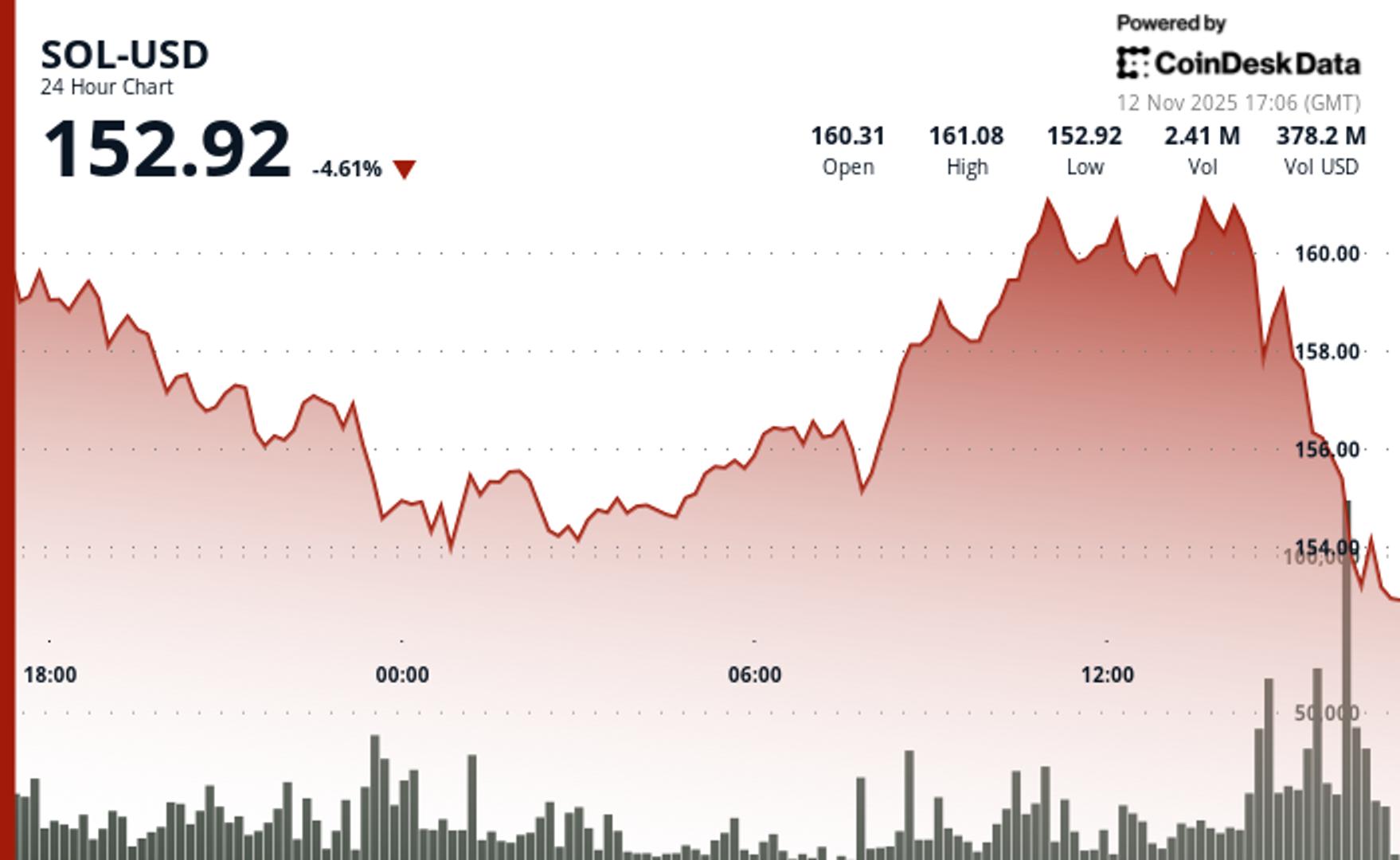

“Institutional inflows of $336 million fail to offset selling pressure as SOL falls to $153 amid fresh token releases.”, — write: www.coindesk.com

Selling intensifies following another scheduled token unlock from bankrupt Alameda Research and the FTX estate on November 11. Analyst MartyParty reports approximately 193,000 SOL tokens worth $30 million get released as part of ongoing monthly vesting. The program has been gradually distributing over 8 million tokens since November 2023. These structured releases, managed under bankruptcy oversight, typically flow to major exchanges for creditor repayment.

Institutional demand remains robust with solana spot ETFs recording their tenth consecutive day of inflows totaling $336 million for the week. Major financial institutions including Rothschild Investment and PNC Financial Services disclosed new holdings in Solana-based products. Grayscale introduced options trading for its Solana Trust ETF (GSOL) to provide additional hedging tools for institutional traders.

Supply Pressure vs Institutional Demand: What Traders Should WatchAlameda’s systematic token releases create predictable selling pressure while institutional flows provide underlying support. SOL finds itself caught between opposing forces. The bankruptcy estate maintains approximately 5 million tokens in locked or staked positions. Smaller monthly unlocks continue through 2028 based on pre-2021 investment agreements.

The 60-minute analysis reveals accelerating bearish momentum as SOL breaks critical support at $156 amid explosive selling volume. The breakdown occurs during 15:00-16:00 UTC when the price collapses from $155.40 to $152.86 on 212,000 volume—123% above the hourly average.

This technical failure confirms the earlier support breach and establishes a descending channel targeting the $152.50-$152.80 demand zone. However, underlying strength in ETF flows suggests institutional accumulation at lower levels. Bitwise’s BSOL leads weekly inflows with $118 million while maintaining its yield-focused strategy through staking rewards averaging over 7% annually.

Key Technical Levels Signal Consolidation Phase for SOLSupport/Resistance: Primary support establishes at $152.80 demand zone with secondary levels at $150; immediate resistance at $156 (former support) and $160

Volume Analysis: 24-hour volume surges 17% above weekly average during breakdown, confirming institutional repositioning rather than retail capitulation

Chart Patterns: Descending channel formation with lower highs at $156.71 and $156.13; break above $160 needed to invalidate the bearish structure

Targets & Risk/Reward: Bounce potential towards $160-$165 resistance if $152.80 holds; breakdown below $150 accelerates towards $145 support levels

CoinDesk 5 Index (CD5) Drops 1.85% in Volatile SessionCoinDesk 5 Index fell from $1,792.49 to $1,759.24, declining $33.25 (-1.85%) across a $74.31 total range as strong bearish momentum emerges after failing resistance at $1,824.82, with significant institutional volume during the 15:00-16:00 selloff confirming the downward break below key support at $1,767.

Disclaimer: Parts of this article were generated with the assistance of AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

View Full Report

Bitcoin’s Coinbase Premium, a popular gauge for US demand, is having its longest negative streak since the April correction, coinciding with the Fed turning more hawkish.

Bitcoin’s Coinbase Premium, a popular gauge for US demand, is having its longest negative streak since the April correction, coinciding with the Fed turning more hawkish.

- Bitcoin dropped back below $102K as cryptos erased overnight gains during US trading hours. ETH, XRP, SOL plunged around 5%.

- Crypto miners and equities slid, led by double-digit losses in AI-linked data center stocks.

- Fed’s December rate cut odds dim as officials grow split over inflation versus labor risks.

Read full story