factor in the short and long term, but a weak agreement will be a long-term negative factor.

Trump is a threat to EuropeReuters wrote that Donald Trump’s victory may be a political boon for Hungarian leader Viktor Orbán, but economically it is bad news for Budapest. The new US president increases inflationary risks.

At the same time, Bank of America experts believe that investors underestimate the risks of a trade war under Trump’s presidency. They forecast a 5% decline in emerging market currencies in the first half of 2025.

You may also be interested in news:

- The Russian Federation is on the verge of economic suicide because of its “special operation”, – Le Monde

- London mercilessly hits Moscow’s wallet: new sanctions were introduced against the “shadow fleet” of the Russian Federation

- For the first time, the European Union introduced sanctions against its own citizen: what was he punished for