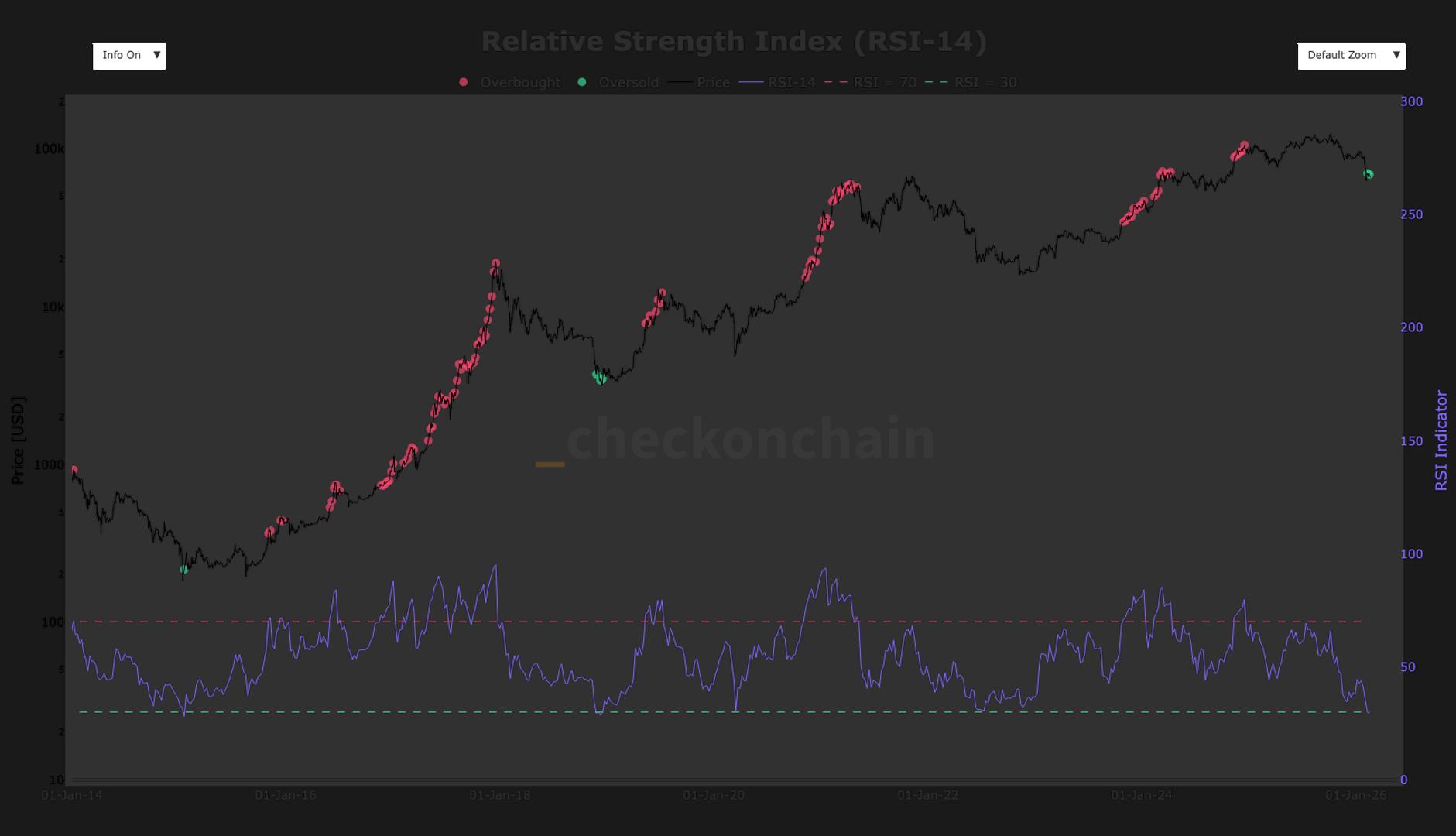

Bitcoin’s 14-day Relative Strength Index (RSI) has fallen below 30 for only the third time in its history, signaling potential oversold conditions. This development, noted by checkonchain, comes as Bitcoin trades around $66,000, having experienced a significant decline of over 50% since its peak in October.

The RSI, a widely used indicator for assessing asset momentum, measures the speed and magnitude of recent price movements. It produces readings between 0 and 100, with values above 70 typically indicating overbought conditions, while those below 30 suggest oversold conditions. The last time Bitcoin’s RSI reached 100 was in December 2024, when the cryptocurrency first surpassed the $100,000 mark.

Historically, prior instances of the RSI dipping below 30 have marked significant market bottoms. For example, in January 2015, the RSI fell to approximately 28 while Bitcoin’s price hovered near $200. This was followed by an eight-month consolidation period before a sustained recovery began. Similarly, in December 2018, the RSI dipped below 30 around the $3,500 mark, leading to three months of sideways trading before a price breakout.

Currently, market sentiment remains cautious, with the Crypto Fear & Greed Index indicating a state of ‘fear’ or ‘extreme fear’ for much of the past month. Bitcoin’s price has briefly approached the $60,000 level, a threshold that historical trends suggest could lead to consolidation before the next upward movement.

In related market activity, both Bitcoin and Ether have seen slight increases, although altcoins have lagged behind in a low-volatility trading environment. As of now, BTC is trading near $67,000 and ETH around $1,970. The derivatives market shows signs of stabilization, with open interest at $15.38 billion and positive funding rates. However, the market remains fragile, as evidenced by $218 million in liquidations and 97 of the top 100 tokens trading in the red.

Bitcoin's recent drop in its 14-day RSI below 30 suggests potential market consolidation around the $60,000 mark. Historical patterns indicate that similar conditions have previously led to significant price recoveries after periods of consolidation.