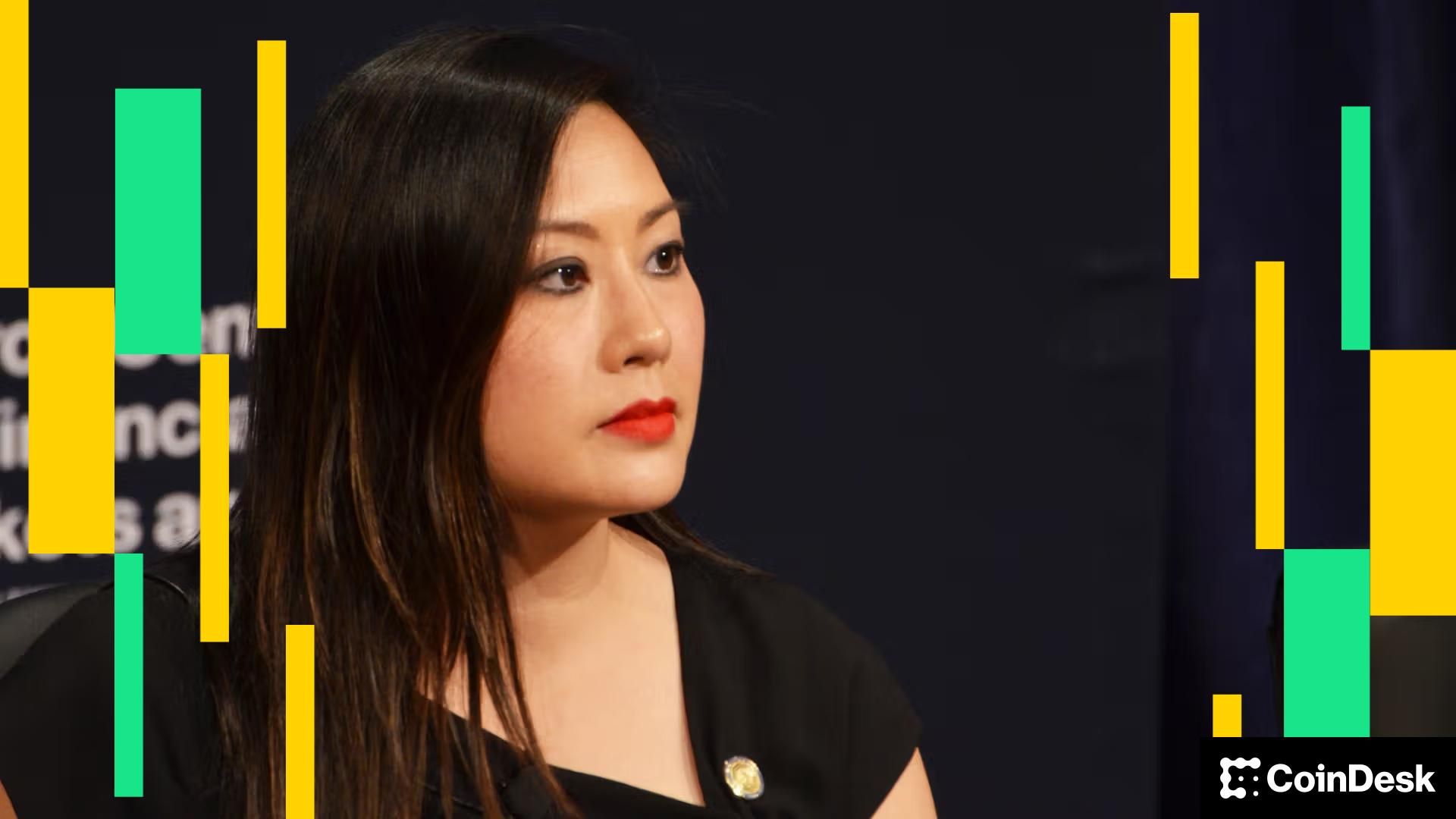

“Acting Chair Caroline Pham has unveiled a first-of-its-kind US program to allow tokenized collateral in derivatives markets, citing “clear guardrails” for firms.”, — write: www.coindesk.com

The program, announced by Acting Chairman Caroline Pham, is part of a broader push to give market participants clear rules for using tokenized collateral, including tokenized versions of real-world assets like US Treasuries.

“Today, I am launching a US digital assets pilot program for tokenized collateral, including bitcoin and ether, in our derivatives markets that establishes clear guardrails to protect customer assets and provides enhanced CFTC monitoring and reporting,” said Pham in a statement.

The CFTC had already begun working to let stablecoins be used as collateral for certain products earlier this year.

For now, the program applies only to futures commission merchants (FCMs) that meet certain criteria. These firms can accept BTC, ETH and payment stablecoins like USDC as margin collateral for futures and swaps, but must comply with strict reporting and custody requirements. For the first three months, they must provide weekly disclosures on digital asset holdings and alert the CFTC of any issues.

In practice, this could mean a registered firm accepting bitcoin as collateral for a leveraged swap tied to commodities, while the CFTC monitors the operational risks and custody arrangements behind the scenes.

The agency also issued a no-action letter giving FCMs limited permission to hold certain digital assets in segregated customer accounts, provided they manage risks carefully. Importantly, the CFTC withdrew older guidance from 2020 that had effectively blocked the use of crypto as collateral in many cases. That advisory is now seen as outdated, especially after the passage of the GENIUS Act, which updated federal rules around digital assets.

Industry executives praised the move. “This major unlock is precisely what the Administration and Congress intended the GENIUS Act to enable,” said Coinbase Chief Legal Officer Paul Grewal in a statement shared by the CFTC.

The CFTC emphasized that its rules remain technology-neutral but said real-world tokenized assets like Treasuries must still meet enforceability, custody, and valuation standards.

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025, with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch, the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B, while derivatives volume peaked the same month at over $4B.

View Full Report

Comptroller of the Currency Jonathan Gould spoke at an industry event in Washington, arguing that the OCC won’t resist crypto because of banker complaints.

Comptroller of the Currency Jonathan Gould spoke at an industry event in Washington, arguing that the OCC won’t resist crypto because of banker complaints.

- Comptroller of the Currency Jonathan Gould delivered some pushback to the traditional banks that have tried to slow the industry’s entry into banking.

- Up to 14 companies have applied for bank charters in the past year, including a number of crypto firms, Gould said.

Read full story