“Rising active addresses and tightening volatility indicate an impending directional move, with $0.16 as a critical breakout threshold.”, — write: www.coindesk.com

Rising active addresses and tightening volatility indicate an impending directional move, with $0.16 as a critical breakout threshold.Updated Dec 9, 2025, 4:29 am Published Dec 9, 2025, 4:29 am

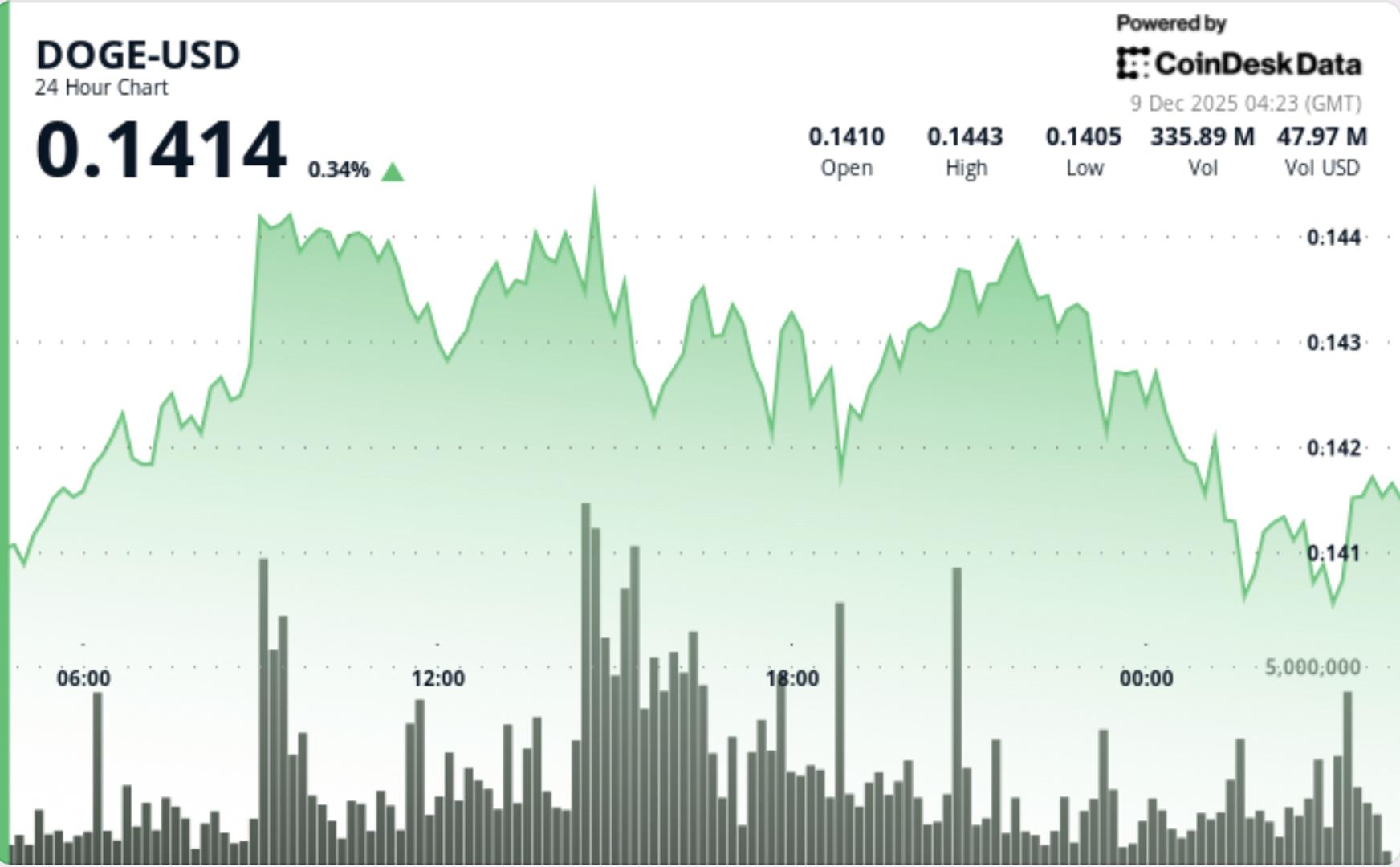

(CoinDesk Data)

(CoinDesk Data)

What to know:

- Dogecoin marked its 12th anniversary, but market reactions were muted, focusing instead on technical patterns and network activity.

- The token consolidated within a tight range, with active buying interest at the lower boundary and potential for a bullish breakout.

- Rising active addresses and tightening volatility indicate an impending directional move, with $0.16 as a critical breakout threshold.

Memecoin posts modest advance with elevated trading activity while technical patterns signal consolidation near key support.

News Background

- Dogecoin marked its 12th anniversary on December 6, twelve years after creators Billy Markus and Jackson Palmer introduced the meme-token that would later evolve into a major crypto asset supported by persistent community engagement.

- Despite the milestone, the market reaction was muted, with trading driven instead by technical structure and network activity.

- On-chain data showed daily active addresses reaching 67,511 on December 3 — the second-highest level in three months — underscoring renewed user participation even as price action remains contained.

Technical Analysis

- DOGE spent the session consolidating within a tight $0.1406–$0.1450 band, forming a compression structure designed to resolve into a broader move.

The token bounced from $0.14 support three separate times, showing active buying interest at the lower boundary of the range. - Each rejection of deeper downside came with declining sell volume, a constructive signal for potential upside resolution.

- Hourly charts revealed a notable volatility pocket around 03:19–03:22 GMT, where the price dipped to $0.1405 before recovering, reinforcing an ascending intraday support line.

- MACD curves continue to converge towards a bullish cross, while range contraction and higher lows hint at an early-stage accumulation pattern rather than distribution.

Price Action Summary

- DOGE advanced from $0.1405 to $0.14155 in a controlled 0.81% gain.

Volume jumped 16.96% above weekly averages, with a notable 465.9M spike (+68% vs 24-hour SMA) at 01:00 GMT confirming institutional interest around range lows. - The token maintained a stable structure despite multiple tests of $0.140–$0.141, while resistance at $0.145 remained unchallenged during the session.

What Traders Should Know

- The consolidation setup is nearing resolution, with $0.16 identified as the critical breakout threshold that would transition DOGE from range-bound action into a trend continuation phase.

- Failure to hold $0.14 risks sending price towards deeper on-chain support near $0.081, as flagged by UTXO realized distribution clusters.

- The combination of rising active addresses and tightening volatility suggests a directional move is approaching.

- Traders should watch for volume expansion above $0.145 or below $0.140 as the likely trigger for the next leg.

More For You

Protocol Research: GoPlus Security

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025, with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch, the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B, while derivatives volume peaked the same month at over $4B.

View Full Report

More For You

Zcash Floats Dynamic Fee Plan to Ensure Users Won’t Be Priced Out

ZEC zoomed 12% amid the fee discussion, beating gains across all major tokens.

ZEC zoomed 12% amid the fee discussion, beating gains across all major tokens.

What to know:

- A new proposal by Shielded Labs suggests a dynamic fee market for Zcash to address rising transaction costs and network congestion.

- The proposed system uses a median fee per action observed over the previous 50 blocks, with a priority lane for high-demand periods.

- The changes aim to maintain Zcash’s privacy features while avoiding complex protocol redesigns.

Read full story