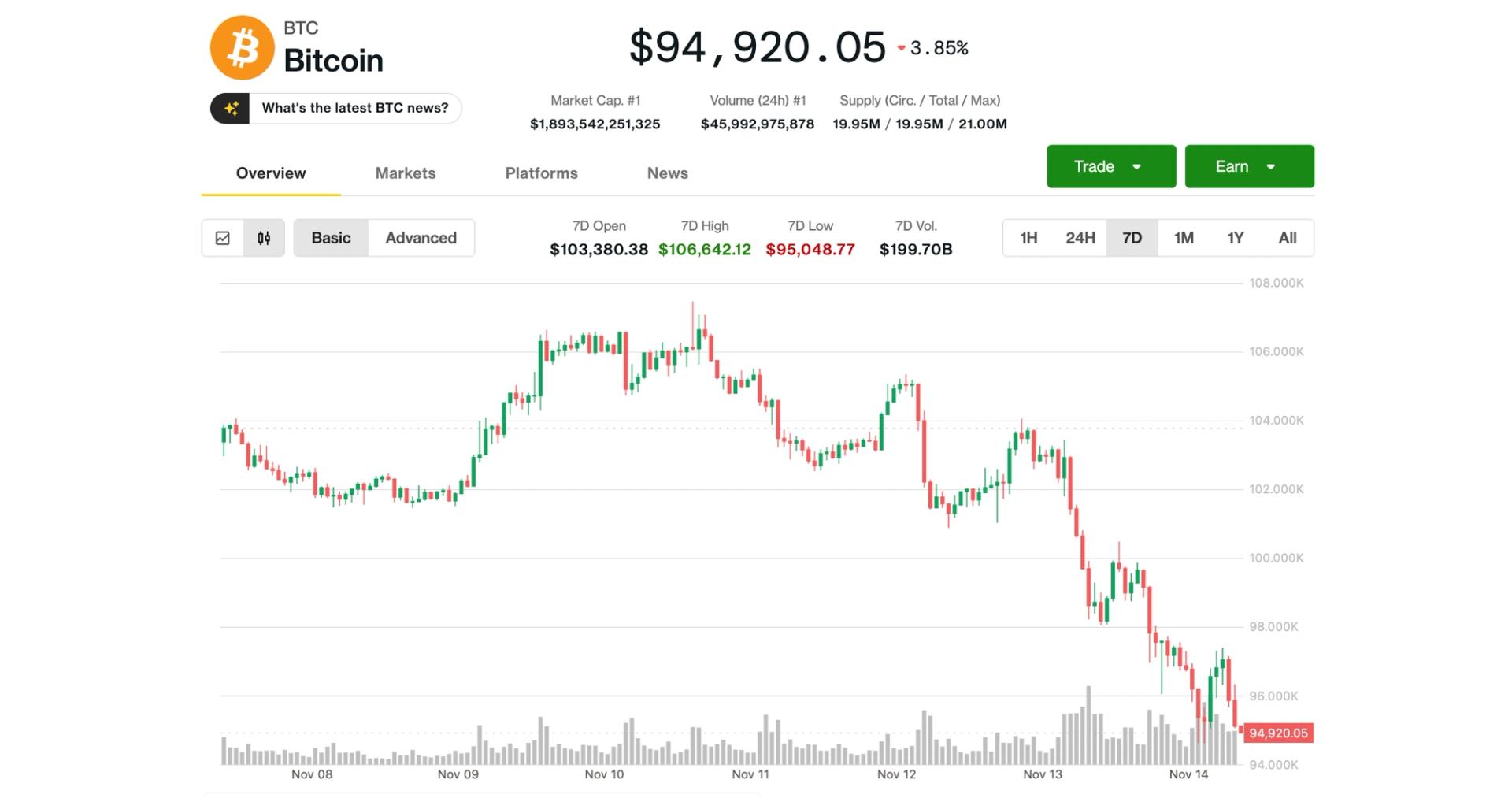

“BTC has tumbled nearly 9% this week, while ETH, SOL declined even further and XRP outperformed.”, — write: www.coindesk.com

The largest cryptocurrency is again underperforming US stocks, with major US indices holding onto minor gains a few minutes prior to the end of trading. BTC was on track to log a 9% loss for the week, its worst performance in eight months.

Ethereum ETH$3,142.02trading below $3,200, fared worse, tumbling more than 11% since Monday, while Solana’s SOL SOL$140.76 lost 15% over the same period. XRP$2.2699 held up better, dipping just 1%, perhaps buoyed by this week’s debut of its first spot ETF in the US, issued by Canary Capital.

Crypto-related equities performed mixed after Thursday’s steep losses. MicroStrategy (MSTR), the largest public holder of bitcoin, slid another 4% to below $200 for the first time since October 2024. Exchange Bullish (BLSH), Ethereum treasury BitMine (BMNR), miners CleanSpark (CLSK), MARA Holdings (MARA) and Hive Digital (HIVE) slid 4%-7%.

On the positive side, miner Hut 8 bounced 6% following earnings results from American Bitcoin, a joint venture with the Trump family, while digital brokerage Robinhood (HOOD) and BTC miner Riot Platforms (RIOT) advanced around 3%.

‘Information vacuum’ clouds investor confidenceThe current market downturn is largely driven by a lack of clarity on key US economic conditions and subsequent monetary policy direction, Bitfinex analysts said. That data blackout was due to the longest US government shutdown that lasted from October 1 until Thursday, which suspended government inflation and jobs data releases.

“The market retracement is the result of an information vacuum and political uncertainty,” they wrote in a Friday note shared with CoinDesk. “Key economic data is still missing to guide the market and the Federal Reserve, putting investors on standby.

However, the shutdown-ending spending bill that lawmakers passed only provides funding to keep the government open until January 30, weighing on investor sentiment. “The temporary funding bill doesn’t resolve the uncertainty — it just pushes the issue further down the road.” Bitfinex analysts added.

Noelle Acheson, author of Crypto Is Macro Now, said the recent drawdown was a necessary correction after months of range-bound consolidation that failed to sustain a breakout above $120,000. “We need to get through this flush before we can breathe more easily,” she wrote. “Once that happens, the longer-term case for BTC strengthens — but we’re not there yet.”

The main driver for BTC remains macro liquidity, Acheson added. While another Fed rate cut might not arrive until later in the first quarter of 2026, expectations for balance sheet adjustments or other easing measures and “liquidity injections” could help rebuild optimism around risk assets including BTC, she said.

BTC headed to $84K, Ledn CIO says Meanwhile, technical indicators suggest bitcoin may still have plenty of room to fall, said John Glover, chief investment officer at crypto lending firm Ledn.

He noted that to a breakdown below the 23.6% Fibonacci retracement level at just below $100,000 opened the path to the next key support level, sitting at around $84,000.

Analyst John Glover outlines bitcoin’s bear market trajectory (Ledn/TradingView)

Analyst John Glover outlines bitcoin’s bear market trajectory (Ledn/TradingView)

Glover believes the current pullback is part of bitcoin’s bear market, forecasting volatile action for the coming months. “We’ll likely see prices back above $100,000 before any sustained break below $90,000,” he said, noting that the full correction could play out through the summer of 2026.

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

View Full Report

Analysts caution that the market remains vulnerable to further declines, with large token movements and macroeconomic factors contributing to uncertainty.

Analysts caution that the market remains vulnerable to further declines, with large token movements and macroeconomic factors contributing to uncertainty.

The debut of the first US spot XRP ETF, Canary Capital’s XRPC, coincided with the selloff, highlighting institutional interest but also market volatility.

Analysts caution that the market remains vulnerable to further declines, with large token movements and macroeconomic factors contributing to uncertainty.

Read full story